India Central Bank Raises Rates

India's central bank raised interest rates on Tuesday for the 13th time since early 2010 but said it was likely to hold off on further increases as it expects high inflation to ease beginning in December.

The Reserve Bank of India raised its policy lending rate, the repo rate, by 25 basis points to 8.5 percent, in line with expectations in a Reuters poll last week.

It also revised down its growth forecast for the fiscal year ending in March to 7.6 percent from 8 percent with a downside bias earlier, while sticking with its forecast that headline wholesale price index inflation will ease to 7 percent at the end of the fiscal year.

The likelihood of a rate move at its December review is relatively low, the central bank said in a statement.

Beyond that, if the inflation trajectory conforms to projections, further rate hikes may not be warranted, it said.

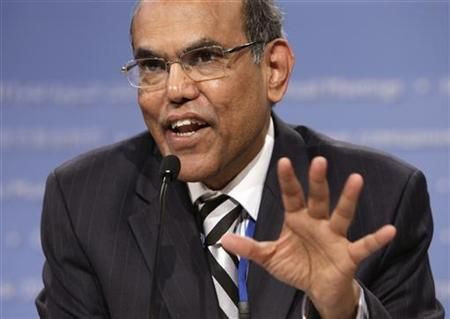

The RBI under Governor Duvvuri Subbarao has been one of the most aggressive central banks anywhere and has continued to take its fight to inflation even as its global counterparts have refocused monetary policy toward promoting growth.

Despite continued policy tightening, inflation in India remains sticky, with the headline wholesale price index up 9.72 percent annually through September, its 10th straight month above 9 percent and highest among the BRIC grouping of economies that includes Brazil, Russia and China.

Meanwhile, India's economy grew at 7.7 percent in the June quarter, its weakest in six quarters, while industrial output growth was below 5 percent in July and August.

In last week's Reuters poll, 17 economists had expected the central bank to raise rates on Tuesday but 13 had expected it to pause, with most respondents expecting rates to remain unchanged after Tuesday for the remainder of the fiscal year through March.

(Reporting by Swati Bhat and Tony Munroe)

© Copyright Thomson Reuters {{Year}}. All rights reserved.