Confident in Graphics and Mobile Processors, Nvidia Raises Fiscal Outlook

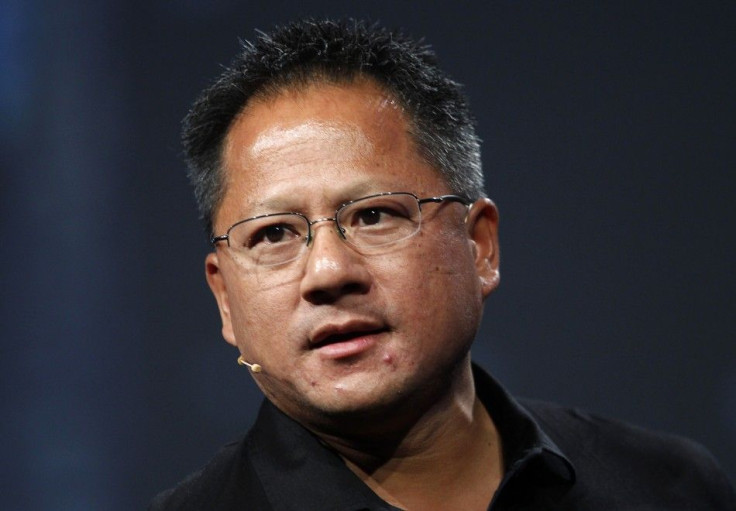

Nvidia's Chief Executive Jen-Hsun Huang has breathed life into his company a mere month after worrying investors with a supposed lack of optimism in mobile.

At the Citigroup Global Technology Conference in New York this week, Huang outlined the future outlook. He said he expects revenue in fiscal 2013 to be $4.7 billion to $5 billion, significantly higher than the $4.45 billion expected by analysts. Margins, he said, will be flat at about 51 percent to 53 percent.

Following this outlook, Nvidiia shares vaulted as much as 11 percent to a high of $14.64. It's currently at $14.46,, a 9.67 percent increase from the Tuesday close.

Huang sees the growth coming from the graphics and mobile processor operations. He also expects the mobile chip business to grow in the current quarter. This comes only a month after Huang was cautious about Nvidia's growth prospects in the mobile business during the company's earnings call.

Since that cautious statement from Huang, he has tried to clear the air and say he wasn't trying to be pessimistic.

Our genuine conservatism was misinterpreted as absence of growth. My sense is that we're going to grow, and we just wanted to take a more conservative posture in the marketplace, considering some actions that our companies, their various competitors and customers are taking against each other. They're not within my control or my ability to forecast, Huang said to Dow Jones Newswire.

Currently, Nvidia's Tegra chip set is found in a significant amount of tablets such as the Samsung Galaxy Tab. However, it's not in Apple's iPad, which dominates the tablet industry. Even worse, the GalaxyTab is currently the subject of ongoing litigation between Samsung and Apple. This has also caused Huang to be cautious.

Even still, his bold outlook for the future of Nvidia has the company currently on the upswing. Analysts are generally optimistic.

Long-term, we think NVIDIA is arguably the best positioned semiconductor company to benefit from Windows-on-ARM deployments, especially if this architecture gains traction in notebook form factors, Mark Lipacis, an analyst at Jefferies, said in a note.

David Wong, analyst at Wells Fargo, wrote that the solid sales outlook for Nvidia could also have positive implications for the overall PC demand environment.

Follow Gabriel Perna on Twitter at @GabrielSPerna

© Copyright IBTimes 2025. All rights reserved.