Xiaomi Shows Strong Revenue Growth In Its First-Ever Earnings Report

Xiaomi Corp. (UNKNOWN:UNKNOWN)(NASDAQOTH:XIACF) (NASDAQOTH:XIACY) , the somewhat controversial and recently public Chinese smartphone maker, issued its first earnings report on Aug. 22. This first public report continued much of the same narrative that arose with the company's initial public offering in July -- namely, strong revenue growth, but with big questions around the company's margins. Those margin worries are likely what caused Xiaomi's IPO to price well below what the company was hoping for when it went public on the Stock Exchange of Hong Kong earlier this summer.

This article originally appeared in the Motley Fool.

It's important to note that Xiaomi is upfront about its low margins, vowing to never make more than a 5% net margin on its hardware. Its "triathalon" strategy is predicated on driving adoption and awareness of the Xiaomi brand and corporate culture through low-priced smartphones, which will (theoretically) drive sales of other hardware products and higher-margin internet services.

Torrid growth

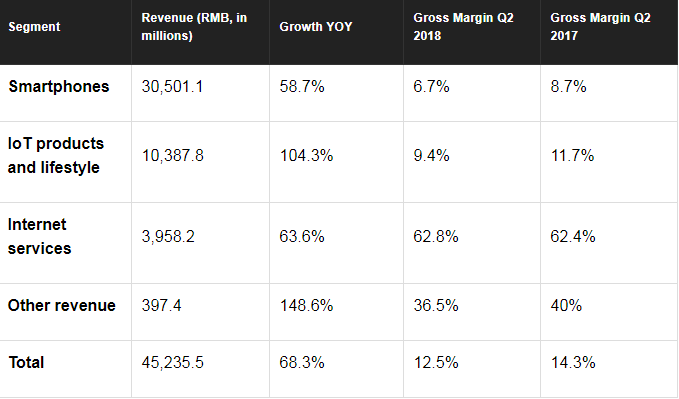

Xiaomi's quarterly results showed the strategy is yielding strong growth across all product categories.

As you can see, Xiaomi's strong growth was broad-based, yet so were its margin declines. Margins fell in all categories except internet services, which is still a relatively small part of the mix.

Still, you can't argue with that strong top line, which was boosted by 151.7% growth in international markets. These included the all-important market of India, which has a large population with fast economic growth that is highly receptive to Xiaomi's low-cost phones. Xiaomi maintained its leading market share in India last quarter, capturing roughly 30% of the Indian market, up from just 18% market share a year ago. Other highlights included strong growth in Indonesia, as well as the introduction of Xiaomi phones in France and Italy. International revenue now makes up a healthy 36% of company revenue.

How's the valuation?

Xiaomi is profitable, but just barely -- its adjusted net profit (excluding stock-based compensation and gains from minority investments in affiliates) in the quarter was RMB 2,116.8. Assuming that annualizes to around RMB 10 billion this year, that would mean the company is trading at around 33 times this year's earnings.

That's definitely not cheap, but not at all crazy for a company that's growing revenue at 68%. Those earnings are also coming at a time when Xiaomi is aggressively investing in its Chinese and international operations. Formerly an e-commerce-only company, Xiaomi has built around 360 physical "Mi" stores and 37,000 direct supply locations around China in the past few years.

Xiaomi was actually only the No. 4 phone maker in China in 2017, with 12.8% of the market (Huawei was the leader, with 20.4% market share) and it's investing heavily to change that. Even though the company's top-line grew over 68%, Xiaomi's selling and marketing expense surged an even greater 81.5%. And remember, Xiaomi's valuation on the Hong Kong stock exchange, which equates to roughly $50 billion, is close to its IPO price but well below the $100 billion valuation it initially sought in its IPO.

Of course, Xiaomi is falling prey to the general malaise overhanging Chinese stocks right now due to trade war unease. The company went public on the Stock Exchange of Hong Kong, so to buy those shares, you'd have to check availability with your online broker. In addition, prospective investors need to be aware of currency changes between the U.S. dollar, Hong Kong dollar, and Chinese yuan. The company earns revenue in Chinese yuan, but the stock is priced in Hong Kong dollars.

The market also generally gives a much lower price-to-earnings multiple to hardware companies compared with software or social media companies, which is why Xiaomi has a much smaller market capitalization than other large Chinese tech stocks such as the BAT: Baidu, Alibaba, and Tencent.

Xiaomi is listed on the Hong Kong stock exchange. There are two Xiaomi tickers trading over the counter in the U.S. XIACY is an unsponsored American Depository receipt; the “Y” at the end of the ticker indicates it’s an ADR. The “F” at the end of the other OTC ticker -- XIACF – indicates these are foreign shares, where a middleman goes to the local market and purchases the underlying shares and resells them in the U.S.

Billy Duberstein owns shares of Alibaba Group Holding Ltd., Tencent Holdings, and Xiaomi. His clients may own shares of the companies mentioned. The Motley Fool owns shares of and recommends Baidu and Tencent Holdings. The Motley Fool has a disclosure policy.