April US New Auto Sales Forecast: SAAR Forecast At 16.2M With Incentives Up Nearly 9%; Nissan Expected To Grow Sales Most

May 1, 2014 UPDATE: Nissan saw the biggest jump in sales last month while Volkswagen continues to falter. Click here to read more from the April 2014 "Big 8" U.S. new-vehicle sales results.

*

Toyota’s decision to move some of its operations from California to Texas to save operating costs and improve margins comes just as analysts and data suggest U.S. consumer demand may be cooling slightly.

The world’s biggest auto manufacturer is expected to move more than 4,000 sales and marketing jobs to the Dallas suburb of Plano -- the latest in a string of such exoduses to greener pastures and lower taxes.

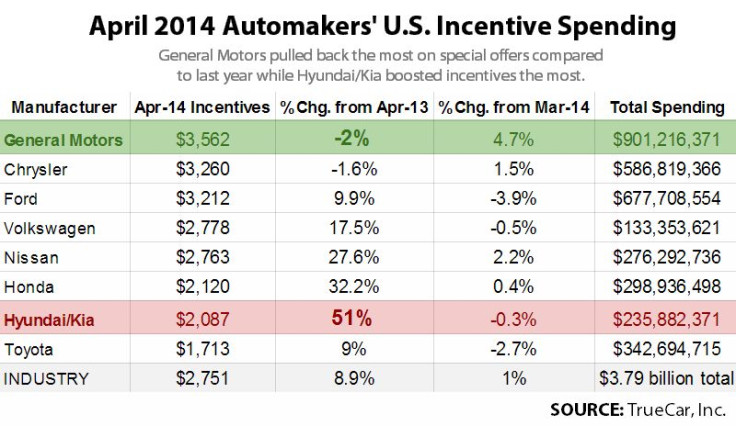

The move comes as Toyota and its rivals have boosted incentive spending to grow sales as the booming U.S. consumer starts tapping the brakes after the post-financial crisis boom years.

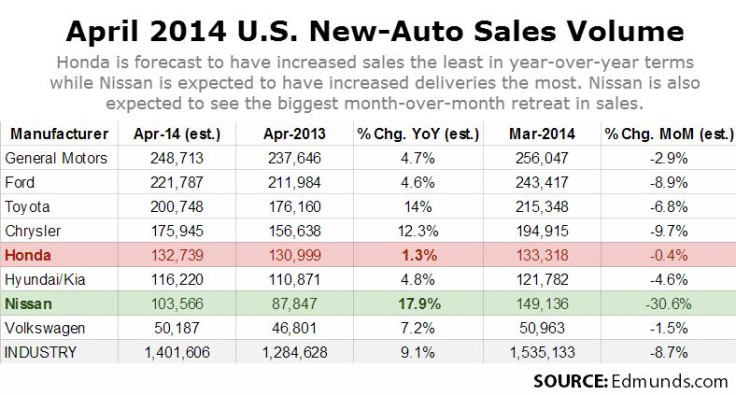

The world’s top automakers report their April 2014 U.S. new-auto sales numbers on Thursday and they’re expected to cool from last month but top April 2013.

Analysts expect sales to increase 9.1 percent from a year ago, to about 1.4 million units in April. But that’s down almost 9 percent from March.

April’s data is expected to show Toyota and the other automakers with U.S. sales at 16.2 million vehicles annually. That’s a bit off March’s 16.3 million pace but in line with the forecasts and better than last year’s 15.6 million sales.

Toyota’s earnings this year are also benefiting from a decline in the value of the yen, which surged in 2011. In addition, it recently agreed to a $1.2 billion fine to settle a U.S. Justice Department probe into its handling of a recall tied to complaints of unintended acceleration.

Nissan, Toyota and Chrysler sales are expected to rise by more than 10 percent each over a year ago. But six of the “Big 8” global automakers have grown incentive spending, four of them by double digits. Dealers say the brutal winter kept buyers at bay this year but that the inventory backlog is being sold off with the help of rising incentives.

