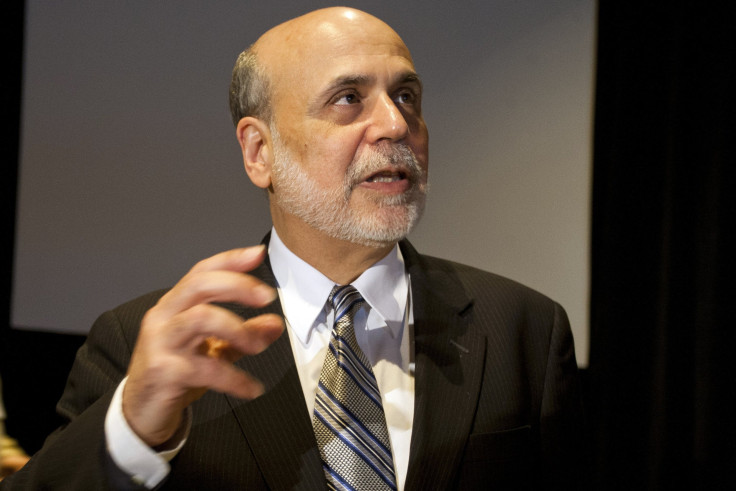

Asian Markets Soar As Ben Bernanke Surprises With Assurance Of A 'Highly Accommodative Policy For The Foreseeable Future'

Asian markets hit a three-week high on Thursday after U.S. Federal Reserve Chairman Ben Bernanke confirmed that monetary policy and low interest rates would continue to be around for sometime to come, citing weak job growth and low inflation, even as the Federal Open Market Committee, or FOMC, struggled to reach a consensus on the issue.

Bernanke’s speech came three hours after the Fed released the minutes of the FOMC meeting held on June 18-19, which showed that the members (about four) in favor of slowing the pace of the monthly bond-buying program were slightly outnumbered by those (about five) who wanted to see further improvement in the labor market before making the decision.

“Highly accommodative monetary policy for the foreseeable future is what’s needed in the U.S. economy,” Bernanke said, in response to a question after his speech at a conference in Cambridge, Mass. He added that interest rate decisions and bond-buying are two distinct tools, and that the Fed might not raise short-term interest rates, even if unemployment climbs down to its target rate.

“There will not be an automatic increase in interest rate when unemployment hits 6.5 percent,” Bernanke said. The country's unemployment rate in June stood at 7.6 percent.

Given the weakness of the labor market “it may be well sometime after we hit 6.5 percent before rates reach any significant level,” Bernanke said adding that inflation, which is still below the Fed’s target of 2 percent “would be a good reason to remain accommodative.”

“There’s still a clear bias to taper but I think they’ve taken just a baby step back from the strength of that bias and data will matter from here,” Julia Coronado, chief economist for North America at BNP Paribas, and a former Fed economist, told Bloomberg News. “It’s not just hiring, it’s GDP and inflation that will factor into the equation.”

Most Asian markets, which could suffer massive outflows if and when the Fed chooses to taper its massive bond-buying program, soared Thursday in reaction to Bernanke’s comments. MSCI's Asia-Pacific index, excluding Japan, jumped 1.7 percent to a three-week high, according to Reuters.

China's Shanghai Composite index rallied up 3.17 percent while Hong Kong’s Hang Seng Index gained 2.38 percent in morning trade. Australia’s S&P/ASX 200 climbed up 0.99 percent and South Korea’s KOSPI Composite index rallied 2.31 percent while India’s BSE Sensex was trading up 1.91 percent in morning trade.

In Japan, the Nikkei was trading down 0.37 percent, after the Bank of Japan kept interest rates steady and the yen gained against the U.S. dollar.

Financial markets across the world have remained volatile since the Fed hinted that it may start to pull back its monthly bond-buying program by the end of this year. And, some remain unconvinced about the future of the quantitative easing, or QE, program, which has funneled easy money into the world's financial system.

“The many FOMC voices seem all over the map, yet they do agree the labor market improvement looks more sustainable now than it did at the time of the QE launch,” Chris Rupkey, the chief financial economist for Bank of Tokyo-Mitsubishi UFJ Ltd, told Bloomberg News. "This means to us that the program’s days are numbered.”

© Copyright IBTimes 2024. All rights reserved.