Cisco Systems 2Q Earnings Preview: Move To Software-Defined Network Gains Takes Time

When Cisco Systems Inc. (NASDAQ:CSCO), the No. 1 provider of Internet products, reports second-quarter results on Wednesday, investors expect marginally higher earnings on marginally higher revenue but nothing like what’s promised for the company’s future.

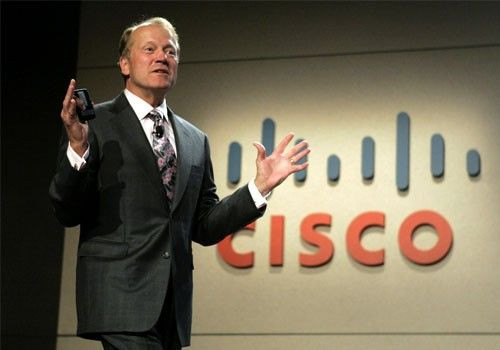

Two months ago, veteran CEO John T. Chambers outlined a plan to shift from hardware to software, targeting the cloud and the expanding world of “big data” that will require software-defined networks (SDNs) with a long-term profit goal ranging between 7 percent and 9 percent.

Over an 18-month transition, the San Jose, Calif., company wants to boost its earnings from software and services above 50 percent, compared with roughly 22 percent now, Chambers said. Cisco still gets most revenue from selling switches and routers for large computer networks.

Cisco has already moved in its new direction. Last month, it announced plans to sell its Linksys unit, which develops Wi-Fi routers and other networking products for consumers, to private Belkin International, for an undisclosed sum. Cisco acquired Linksys, of Irvine, Calif., for $500 million in 2003.

Cisco said it plans to work with Belkin on software after the divestiture.

Last month, Cisco tapped its $45 billion cash pile to acquire Intucell, a private Israeli developer of SDNs for the mobile phone sector. The price was $475 million plus retention-based incentives for senior executives who’ll be integrated into Cisco’s Service Provider Mobility Group. The acquisition is expected to close by midyear.

Analysts expect Cisco to report second-quarter earnings of $2.55 billion, or 48 cents a share, a penny ahead of prior-year earnings. Revenue is expected to rise only about 5 percent to $12.06 billion.

Twenty-nine of the 38 analysts who cover the stock have a "buy" rating on the shares.

While forecasting a notable gain over the major slowdowns and losses reported during 2013, they say Cisco is running better now but the enterprise market and government agencies aren’t ordering new products as robustly as expected.

Amitabh Passi, who covers Cisco for UBS, said public sector orders, which can account for as much as 20 percent of demand, remain soft. His survey of chief information officers (CIOs) of major corporate customers showed they expected growth to be lower than previously expected over the next 12 months, or 4.4 percent, compared with as much as 7.8 percent they'd earlier predicted.

In Cisco’s favor: The CIOs plan to concentrate on software and security services, with more than 40 percent showing a preference for Cisco products, compared with those of rivals such as Dell Inc. (NASDAQ:DELL), Juniper Networks Inc. (NASDAQ:JNPR) and Aruba Networks Inc. (NASDAQ:ARUN).

That gives Cisco “the fire power” to execute its plans, Passi said, with long-term gains in earnings. The analyst has a “buy” rating on the shares with a 12-month target of $23.50.

At Sterne Agee, analyst Shaw Wu said he presumes the earnings will be “modestly better” than anticipated because some of Cisco’s rivals including Juniper Networks and F5 Networks Inc. (NASDAQ:FFIV) have reported better-than-expected results. One reason could be that small- and medium-sized businesses appear to be ordering more as opposed to enterprises.

Wu estimated about 50 percent of Cisco sales comes from enterprises, with only about 20 percent from the smaller-sized customers.

The analyst also has a “buy” rating on Cisco, with a 12-month target of $23.

With dividends included, the return on Cisco shares for the past 12 months has been 9 percent.

They rose 11 cents to close at $21.27 in Monday trading after setting a 52-week high of $21.34 earlier.

© Copyright IBTimes 2025. All rights reserved.