Earnings Preview: Apple Inc (AAPL), Facebook Inc (FB), Ford Motor Company (F), Google Inc (GOOG), Pfizer Inc (PFE)

Fourth-quarter earnings reports will continue to make headlines next week. So far this season, about a fifth of the companies in the S&P 500 (INDEXSP:.INX) have reported results, with around 65 percent of them topping Wall Street estimates -- about the historical average.

We ran a screen and produced a list of 58 notable companies set to report their earnings Jan. 27 to Jan. 31. We have highlighted their expected reporting dates and times, along with analysts’ earnings-per-share (fully reported) and revenue estimates from Reuters, as well as the stocks’ year-to-date performances.

Monday Before Markets Open, or BMO:

Caterpillar Inc. (NYSE:CAT) is a manufacturer of construction and mining equipment, diesel and natural gas engines, industrial gas turbines and diesel-electric locomotives. The company has a market capitalization of $56.33 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.31 on revenue of $13.64 billion, compared with a profit of $1.04 a share on revenue of $16.08 billion in the year-ago period. Caterpillar is trading at around $88.52 a share. In the past 12 months, the stock has lost 8.6 percent.

Monday After Markets Close, or AMC:

Apple Inc. (NASDAQ:AAPL) is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers and portable digital music players. The company has a market capitalization of $493.15 billion. It is expected to report FY 2014 first-quarter EPS of $14.05 on revenue of $57.46 billion, compared with a profit of $13.81 a share on revenue of $54.51 billion in the year-ago period. Apple is trading at around $548.10 a share. In the past 12 months, the stock has gained 6.6 percent.

United States Steel Corp. (NYSE:X) produces and sells steel mill products. The company has a market cap of $3.83 billion. It's expected to report a loss of 52 cents per share in the fourth quarter of fiscal year 2013 on revenue of $4.36 billion, compared with a loss of 35 cents per share on revenue of $4.49 billion in the year-ago period. United States Steel Corp. is trading at around $26.48 per share. In the past 12 months, the stock has gained 6.0 percent.

Tuesday BMO:

AK Steel Holding Corp. (NYSE:AKS) is an integrated producer of flat-rolled carbon, stainless and electrical steels and tubular products. The company has a market capitalization of $917.58 million. It's expected to report a FY 2013 fourth-quarter profit of less than one cent per share on revenue of $1.44 billion, compared with a loss of $1.89 a share on revenue of $1.42 billion in the year-ago period. AK Steel Holding is trading at around $6.73 a share. In the past 12 months, the stock has gained 46.4 percent.

Comcast Corp. (NASDAQ:CMCSA) is a provider of entertainment, information and communications products and services. The company has a market capitalization of $138.57 billion. It is expected to report FY 2013 fourth-quarter EPS of 68 cents on revenue of $16.63 billion, compared with a profit of 56 cents a share on revenue of $15.94 billion in the year-ago period. Comcast is trading at around $52.96 a share. In the past 12 months, the stock has gained 32.4 percent.

Corning Inc. (NYSE:GLW) is a global, technology-based corporation. The company has a market capitalization of $27.39 billion. It is expected to report FY 2013 fourth-quarter EPS of 26 cents on revenue of $1.93 billion, compared with a profit of 19 cents a share on revenue of $2.15 billion in the year-ago period. Corning is trading at around $18.94 a share. In the past 12 months, the stock has gained 54.8 percent.

D.R. Horton Inc. (NYSE:DHI) is a homebuilding company that constructs and sells homes in the U.S. The company has a market capitalization of $7.07 billion. It is expected to report FY 2014 first-quarter EPS of 30 cents on revenue of $1.45 billion, compared with a profit of 20 cents a share on revenue of $1.23 billion. D.R. Horton is trading at around $21.91 a share. In the past 12 months, the stock has gained 0.4 percent.

