Analysis-Brazil Risk Premium Soars After Congress Breaks Spending Cap

Brazilian fixed-income markets are pricing in the highest risk levels in years, raising red flags among investors and government officials who see little relief in sight.

While global interest rate hikes and recession risks have put all emerging markets under pressure, Brazil faces special scrutiny after Congress cracked open a constitutional spending cap to allow a burst of election-year expenditures.

"The problem is the change in the spending cap," said an Economy Ministry official, who requested anonymity to discuss the situation openly. "It weakens the reading that the fiscal situation will be under control in the coming years."

Even with positive surprises such as strong June tax revenue data on Thursday, the official said Brazil's yield curve remains under pressure as investors brace for the worst.

Both major presidential candidates on the ballot in October - leftist former President Luiz Inacio Lula da Silva and right-wing incumbent Jair Bolsonaro - have signaled they plan to extend this year's boost in social spending into next year.

"It's a fiscal bomb," said Sergio Goldenstein, chief strategist at Renascen?a DTVM. "Risk premiums look high, but there is little room for a relevant drop."

The real rate for inflation-linked government bonds has been running at the highest level since late 2016, while Brazil's five-year credit default swaps are at highs last seen at the beginning of the pandemic in March 2020.

(GRAPHIC: Yields climb for Brazil gov't inflation-linked bonds -

)

Concerns about Brazil's credit profile come as commodity shocks from the war in Ukraine rattle the global economy and contribute to inflation, prompting rich nations to start raising interest rates.

"All the credit spreads in the world are opening, our bonds are not immune to that," said Ronaldo Patah, chief strategist at UBS Consenso.

In fact, Brazil's strong exports of grains, oil and iron ore give it some advantages compared to other emerging markets riding out the current surge in commodity prices, independent of the political risks in Brasilia now rattling investors.

Brazil's central bank also got an early start hiking rates compared to most peers, raising its benchmark interest rate from a record low 2% in March 2021 to 13.25% currently, with another hike penciled in for August to curb double-digit inflation.

Most of the market has therefore been betting on rate cuts supporting growth from the middle of next year. However, risk premiums now point to rates above 13% in the yield curve for maturities ranging from 2024 to 2033, while mid-2023 vertices indicate an accumulated rate above 14%.

"I am struck by this process of (yield curve) flattening that we are seeing at a very high level", said the chief economist at Ativa Investimentos Etore Sanchez.

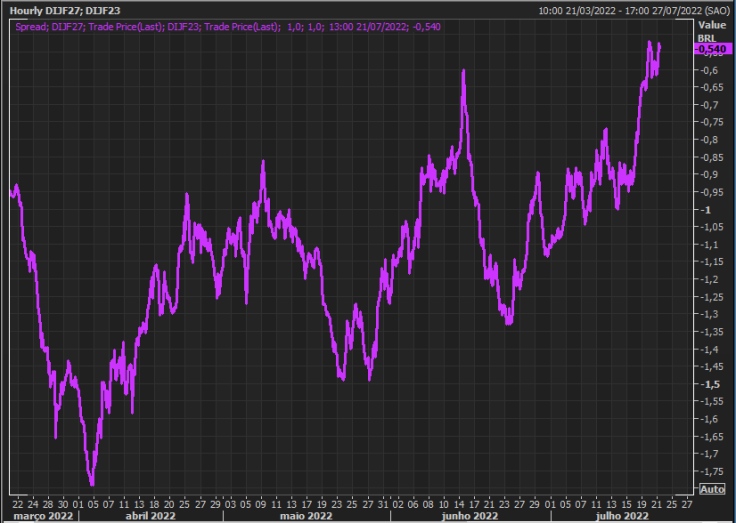

(GRAPHIC: Brazil rate curve flattening -

)

Roberto Dumas, chief strategist at Banco Voiter, said Brazil is caught between a central bank tightening rates while the government is finding new ways to boost spending. "The more one accelerates, the more the other needs to step on the brakes. Everyone is projecting more and more that the Selic will rise more than expected", said Dumas, who foresees the benchmark rate at 14.25% at the end of this year.

© Copyright Thomson Reuters {{Year}}. All rights reserved.