Stocks slid on Monday as resurgent uncertainty in Europe cast doubts on the bloc's ability to push through measures to end its debt crisis, while Wal-Mart weighed on the Dow after a report it stymied a probe into bribery allegations.

Thomson Reuters Corp said on Monday it is selling its Healthcare business to private equity firm Veritas Capital for $1.25 billion in cash.

Kellogg Co cut its full-year outlook after a disappointing first-quarter performance, sending the cereal maker's shares down 5.5 percent and pressuring the packaged food sector overall.

Allegations that Wal-Mart Stores Inc stymied an internal investigation into extensive bribery at its Mexican subsidiary are likely to lead to years of regulatory scrutiny and could eventually cost some executives their jobs.

Internet and network security provider Check Point Software Technologies said it expected to meet second-quarter estimates, after reporting a rise in first-quarter net profit that beat forecasts on strong sales of its new products.

Stocks fell more than 1 percent on Monday as renewed anxiety over Europe's economy and the region's debt crisis spurred profit-taking, while Wal-Mart weighed on the Dow after a report it stymied a probe into bribery allegations.

Volkswagen , the world's second largest carmaker, will invest about 170 million euros ($225 million) building a new plant in Urumqi, western China, capable of making 50,000 vehicles annually starting 2015, the company said on Monday.

Stock index futures pointed to a sharply lower open on Monday on weak European data and renewed anxiety over how the region would tackle its debt crisis, while Wal-Mart slumped after a report it stymied a probe into bribery allegations.

ConocoPhillips , which is splitting into two stand-alone companies at the end of the month, reported a lower-than-expected quarterly profit, hurt by weak refining margins, and its shares fell in premarket trading.

Spain's budget deficit was confirmed at 8.5 percent of economic output in 2011 by the EU's statistics office Eurostat on Monday, dispelling doubts about the new Spanish government's reading of its national accounts.

Kellogg Co cut its full-year outlook on Monday, citing a weaker-than-expected first-quarter performance, and its shares fell 6.3 percent.

In the 1990s, Huawei CEO Ren Zhengfei visited the United States several times, hoping to learn from its leaders of industry about how to turn his Chinese telecoms equipment maker into a global company. On one trip in 1992, in the days before China had credit cards, he paid all his bills with cash from a $30,000 stash in his briefcase.

Stock index futures were sharply lower on Monday as political uncertainty in Europe raised new questions about how effectively the region would tackle its sovereign debt crisis.

China and Germany, the world's two biggest exporters, can nearly double their bilateral trade in the next three years, but must also improve their market access and combat protectionism, Chinese Premier Wen Jiabao said on Monday.

In the meantime, New-York based Wall street Journal (WSJ) put out a list that includes ten of the fastest super cars in the world for 2012, along with each car's specifications. Click on the slideshow above to view the list.

Stock futures pointed to a lower open for equities on Wall Street on Monday, with futures for the S&P 500, the Dow Jones and the Nasdaq 100 falling 0.8 to 0.9 percent.

Internet and network security provider Check Point Software Technologies reported higher first-quarter net profit that beat estimates on Monday, boosted by sales growth and new products.

Alibaba.com Ltd, China's largest listed e-commerce company, posted a 25 percent slide in first-quarter earnings on Monday, weighed by a stagnant paying member base and higher operating expenses.

Germany's manufacturing sector unexpectedly shrank at the fastest pace in nearly three years in April, denting hopes it can drive growth in the euro zone and

China's hot Internet sector is facing a problem it is unaccustomed to: a lack of money.

U.S. stock futures pointed to a lower open for equities on Wall Street on Monday, with futures for the S&P 500, the Dow Jones and the Nasdaq 100 falling 0.8 to 0.9 percent.

Fresh from a big victory in raising $430 billion for the International Monetary Fund, Christine Lagarde's tougher test as head of the global lender will be finding a way to give emerging economies more influence.

Global finance chiefs pressed Europe in weekend talks to quickly put in place the economic reforms needed to finally extinguish its debt crisis now that newly increased financial buffers have bought some precious time.

The euro edged down from two-week highs and shares weakened on Monday as political developments in France and the Netherlands raised fears about the region's commitment to tackle its ongoing debt crisis.

After years of losing customers to Europe-based retailers that give young shoppers fresh fashions more quickly, U.S. clothes retailers are fighting back.

China will take a gradual approach to yuan reform and will not be in a hurry to free up deposit rates offered by banks, as it seeks to rebalance its economy and deepen its financial markets.

Asian shares and the euro eased on Monday, but losses were kept in check after a report showed Chinese factory activity stabilizing in April, alleviating worries about a sharp growth slowdown in the world's second-largest economy.

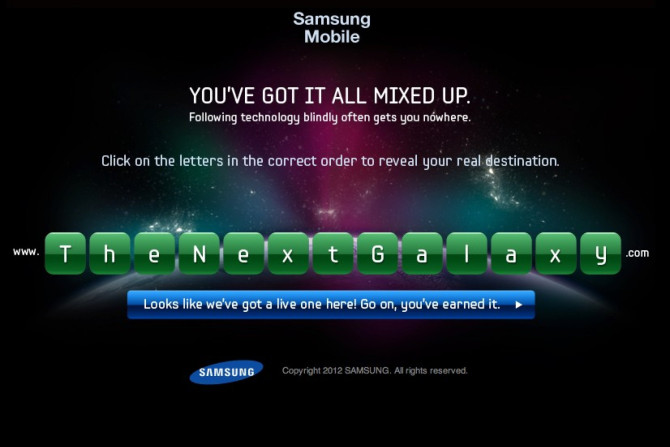

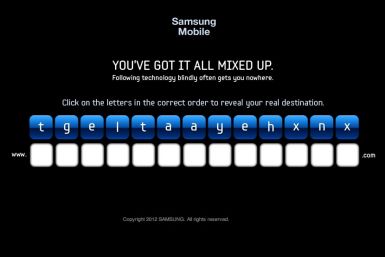

Samsung may unveil its third generation Galaxy S smartphone, the Galaxy S3, on Monday, April 23 at 7 a.m. On Sunday, Samsung Mobile's twitter account made a mysterious announcement at 9:52 a.m.: Destination: tgeltaayehxnx. If you add a .com to the end of that anagram for The Next Galaxy, you visit a Samsung Mobile website a beautiful-looking countdown clock.

The head of the International Monetary Fund on Sunday renewed a push to fully fund a $17 billion lending package for poor countries, which are threatened by high oil prices and the risk of euro-zone contagion.

Allegations that Wal-Mart Stores Inc stymied an internal investigation into extensive bribery at its Mexican subsidiary is likely to lead to years of regulatory scrutiny and could eventually cost some top executives their jobs, analysts said.