Danaher Corp. (NYSE:DHR) designs, manufactures and markets professional, medical, industrial and commercial products and services. The company has a market cap of $53.64 billion. It's expected to report FY 2013 fourth-quarter EPS of 97 cents on revenue of $5.20 billion, compared with a profit of 89 cents a share on revenue of $4.98 billion in the year-ago period. Danaher is trading at around $76.95 a share. In the past 12 months, the stock has gained 27.3 percent.

E I Du Pont De Nemours And Co (NYSE:DD) is a chemical company with a market capitalization of $57.01 billion. It's expected to report FY 2013 fourth-quarter EPS of 48 cents on revenue of $7.78 billion, compared with a profit of 12 cents a share on revenue of $7.33 billion in the year-ago period. DuPont is trading at around $61.53 a share. In the past 12 months, the stock has gained 29.6 percent.

Pfizer Inc. (NYSE:PFE) is a research-based, global biopharmaceutical company. The company has a market capitalization of $200.72 billion. It's expected to report FY 2013 fourth-quarter EPS of 43 cents on revenue of $13.35 billion, compared with a profit of 85 cents per share on revenue of $15.07 billion in the year-ago period. Pfizer is trading at around $31.00 per share. In the past 12 months, the stock has gained 16.3 percent.

Ford Motor Co. (NYSE:F) operates in the global automotive industry. The company has a market capitalization of $64.57 billion. It is expected to report FY 2013 fourth-quarter EPS of 32 cents on revenue of $35.22 billion, compared with a profit of 40 cents a share on revenue of $34.50 billion in the year-ago period. Ford Motor Company is trading at around $16.40 a share. In the past 12 months, the stock has lost 0.8 percent.

Tuesday AMC:

Amgen Inc. (NASDAQ:AMGN) is a global biotechnology pioneer that discovers, develops, manufactures and delivers human therapeutics. The company has a market cap of $92.90 billion. It's expected to report FY 2013 fourth-quarter EPS of $1.59 on revenue of $4.81 billion, compared with a profit of $1.01 per share on revenue of $4.42 billion in the year-ago period. Amgen Inc. is trading at around $123.19 per share. In the past 12 months, the stock has gained 48.3 percent.

AT&T Inc. (NYSE:T) is a provider of telecommunications services in the U.S. and worldwide. The company has a market capitalization of $177.67 billion. It is expected to report FY 2013 fourth-quarter EPS of 50 cents on revenue of $33.06 billion, compared with a loss of 68 cents a share on revenue of $32.61 billion in the year-ago period. AT&T is trading at around $33.66 a share. In the past 12 months, the stock has lost 0.4 percent.

Electronic Arts Inc. (NASDAQ:EA) develops, markets, publishes and distributes game software content and services that can be played by consumers on a variety of video game machines and electronic devices. The company has a market capitalization of $7.36 billion. It is expected to report a loss of 92 cents a share in the third quarter of fiscal year 2014 on revenue of $1.66 billion, compared with a loss of 15 cents a share on revenue of $1.18 billion in the year-ago period. Electronic Arts is trading at around $23.79 a share. In the past 12 months, the stock has gained 69.5 percent.

Yahoo! Inc. (NASDAQ:YHOO) is a digital media company. The company has a market capitalization of $39.75 billion. It is expected to report FY 2013 fourth-quarter EPS of 33 cents on revenue of $1.20 billion, compared with a profit of 23 cents a share on revenue of $1.22 billion in the year-ago period. Yahoo is trading at around $39.26 a share. In the past 12 months, the stock has gained 94.6 percent.

Wednesday BMO:

Phillips 66 (NYSE:PSX) is engaged in producing natural gas liquids and petrochemicals. The company has a market capitalization of $46.03 billion. It is expected to report FY 2013 fourth-quarter EPS of 96 cents on revenue of $39.31 billion, compared with a profit of $1.11 a share on revenue of $43.99 billion in the year-ago period. Phillips 66 is trading at around $76.51 a share. In the past 12 months, the stock has gained 38.2 percent.

