It’s Official: China Consumed, Mined & Imported The Most Gold Ever In 2013

China has been officially crowned the world’s largest gold market for the first time, according to fresh industry figures from Tuesday.

The country overtook India as the world’s largest consumer of gold in 2013, with consumer demand soaring 32 percent to 1,066 tonnes for 2013. That’s the most gold ever demanded annually by one country’s consumers in bars, coins and jewelry, topping India’s previous 2010 record of 1,007 tonnes.

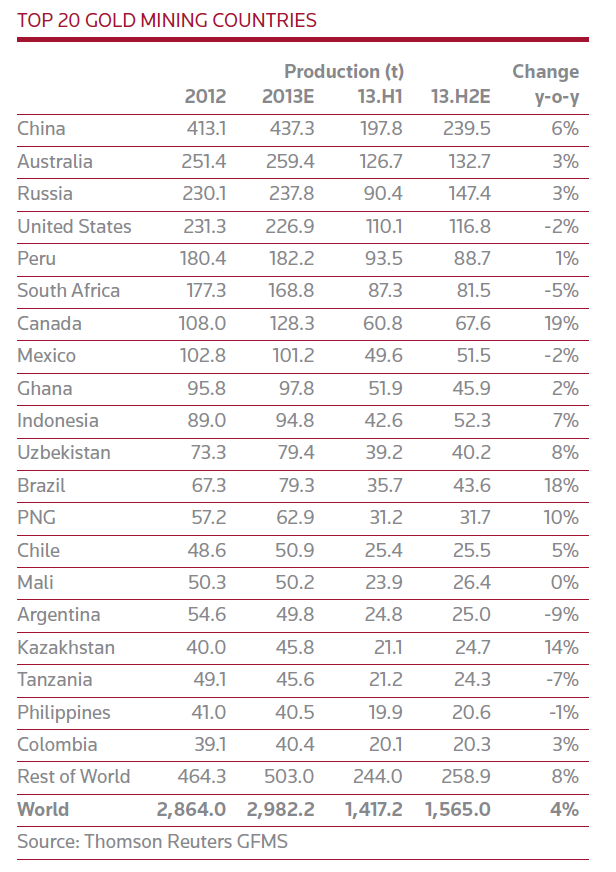

China is already the world’s top producer of gold, mining 437 tonnes in 2013 on industry estimates, with the largest annual increase globally for 2013. It displaced South Africa as the world’s largest gold producer in 2007. The country also imported a record 1,108 metric tons in 2013, up 33 percent from a year ago, via Hong Kong. That’s more gold imports than any other country.

“The impact on the Chinese gold industry of the extraordinary growth in 2013 demand has been marked, with significant growth in both manufacturing and retail network capacity,” reads the World Gold Council’s latest quarterly demand report.

“The gold market has really taken off in China over the last five years, to being quite small to now being the largest in the world,” council managing director Marcus Grubb told IBTimes in a phone interview.

“You’ve seen an expansion in the number of businesses selling gold, both at an investment and jewelry level,” continued Grubb. “Wholesalers and fabricators in Shenzen and in manufacturing zones are particularly interesting.”

“There may be up to 300 tonnes now sitting in that inventory and stocking chain in the Chinese system, with banks, fabricators, jewelers, wholesalers and dealers,” he said. “Those businesses were not stocking for fun.”

Much of the demand surge has stemmed from weak gold prices, which plunged abruptly to lows in April and June 2013. The precious metal fell 28 percent in price in 2013, in its worst showing since 1981.

That meant Chinese consumers snapped up physical gold at bargain prices, though Chinese buying in the second half of 2013 slowed significantly.

Although Wall Street analysts have said Chinese physical demand may be gold’s strongest single support, record consumer buying has done little to lift prices. Western investors sold off over 880 tonnes, or 28 million ounces, from gold exchange-traded funds in 2013, with high-profile hedge funds liquidating the metal from portfolios.

That led to much negative market sentiment in 2013, despite China’s extraordinary $49 billion consumer market. Investment demand, which drives prices via influential futures markets, fell 50 percent in 2013, in the second worst year on record. That meant global gold demand shrank 15 percent in value in 2013 to $170 billion.

Global consumer demand rebounded to its best since the start of the financial crisis in 2008, according to World Gold Council data.

It’s unclear if gold flows from the West to East in 2013, which saw bullion refiners profit, could easily reverse. Chinese consumers often hoard gold and may be unwilling to relinquish it, even if prices fluctuate, according to Ed Moy, chief strategist for precious metals seller Morgan Gold.

“The Western focus is a lot more now on electronic derivatives and paper gold. The East is focused a lot on physical gold itself,” said Moy in an interview. “Individuals don’t have the capacity to necessarily buy a 400 ounce bar of gold – that’d be about half a million bucks – but they’re the ones driving demand for individual bullion coins.”

Grubb estimated that China’s gold consumer market may have circulated close to 1,400 tonnes of gold, far exceeding official estimates of 1,066 tonnes, if over-the-counter flows are included.

Gold opened at $1,318 per ounce on Monday on New York’s COMEX exchange, at its highest since November.

© Copyright IBTimes 2024. All rights reserved.