Another Jump In Inflation Firms Fed Pivot To Higher Rates

The Federal Reserve's preferred measure of inflation rose again in January, likely firming the central bank's intent to raise interest rates through the year even as policymakers start to weigh the possible impact of the Russia-Ukraine conflict on the economic outlook.

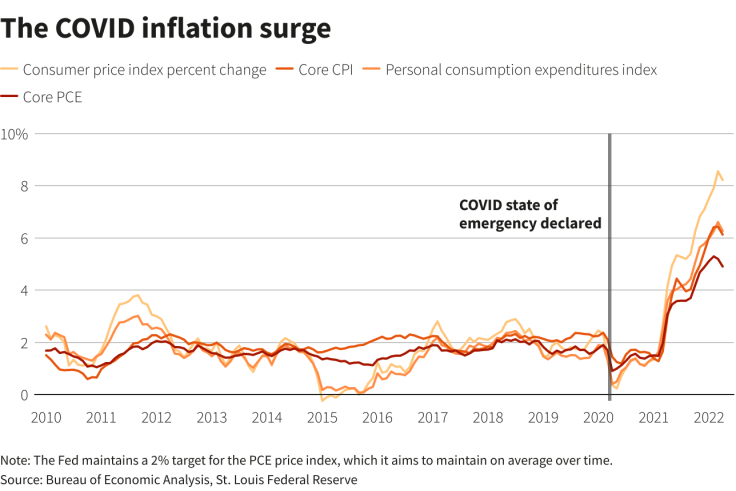

The personal consumption expenditures price index rose at a 6.1% annual rate through January, its highest since 1982 and a level more than triple the 2% inflation rate the Fed has set as its target for the U.S. economy.

It's the 14th month in a row that that measure of the annual rate of inflation has not retreated - a run not seen since the 1970s and a blow to arguments commonly heard at the Fed last year

that rising prices would prove "transitory" and disappear as the economy reopened - and could keep alive arguments for larger and faster rate hikes. Moreover, the month-to-month change in the same index showed no indication that a moderation was imminent.

(GRAPHIC: The COVID inflation surge The COVID inflation surge -

)

The Fed is set to raise interest rates when it meets on March 15-16, but officials have been debating whether the initial "liftoff" from the current near zero level should be a standard quarter point increase, or a larger half point hike to demonstrate the Fed's seriousness in controlling prices.

On Thursday one Fed governor - Christopher Waller - flagged Friday's PCE inflation report as one to watch, saying if it shows "the economy is still running exceedingly hot, a strong case can be made for a 50-basis-point hike in March."

For now at least the data are not only hot but getting hotter: Since September the PCE index has jumped in steady increments from 4.4% to 6.1%, and has either risen or held level with the prior month in each report since November 2020. Expected impacts from the rapid spread of the Omicron coronavirus variant never appeared, with consumer spending exceeding expectations.

Now the virus is fading and Fed officials look for a renewed sense of reopening in society and the economy to keep growth strong.

Trading in futures contracts based on expectations of Fed policy show investors downplaying the chance now of a half-point increase.

But the PCE report is still moving in the wrong direction for Fed officials hoping to avoid the most aggressive measures to control inflation.

"Though diminished, the chance of a 50bp move is still intact," wrote III Capital Chief Economist Karim Basta. Inflation at 6% "would definitely qualify as hot."

The main factor tempering arguments for a faster move by the Fed is the economic fallout from Russia's invasion of Ukraine. That could for a variety of reasons drive prices higher; it could also pose risks to global economic growth, or rattle financial markets in a way that could make the Fed less inclined to raise rates as fast as it would otherwise.

But with the incursions less than 48 hours old that analysis was just beginning.

"In theory, the war has two contrasting effects on Fed policy: It could stoke inflation...and it could slow economic growth," wrote Piper Sandler macro analysts Roberto Perli and Benson Durham. "The Fed is likely to be more concerned about the latter than the former...The war will not delay liftoff...But it could well result in fewer rate hikes this year than the market is currently pricing."

© Copyright Thomson Reuters {{Year}}. All rights reserved.