The Boeing Co. (NYSE:BA) is an aerospace company. The company has a market capitalization of $106.41 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.30 on revenue of $22.74 billion, compared with a profit of $1.28 a share on revenue of $22.30 billion in the year-ago period. The Boeing Company is trading at around $141.44 a share. In the past 12 months, the stock has gained 90.5 percent.

The Dow Chemical Co. (NYSE:DOW) is a diversified manufacturer and supplier of products used primarily as raw materials in the manufacture of customer products and services worldwide. The company has a market capitalization of $54.17 billion. It is expected to report FY 2013 fourth-quarter EPS of 42 cents on revenue of $14.13 billion, compared with a loss of 61 cents a share on revenue of $13.92 billion in the year-ago period. Dow Chemical is trading at around $44.43a share. In the past 12 months, the stock has gained 31.0 percent.

EMC Corp. (NYSE:EMC) and its subsidiaries develops, delivers and supports the information technology industry's range of information infrastructure and virtual infrastructure technologies, solutions and services. The company has a market capitalization of $53.78 billion. It is expected to report FY 2013 fourth-quarter EPS of 48 cents on revenue of $6.64 billion, compared with a profit of 39 cents a share on revenue of $6.03 billion in the year-ago period. EMC is trading at around $26.10 a share. In the past 12 months, the stock has gained 6.5 percent.

Hess Corp. (NYSE: HES) is a global integrated energy company engaged in the exploration for and the production of crude oil and natural gas, the refining of crude oil and the sale of refined products, natural gas and electricity. The company has a market capitalization of $26.07 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.15 on revenue of $2.36 billion, compared with a profit of $1.66 a share on revenue of $9.70 billion in the year-ago period. Hess Corp. is trading at around $77.24 a share. In the past 12 months, the stock has gained 33.6 percent.

Hudson City Bancorp Inc. (NASDAQ:HCBK) is a federal stock savings bank. The company has a market capitalization of $4.80 billion. It is expected to report FY 2013 fourth-quarter EPS of 7 cents on revenue of $133.59 million, compared with a profit of 10 cents a share on revenue of $192.26 million in the year-ago period. Hudson City Bancorp Inc. is trading at around $9.08 a share. In the past 12 months, the stock has gained 5.0 percent.

JetBlue Airways Corp. (NASDAQ: JBLU) is a passenger airline that operates primarily on point-to-point routes. The company has a market capitalization of $2.58 billion. It is expected to report FY 2013 fourth-quarter EPS of 13 cents on revenue of $1.35 billion, compared with a profit of 0 cent a share on revenue of $1.19 billion in the year-ago period. JetBlue Airways is trading at around $9.19 a share. In the past 12 months, the stock has gained 46.6 percent.

Marathon Petroleum Corp. (NYSE:MPC) is a petroleum product refiners, transporters and marketers in the U.S. The company has a market capitalization of $25.57 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.00 on revenue of $19.69 billion, compared with a profit of $2.24 a share on revenue of $20.68 billion in the year-ago period. Marathon Petroleum is trading at around $84.85 a share. In the past 12 months, the stock has gained 25.6 percent.

Valero Energy Corp. (NYSE:VLO) is an independent petroleum refining and marketing company. The company has a market capitalization of $27.60 billion. It's expected to report FY 2013 fourth-quarter EPS of 82 cents on revenue of $28.64 billion, compared with a profit of $1.82 per share on revenue of $34.70 billion in the year-ago period. Valero Energy Corporation is trading at around $51.25 a share. In the past 12 months, the stock has gained 35.0 percent.

The Southern Co. (NYSE:SO) is one of America's largest generators of electricity. The company has a market capitalization of $36.54 billion. It is expected to report FY 2013 fourth-quarter EPS of 49 cents on revenue of $3.86 billion, compared with a profit of 44 cents a share on revenue of $3.70 billion in the year-ago period. The Southern Company is trading at around $41.43 a share. In the past 12 months, the stock has lost 4.7 percent.

