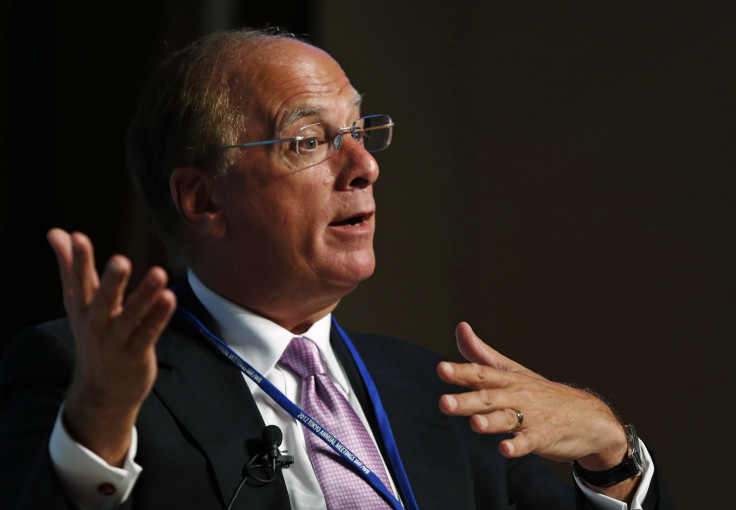

BlackRock (BLK) CEO Fink Talks 2014 And Need For Quick Reduction In Fed's Quantitative Easing

The head of the world's largest asset manager on Wednesday challenged the Federal Reserve to reduce its $85 billion per month bond purchases as soon as possible because the policy, called quantitative easing, hasn’t defeated structural unemployment.

“If the Fed admits we have structural unemployment, then they would have to admit that’s why quantitative easing has not created jobs,” said Larry Fink, CEO and chairman of BlackRock, Inc. (NYSE:BLK), which handles more than $4.1 trillion in assets.

“It’s created a huge rally in equities and other financial assets, which is all good, especially for wealthy people,” he continued in a speech to a New York City audience of state treasurers. “I believe taper [of bond purchases] should begin as soon as possible.”

The Fed surprised markets and Fink, too, when it decided to keep quantitative easing on course for the near future earlier in September. The bond purchases aim to slash bond yields, which move in the opposite direction of bond prices, and thus -- theoretically, at least -- make it cheap for businesses to borrow so they can expand their operations and hire more people.

Fink also noted that corporate profits have risen substantially, without meaningful wage increases.

U.S. CEOs have been confused by dysfunctional political signals from Washington, D.C., he said, and so are understandably hoarding cash, buying back shares and hiking dividends, instead of investing for the long term.

Narrowing federal deficits also mean that if the Fed doesn’t put the brakes on soon, they could create “a giant bubble,” according to Fink.

“They could be creating a giant bubble if they don’t aggressively start tapering, because of the imbalance of issuance versus their purchasing,” he said of the Fed.

Fink also said he wouldn’t be surprised if soaring equity markets this year saw a significant correction of 10 to 12 percent in 2014, echoing recent remarks from economists and analysts.

Official U.S. unemployment stood at 7.3 percent in October, though it could sink as low as 7 percent by the year’s end. Experts have speculated that unemployment rates may have to fall to 6.5 percent or 5.5 percent before rock-bottom interest rates rise.

The Federal Reserve has also warned that the unemployment rate pure and simple may not be the best measure to time taper by. Labor force participation fell to a 35 year-low in October, even as the official unemployment rate has eased.

Structural unemployment, though, happens partly because there are too many people willing to work, and too few jobs. Workers lacking needed skills and technological advances that render workers obsolete also play a role. Government-backed infrastructure projects could help solve this dilemma, Fink suggested, though this requires decisive fiscal policy action.

Interpreting Federal Reserve remarks from October, Fink said: “We need fiscal policy to create jobs now. The Federal Reserve with low interest rates cannot do it.”

In his global travels, Fink has found that structural unemployment is a problem even in emerging economies like the BRIC nations, which are Brazil, Russia, India, China and South Africa.

Fink predicted that 10-year Treasury bond interest rates won’t reach beyond 3.75 percent in coming years. Uncertainty in emerging markets over the next nine months could make low equity prices there especially attractive, he said.

U.S. equities won’t see a major rally, as they have in past months, but will normalize at 6 to 9 percent growth rates, he predicted.

BlackRock manages over 7000 investment portfolios worldwide and counts dozens of Fortune 100 companies as their clients.

The U.S. unemployment report from the Labor Department is due this Friday, Dec. 6.

© Copyright IBTimes 2025. All rights reserved.