Natural Disasters And Catastrophic Events Racked Up $92B In Global Economic Losses In 2015: Report

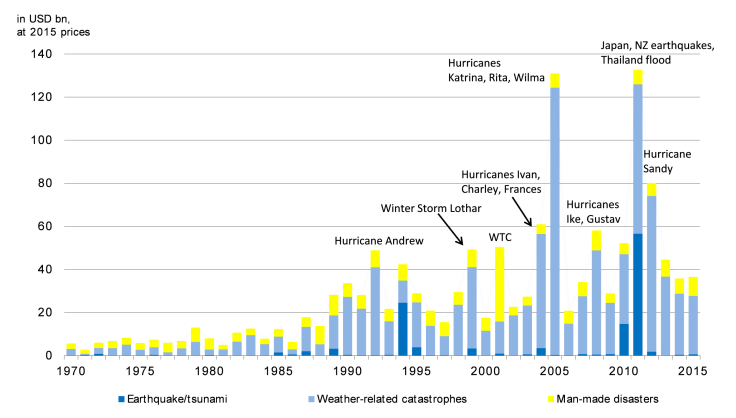

Hundreds of catastrophic disasters rattled and pummeled the world last year, racking up roughly $92 billion in global economic losses as infrastructure crumbled, businesses halted and thousands of people lost their lives.

North America suffered one of the highest levels of economic damage, with nearly $29 billion in losses for 2015, the reinsurance giant Swiss Re said this week in a report that tallies the cost of more than 350 natural and man-made disasters last year.

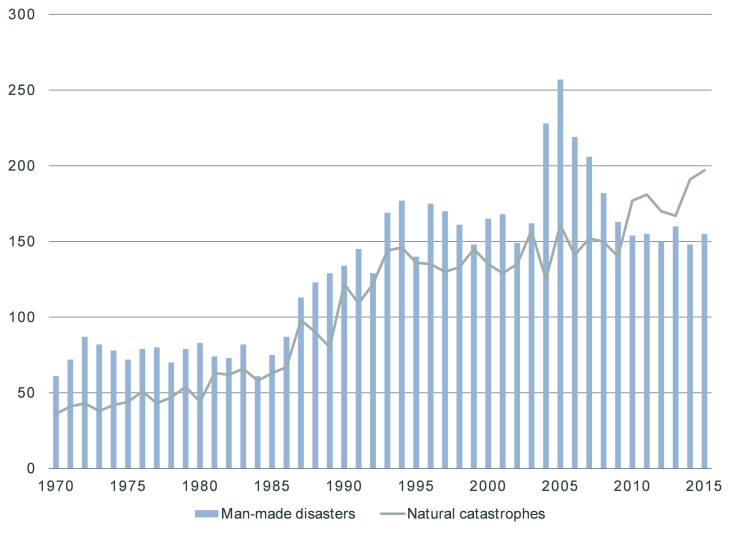

Natural disasters were largely to blame for the losses, with 198 such events — the highest number ever recorded in a single year, Swiss Re said. The devastating earthquake in Nepal last April caused $6 billion in estimated losses alone and killed nearly 9,000 people. In the U.S., a severe drought and wildfires scorched the U.S. West Coast, harsh winter storms chilled the eastern states, and record-smashing floods drenched the Midwest and Southeast.

Man-made events, including the deaths of thousands of refugees crossing the Mediterranean Sea to Europe, accounted for the remaining 155 disasters.

Last year’s number of catastrophes was higher than in 2014 when 339 events took place. But the overall economic losses were actually lower in 2015 than the previous year, with 2014 losses totaling about $113 billion worldwide.

The fact that more disasters wreaked less economic havoc in 2015 is largely a reflection of the types of natural and man-made events that afflicted the world, said Monica Ningen, managing director and chief property underwriter in the U.S. and Canada at Swiss Re.

In the U.S., for instance, nearly a dozen tropical storms last year caused catastrophic flooding. But because the storms didn’t evolve into hurricanes, or make landfall, the extent of that damage was limited. And the wildfires that blazed across California, Washington and Alaska largely avoided dense urban centers packed with people, expensive infrastructure and bustling economic activity.

Ningen said that while the U.S. and other nations are getting better about preparing for storms and responding to tragedies, most of those efforts are relatively recent, and thus it’s too soon to tell if those measures helped limit the scale of economic losses. After Hurricane Sandy smashed into the U.S. East Coast in October 2012, striking the world’s financial capital New York City, many states and governments began adopting “resiliency” plans to prepare for storms and other events made worse by global warming, including coastal flooding and intense heatwaves.

“Is there progress being made? Yes. But there hasn’t been a really big event [in the U.S.] to really test how well we’re doing,” Ningen said.

While pegging individual events to global warming is tricky scientifically, a handful of last year’s U.S. disasters were likely exacerbated by the changing climate. In California, where a devastating drought has scorched crops and sucked wells dry, scientists said they determined human activity has caused as much as one-quarter of the brutal event. The same dry conditions helped ignite what became the worst year for wildfires in the U.S. since 1960. Wildfires in general have grown more intense and destructive in recent decades as more people move into arid, fire-prone landscapes and global temperatures rise.

Worldwide, the Swiss Re report found a growing gap in the economic losses that were covered — or not covered — by insurance. The majority of losses from catastrophic events — about $55 billion, or 60 percent — did not have coverage, meaning taxpayers were left to foot the bill of cleanup and recovery, if cleanup happened at all.

The insurance gap is largest in developing countries in Africa and Asia where people are either less likely to be able to afford coverage or have limited access to such financial safeguards.

Ningen said Swiss Re was concerned about the lack of coverage, which is perhaps not a surprising response from a company that provides insurance and reinsurance products. The Zurich-based firm generated premiums and fees income of $30.2 billion in 2015.

As natural disasters and weather events become more frequent and severe due to global warming, the loss in lives and dollars will undoubtedly soar in the coming decades, researchers have warned.

“People often ask the question of whether we can afford to adapt our societies,” Ningen said. “It costs us a lot more money in total losses and impact to lives if we don’t create those resilient communities up front.”

© Copyright IBTimes 2024. All rights reserved.