Wednesday AMC:

Citrix Systems Inc. (NASDAQ:CTXS) designs, develops and markets technology solutions that enable information technology services. The company has a market capitalization of $11.12 billion. It is expected to report FY 2013 fourth-quarter EPS of 68 cents on revenue of $805.39 million, compared with a profit of 60 cents a share on revenue of $740.00 million in the year-ago period. Citrix Systems is trading at around $59.67 a share. In the past 12 months, the stock has lost 11.8 percent.

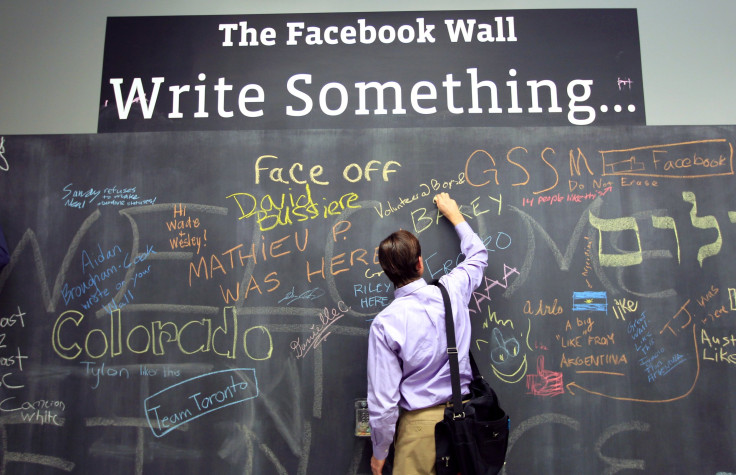

Facebook Inc. (NASDAQ:FB) is engaged in building products to create utility for users, developers, and advertisers. The company has a market capitalization of $137.91 billion. It is expected to report FY 2013 fourth-quarter EPS of 20 cents on revenue of $2.34 billion, compared with a profit of 3 cents a share on revenue of $1.59 billion in the year-ago period. Facebook is trading at around $56.63 a share. In the past 12 months, the stock has gained 90.9 percent.

Qualcomm Inc. (NASDAQ:QCOM) designs, manufactures and markets digital wireless telecommunications products and services based on its code division multiple access (CDMA) technology and other technologies. The company has a market capitalization of $128.05 billion. It is expected to report FY 2014 first-quarter EPS of $1.03 on revenue of $6.66 billion, compared with a profit of $1.09 a share on revenue of $6.02 billion in the year-ago period. Qualcomm is trading at around $75.87 a share. In the past 12 months, the stock has gained 17.3 percent.

Symantec Corp. (NASDAQ:SYMC) is a global provider of security, storage, and systems management solutions that help businesses and consumers secure and manage their information. The company has a market capitalization of $16.49 billion. It is expected to report FY 2014 third-quarter EPS of 27 cents on revenue of $1.65 billion, compared with a profit of 30 cents a share on revenue of $1.79 billion in the year-ago period. Symantec is trading at around $23.62 a share. In the past 12 months, the stock has gained 14.2 percent.

Thursday BMO:

3M Co. (NYSE:MMM) is a diversified technology company. The company has a market capitalization of $90.70 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.62 on revenue of $7.71 billion, compared with a profit of $1.41 a share on revenue of $7.39 billion in the year-ago period. 3M is trading at around $134.71 a share. In the past 12 months, the stock has gained 36.4 percent.

Altria Group Inc. (NYSE:MO) is engaged in the manufacture and sale of cigarettes and certain smokeless products in the U.S. The company has a market capitalization of $74.74 billion. It is expected to report FY 2013 fourth-quarter EPS of 47 cents on revenue of $4.47 billion, compared with a profit of 55 cents a share on revenue of $4.46 billion in the year-ago period. Altria Group is trading at around $37.37 a share. In the past 12 months, the stock has gained 12.3 percent.

