What Triggered The Recent Bitcoin Selloff?

KEY POINTS

- Rising CPI rates cause Bitcoin's price to decline

- BTC price jumps are common in bear markets

- Ethereum continues to outperform Bitcoin

Bitcoin (BTC), the world's biggest cryptocurrency, saw a price rally last month, jumping from $19,315 to around $25,000 in August. However, this growth was not sustainable as the cryptocurrency dropped below $21,000 over the weekend.

While Bitcoin has been following a downtrend in the longer run, being almost 70% off from its all-time high of $69,000 in November last year, the price did try to break into a minor uptrend and enter the $30,000 level but failed to push through the $25,000 resistance.

One of the major reasons for the weekend selloff was Ethereum's upcoming Merge upgrade. Although this is a bullish event for Ethereum, the Merge will mark the transition of the network from energy exhaustive proof-of-work to proof-of-stake system. This implies that Bitcoin, which operates using proof-of-work consensus, might also need to upgrade its network or lose its special position in the market.

The bullish sentiment surrounding Ethereum's Merge failed to fuel the price action of Bitcoin, which was a major reason why the BTC selloff was initiated. In the past few weeks when the market was bullish, Ethereum continued to outperform Bitcoin as the world's biggest cryptocurrency's dominance fell below 41%.

ETH dominance even rose to 20% for a brief interval as it traded at $2,000 after developers revealed a potential date for the Merge launch.

Meanwhile, Bitcoin was also bullish following the introduction of a private BTC trust by the largest asset management firm BlackRock. However, the support for ETH Merge was unequivocally larger and subdued BlackRock's bullish move.

Another reason for the recent Bitcoin selloff is rising Consumer Price Index (CPI) rates. The U.S. witnessed historically high CPI rates this year, marking a 40-year high in June, according to TradingEconomics. While the CPI rose to 9.1% in June, leading to a crypto market crash, the July CPI was slightly better at 8.5%. However, the rates were still very high.

Bitcoin's most widely touted feature is its position as a store of value. However, when the CPI rates rise, the investment in Bitcoin decreases because investors find interest-based securities more appealing due to higher interest rates. There is a constant increase in CPI in every major country around the globe which might be here for a while.

When CPI rates increase, the investors look for less volatile and high liquidity investments instead of cryptocurrencies, which are still unregulated in most countries.

Interestingly, the U.S. Fed's annual meeting to be held in Jackson Hole, Wyoming, this week is expected to provide an update on the future direction of global monetary policy, Yahoo Finance reported. The event is very crucial for the financial sector as it will signal policy shifts that lie in the coming days and months.

Another important factor that drives the price of Bitcoin is capital investment. The crypto market is still not a mainstream investment option for major venture capitalists and investors. Billionaires like Charlie Munger, Warren Buffett and Bill Gates have all advised against investing in Bitcoin (BTC) despite saying that blockchain is a promising technology.

Until we see more and more companies investing in the world's biggest cryptocurrency and the general crypto industry as a whole, a price rally for BTC toward the much anticipated and chased-after $100,000 price level is not possible.

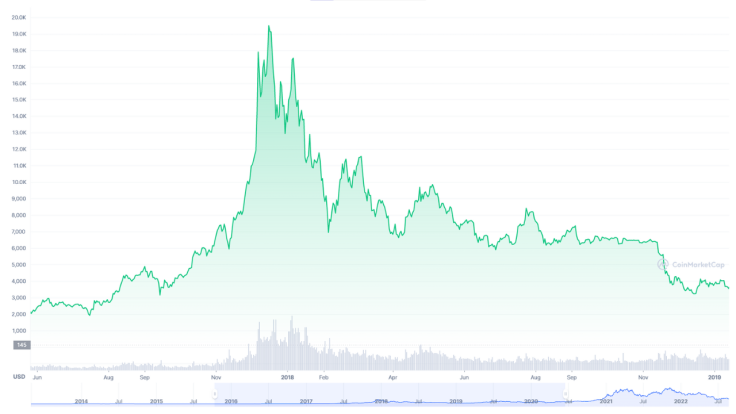

The price surge seen in the last few weeks is common in crypto bear markets as well. As seen in the data from CoinMarketCap, Bitcoin rose from $1,929 in July 2017 to $19,497 in December 2017. From there, BTC crashed violently to $6,955 by February 2018, marking a 64% price crash.

However, the prices once again rallied to $11,403 in February 2018, dropping to $6,636 in April that year, i.e., a decline of 41%. Bitcoin was at $3,545 by the end of December 2018 and $8,574 by May 2019.

The volatility in Bitcoin price and price surges in bear markets are quite common. However, it does not mean that we will witness an all-time high anytime soon.

© Copyright IBTimes 2025. All rights reserved.