Worldwide Tablet Market Has Challenging Year Ahead, While Apple’s iPad Continues To Lead

Although total shipments of Apple Inc.’s (NASDAQ:AAPL) iPad fell in the first quarter from a year earlier, the company’s flagship tablet managed to retain its top position in the market by accounting for nearly one-third of all tablets shipped during that period, market research firm International Data Corporation said in a report.

But 2014 will be very challenging for tablets, which saw a slowdown in shipments as more consumers favor large-screen phones and hold on to their existing tablets for longer periods of time, IDC said.

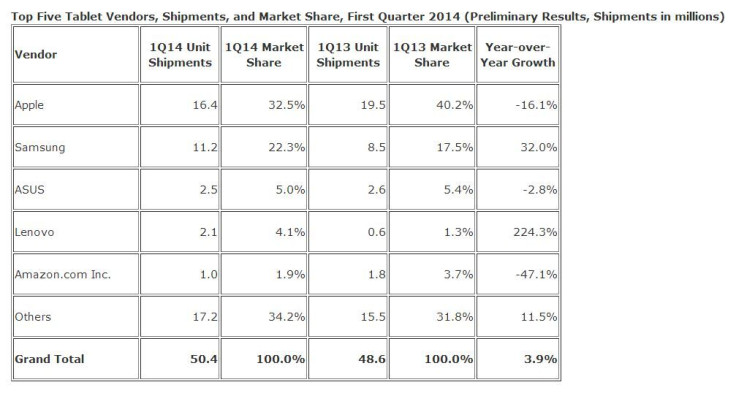

Apple shipped 16.4 million iPads in the first three months of 2014, a decline of 16.1 percent, IDC said. Last week, Apple attributed the drop to something it calls "channel inventory variations." The “channel” is Apple's collection of retail partners, which have grown steadily over the years, to include retailers like Walmart and Best Buy.

IDC said that Apple sold 26 million iPads in the fourth quarter and 19.5 million units in the first quarter of 2013.

Despite the contraction in sales during the first three months of 2014, Apple's market share slipped modestly to 32.5 percent, down from 33.2 percent the previous quarter. Samsung Electronics Co. Ltd. (KRX:005935) once again grew its worldwide share, increasing from 17.2 percent in the fourth quarter to 22.3 percent this quarter. Rounding out the top five were ASUS (TPE:2357) with 5 percent, Lenovo (HKG:0992) with 4.1 percent and Amazon (NASDAQ:AMZN) with 1.9 percent.

Google Inc.'s (NASDAQ:GOOG) Android-based operating system, a strong competitor to Apple's ioS, continued to perform well.

“With roughly two-thirds share, Android continues to dominate the market,” Jitesh Ubrani, a research analyst at IDC, said in a statement.

“Although its share of the market remains small, Windows devices continue to gain traction thanks to sleeper hits like the Asus T100, whose low cost and 2-in-1 form factor appeal to those looking for something that's 'good enough.'”

When it comes to the overall market, the total worldwide tablet shipments for the first quarter slipped to 5.4 million units, a decline of 35.7 percent from the high-volume holiday quarter and represented only a modest growth of 3.9 percent from the same period a year earlier.

The slowdown was felt across operating systems and screen sizes and likely points to an even more challenging year ahead for the category, according to IDC.

“The rise of large-screen phones and consumers who are holding on to their existing tablets for ever longer periods of time were both contributing factors to a weaker-than-anticipated quarter for tablets and 2-in-1s,” Tom Mainelli, IDC's program vice president, devices and displays, said. “In addition, commercial growth has not been robust enough to offset the slowing of consumer shipments.”

© Copyright IBTimes 2025. All rights reserved.