The Blackstone Group LP (NYSE:BX) is a manager of private capital and provider of financial-advisory services. The company has a market cap of $17.97 billion. It's expected to report an FY 2013 fourth-quarter EPS (excluding one-time items) of 82 cents on revenue of $1.74 billion, compared with a profit of 59 cents a share in the year-ago period on revenue of $1.23 billion. Blackstone is trading at around $31.81 a share. In the past 12 months, the stock has gained 79.4 percent.

Cardinal Health Inc. (NYSE:CAH) is a health-care services company. The company has a market cap of $22.87 billion. It is expected to report FY 2014 second-quarter EPS of 74 cents on revenue of $20.78 billion, compared with a profit of 88 cents on revenue of $25.23 billion in the year-ago period. Cardinal Health is trading at around $66.96 a share. In the past 12 months, the stock has gained 50.0 percent.

Celgene Corp. (NASDAQ:CELG) is a global biopharmaceutical company engaged in the discovery, development and commercialization of therapies designed to treat cancer and immune-inflammatory-related diseases. The company has a market cap of $69.45 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.11 on revenue of $1.72 billion, compared with EPS of 61 cents on revenue of $1.45 billion in the year-ago period. Celgene is trading at around $168.55 a share. In the past 12 months, the stock has gained 68.5 percent.

Colgate-Palmolive Co. (NYSE:CL) is a consumer products company. The company has a market cap of $58.70 billion. It is expected to report FY 2013 fourth-quarter EPS of 68 cents on revenue of $4.40 billion, compared with EPS of 63 cents on revenue of $4.29 billion in the year-ago period. Colgate-Palmolive is trading at around $63.44 a share. In the past 12 months, the stock has gained 16.4 percent.

ConocoPhillips (NYSE:COP) is an international integrated energy company. The company has a market capitalization of $83.12 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.42 on revenue of $15.13 billion, compared with a profit of $1.16 a share on revenue of $16.37 billion in the year-ago period. ConocoPhillips is trading at around $67.85 a share. In the past 12 months, the stock has gained 14.5 percent.

Eli Lilly & Co. (NYSE:LLY) discovers, develops, manufactures, and sells pharmaceutical products. The company has a market capitalization of $62.13 billion. It is expected to report FY 2013 fourth-quarter EPS of 73 cents on revenue of $5.46 billion, compared with a profit of 74 cents a share on revenue of $5.96 billion in the year-ago period. Eli Lilly is trading at around $55.15 a share. In the past 12 months, the stock has gained 2.6 percent.

Franklin Resources Inc. (NYSE:BEN) is a global investment management organization. The company has a market capitalization of $35.44 billion. It is expected to report FY 2014 first-quarter EPS of 92 cents on revenue of $2.10 billion, compared with a profit of 81 cents a share on revenue of $1.90 billion in the year-ago period. Franklin Resources is trading at around $56.18 a share. In the past 12 months, the stock has gained 26.4 percent.

Occidental Petroleum Corp. (NYSE:OXY) engages in the exploration and production of oil and gas properties in the U.S. and internationally. The company has a market capitalization of $72.08 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.78 on revenue of $5.79 billion, compared with a profit of 42 cents a share on revenue of $6.17 billion in the year-ago period. Occidental Petroleum is trading at around $89.42 a share. In the past 12 months, the stock has gained 8.3 percent.

Peabody Energy Corp. (NYSE:BTU) is a coal company with a market capitalization of $4.71 billion. It's expected to report a loss of 15 cents per share on revenue of $1.77 billion in the fourth quarter of fiscal year 2013, compared with a loss of $3.78 per share on revenue of $2.02 billion in the year-ago period. Peabody Energy is trading at around $17.45 a share. In the past 12 months, the stock has lost 32.8 percent.

