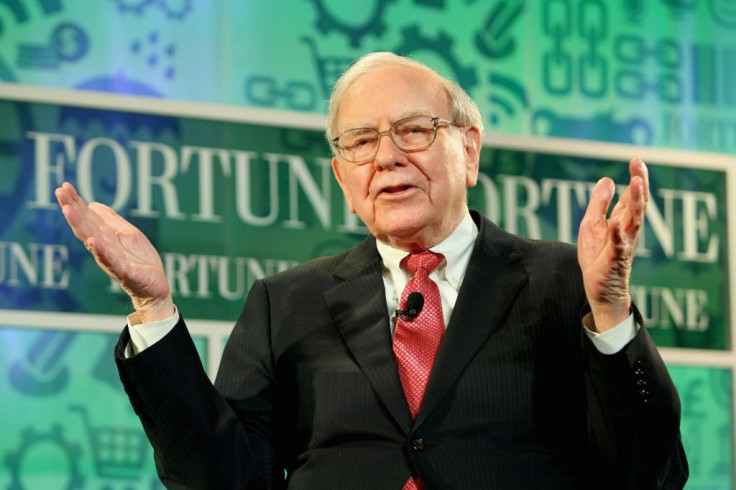

What Warren Buffett Said About Investing On Robinhood, Billionaire Investor Describes ‘Casino’ Aspect

Young and inexperienced investors have been flooding the stock market due to the accessibility of trading app Robinhood. That's not good news, according to billionaire investor Warren Buffett, who believes the platform is creating a "casino" effect on what he essentially describes as gambling.

In Saturday's Berkshire Hathaway’s annual meeting, Buffett blamed the trading app for the erratic changes to the stock market.

Buffett said Robinhood has “become a very significant part of the casino aspect, the casino group, that has joined into the stock market in the last year or year and a half.”

Buffett claimed the app was responsible for allowing inexperienced people to enter the stock market due to some of its perks, including a lack of commission fees.

“American corporations have turned out to be a wonderful place for people to put their money and save, but they also make terrific gambling chips,” Buffett said.

“If you cater to those gambling chips when people have money in their pocket for the first time and you tell them they can make 30 or 40 or 50 trades a day, and you’re not charging them any commission, but you’re selling their order flow or whatever...I hope we don’t have more of it.”

Rather than investing in individual stocks, Buffett believes people would be better off owning an S&P 500 index fund.

A spokesperson for Robinhood fired back at Buffett, suggesting "the Oracle of Omaha" may be worried about average Americans interfering with his wealth.

“There is an old guard that doesn’t want average Americans to have a seat at the Wall Street table so they will resort to insults,” the spokesperson said.

The rep added, “The new generation of investors aren’t a ‘casino group.’ They are tearing down old barriers to investing and taking control of their financial futures. Robinhood is on the right side of history.”

Due to the coronavirus pandemic, Robinhood has experienced millions of new investors eager to try their luck on the stock market.

Buffett doesn’t see the influx as something to celebrate or be proud of.

“The degree to which a very rich society can reward people who now know how to take advantage essentially of the gambling instincts of not only the American public but the worldwide public, it’s not the most admirable part of the accomplishment,” he said.

© Copyright IBTimes 2025. All rights reserved.