“This month, the Asian manufacturers turned up the incentive dial, while the Domestic manufacturers remained more restrained,” Larry Dominique, executive vice president of TrueCar Inc., said by email.

South Korean Hyundai and Kia, which which share many of their operations, boosted their combined incentives by 51 percent this year as their inventory aged absent major new model rollouts. On the bright side for Hyundai, it revealed its new Sonata recently at the New York International Auto Show, so analysts expect April may represent a peak in incentive spending.

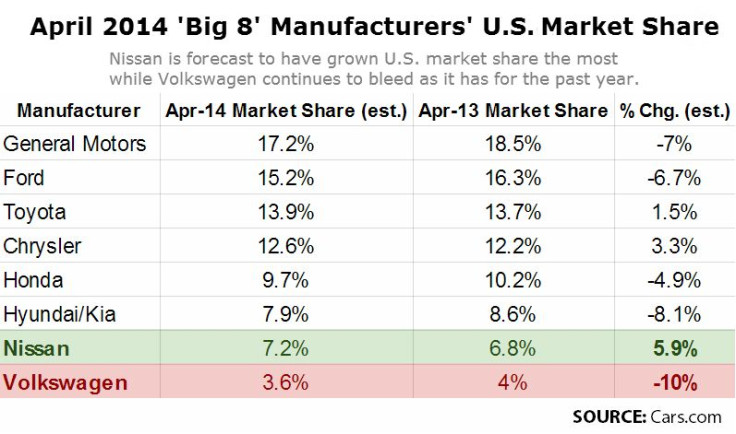

Nissan has seen its share of the U.S. market grow on robust demand for its Rogue compact crossover and its Infiniti SUVs, and the Japanese maker led market share growth.

Chrysler has grown its share since April 2013 on the backs of its Jeep Cherokee and Grand Cherokee. The company’s upcoming 200 sedan is expected to support recent sales growth.

Volkswagen, on the other hand, is still losing market share as it struggles against competitor’s new offerings and its corporate model of favoring longer product life cycles and fewer new products.

In March, Dodge's Ram pickup truck outsold GM’s 2014 Chevy Silverado, which forced the Detroit auto giant to ratchet up incentive spending by $800 per unit while Chrysler Group, a bad sign for a model in its first year of its life cycle.

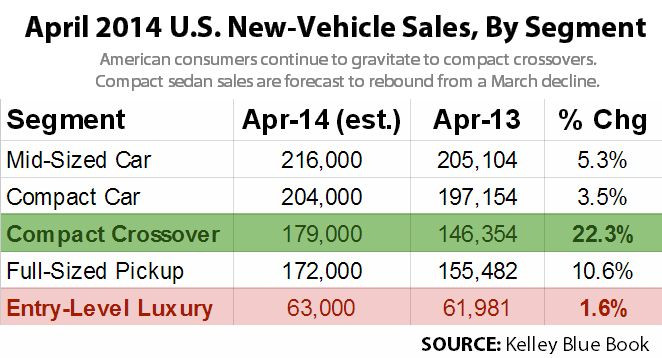

The new Ford F-150, the best-selling vehicle in the U.S. will be out by the end of the year, so the market is getting crowded with fresh offers in the lucrative pickup truck market.

Trucks are important to the Detroit 3 automakers because they make wider margins on the sale of each vehicle in this segment.

Americans are still on track to send sales back to levels prior to the 2009 auto industry recession that saw only 10.4 million cars sold in the U.S. This year is still on track to match or top 2007 sales volume. The uptick in incentives might just be a response to a slow weather-related start to the year, or it could be a symptom that sales have reaches a cyclical peak forcing automakers to spend more making sales. If history is any indication, May U.S. new-auto sales should be higher than April’s.

“The first half of March was experiencing a hangover from the weather, but then things picked up in the last week,” Eric Lyman, vice president of editorial and consulting at TrueCar Inc., said. “This really reflects some of the pent-up demand that we saw from January and February. We haven't seen all of those people that put off their purchases in the first two months of the year. We're likely to see the impact of that slow start of the year continue to trickle in.”

© Copyright IBTimes 2025. All rights reserved.