Time Warner Cable Inc. (NYSE:TWC) is a provider of video, high-speed data and voice services in the U.S. The company has a market capitalization of $38.45 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.72 on revenue of $5.56 billion, compared with a profit of $1.68 a share on revenue of $5.49 billion in the year-ago period. Time Warner Cable is trading at around $134.55 a share. In the past 12 months, the stock has gained 33.8 percent.

Viacom Inc. (NASDAQ:VIAB) is an entertainment content company. The company has a market capitalization of $24.3 billion. It is expected to report FY 2014 first-quarter EPS of $1.16 on revenue of $3.32 billion, compared with a profit of 92 cents a share on revenue of $3.31 billion in the year-ago period. Viacom is trading at around $83.52 a share. In the past 12 months, the stock has gained 44.3 percent.

Visa Inc. (NYSE:V) is a global payments-technology company. The company has a market cap of $145.29 billion. It is expected to report FY 2014 first-quarter EPS of $2.17 on revenue of $3.14 billion, compared with a profit of $1.93 a share on revenue of $2.85 billion in the year-ago period. Visa is trading at around $228.25 a share. In the past 12 months, the stock has gained 44.2 percent.

Xcel Energy Inc. (NYSE:XEL) is a holding company with subsidiaries engaged primarily in the utility business. The company has a market cap of $14.17 billion. It is expected to report FY 2013 fourth-quarter EPS of 27 cents on revenue of $2.70 billion, compared with EPS of 29 cents on revenue of $2.55 billion in the year-ago period. Xcel Energy Inc. is trading at around $28.48 a share. In the past 12 months, the stock has gained 5.4 percent.

United Parcel Service Inc. (NYSE:UPS) is a package delivery company that operates in the U.S. less-than-truckload industry, and the provider of global supply chain management solutions. The company has a market capitalization of $90.92 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.01 on revenue of $15.18 billion, compared with a loss of $1.83 a share on revenue of $14.57 billion in the year-ago period. UPS is trading at around $97.94 a share. In the past 12 months, the stock has gained 22.0 percent.

Exxon Mobil Corp. (NYSE:XOM) is a manufacturer and marketer of commodity petrochemicals. The company has a market capitalization of $423.66 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.91 on revenue of $113.99 billion, compared with a profit of $2.20 a share on revenue of $115.17 billion in the year-ago period. Exxon Mobil is trading at around $96.97 a share. In the past 12 months, the stock has gained 6.8 percent.

Thursday AMC:

Amazon.com Inc. (NASDAQ:AMZN) serves consumers through its retail Websites and focuses on selection, price, and convenience. The company has a market capitalization of $183.03 billion. It is expected to report FY 2013 fourth-quarter EPS of 68 cents on revenue of $26.06 billion, compared with a profit of 21 cents a share on revenue of $21.27 billion in the year-ago period. Amazon.com Inc. is trading at around $399.87 a share. In the past 12 months, the stock has gained 47.0 percent.

Broadcom Corp. (NASDAQ:BRCM) is a global semiconductor solution for wired and wireless communications. The company has a market capitalization of $18.40 billion. It's expected to report FY 2013 fourth-quarter EPS of 27 cents on revenue of $2.02 billion, compared with a profit of 43 cents per share on revenue of $2.08 billion in the year-ago period. Broadcom is trading at around $29.77 a share. In the past 12 months, the stock has lost 14.5 percent.

Google Inc. (NASDAQ:GOOG) is a global technology company focused on improving the ways people connect with information. The company has a market cap of $387.57 billion. It's expected to report an FY 2013 fourth-quarter EPS of $10.13 on revenue of $16.76 billion, compared with a profit of $8.62 a share on revenue of $12.16 billion in the year-ago period. Google is trading at around $1,160.10 a share. In the past 12 months, the stock has gained 64.7 percent.

Friday BMO:

AbbVie Inc. (NYSE:ABBV) is a research-based pharmaceuticals company with a market capitalization of $77.59 billion. It is expected to report FY 2013 fourth-quarter EPS of 69 cents on revenue of $5.09 billion. AbbVie, the Abbott Laboratories (NYSE: ABT) spin-off, is trading at around $48.87 a share. In the past 12 months, the stock has gained 31.0 percent.

Chevron Corp. (NYSE:CVX) engages in petroleum operations, chemicals operations, mining operations, power generation and energy services. The company has a market capitalization of $227.68 billion. It is expected to report FY 2013 fourth-quarter EPS of $2.68 on revenue of $63.14 billion, compared with a profit of $3.70 a share on revenue of $60.55 billion in the year-ago period. Chevron is trading at around $118.39 a share. In the past 12 months, the stock has gained 2.7 percent.

Dominion Resources Inc. (NYSE:D) is a producer and transporter of energy. The company has a market capitalization of $38.51 billion. It is expected to report FY 2013 fourth-quarter EPS of 89 cents on revenue of $3.15 billion, compared with a loss of $1.15 a share on revenue of $3.17 billion in the year-ago period. Dominion Resources is trading at around $66.40 a share. In the past 12 months, the stock has gained 25.5 percent.

KKR Financial Holdings LLC (NYSE:KFN) is a specialty finance company focused on a range of asset classes. The company has a market capitalization of $2.67 billion. It is expected to report FY 2013 fourth-quarter EPS of 24 cents on revenue of $132.00 billion, compared with a profit of 40 cents a share on revenue of $133.66 billion in the year-ago period. KKR Financial Holdings LLC is trading at around $13.05 a share. In the past 12 months, the stock has gained 14.8 percent.

Mastercard Inc. (NYSE:MA) is a global payments and technology company. The company has a market capitalization of $95.75 billion. It is expected to report FY 2013 fourth-quarter EPS of 60 cents on revenue of $2.14 billion, compared with a profit of $4.86 a share on revenue of $1.90 billion in the year-ago period. Mastercard is trading at around $82.36 a share. In the past 12 months, the stock has lost 84.2 percent.

Mattel Inc. (NASDAQ:MAT) designs, manufactures and markets a variety of toy products worldwide which are sold to its customers and directly to consumers. The company has a market capitalization of $14.54 billion. It is expected to report FY 2013 fourth-quarter EPS of $1.20 on revenue of $2.37 billion, compared with a profit of 87 cents a share on revenue of $2.26 billion in the year-ago period. Mattel is trading at around $42.96 a share. In the past 12 months, the stock has gained 13.0 percent.

Tyco International Ltd. (NYSE:TYC) is a Switzerland-based holding company of the Tyco Group. The company has a market cap of $18.87 billion. It is expected to report FY 2014 fourth-quarter EPS of 43 cents on revenue of $2.63 billion, compared with EPS of 34 cents on revenue of $2.60 billion in the year-ago period. Tyco International is trading at around $45.53 a share. In the past 12 months, the stock has gained 29.2 percent.

Tyson Foods Inc. (NYSE:TSN) is a meat protein and food production company. The company has a market capitalization of $12.19 billion. It is expected to report FY 2014 first-quarter EPS of 65 cents on revenue of $8.76 billion, compared with a profit of 48 cents per share on revenue of $8.40 billion in the year-ago period. Tyson Foods is trading at around $35.46 per share. In the past 12 months, the stock has gained 62.3 percent.

Weyerhaeuser Co. (NYSE:WY), formerly Weyerhaeuser Timber Co., is a forest-products company. The company has a market cap of $17.81 billion. It is expected to report FY 2013 fourth-quarter EPS of 29 cents a share on revenue of $2.30 billion, compared with a profit of 26 cents a share on revenue of $2.00 billion in the year-ago period. Weyerhaeuser is trading at around $30.56 a share. In the past 12 months, the stock has lost 0.2 percent.

© Copyright IBTimes 2024. All rights reserved.