Can Twitter Fix Its Revenue Problem? Quarterly Earnings Are Due

This article was originally published on the Motley Fool.

Twitter (NYSE:TWTR) is set to report its second-quarter earnings on July 27, just one day after social-network juggernaut Facebook (NASDAQ:FB). Important questions loom ahead of the release: Will Twitter's recent return to user growth persist? Can Twitter charge high-enough premiums for its ads in a Facebook-dominated digital ad market?

• Motley Fool Issues Rare Triple-Buy Alert

But one hot topic -- Twitter's revenue headwinds -- will likely rise above these lingering concerns when the company reports second-quarter results. Here's why investors should check on Twitter's revenue, and look for insight into what to expect from the key metric going forward.

Declining revenue

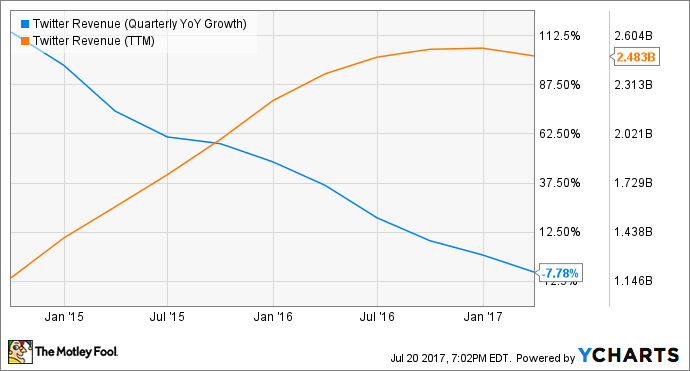

Twitter's recent revenue trajectory is worrying. After decelerating substantially in 2016, Twitter's year-over-year revenue-growth rate officially turned negative in the first quarter of 2017. Revenue was down 8% year over year. Twitter recently blamed its revenue headwinds on increasing competition for digital ad spending, as well as Twitter's move to reprioritize its revenue products.

Facebook is likely a primary culprit in the more competitive digital-advertising space that Twitter cites. Facebook's advertising revenue has been skyrocketing, up 51% year over year in the social-network's most recent quarter. This soaring ad revenue comes as Facebook continues to push its video-first strategy.

As far as how Twitter's overhaul of its revenue products is negatively impacting revenue, management has said that the move includes the elimination of some revenue drivers. In the near term, therefore, this refocusing means Twitter loses out on some top-line opportunity.

• This Stock Could Be Like Buying Amazon in 1997

Twitter management didn't provide revenue guidance for its second quarter, but analysts expect revenue headwinds to persist. On average, analysts expect Twitter to report second-quarter revenue of $548 million, down about 9% year over year from $602 million in the year-ago quarter.

It's no surprise that analysts expect another quarter of declining revenue in Q2. Not only is Twitter in the middle of overhauling its revenue-product portfolio, but management admitted in Twitter's first-quarter shareholder letter that "there is still work to be done to translate [recent changes to its service] into revenue growth."

What needs to change

Twitter is attempting to address its revenue problem in a number of ways, including by focusing on its highest-revenue-generating ad products, launching new effective ad products, growing its user base, and following in Facebook's footsteps with a significant emphasis on video.

It's not yet clear when, or to what degree, Twitter anticipates its revenue to begin an upward march. But if management is right about the way things will unfold, Twitter's recent user growth could provide a preview of the growth management expects in the future: Twitter management has said its return to user growth will drive revenue growth. Twitter's monthly and daily active users were up 6% and 14%, respectively, year over year in Q1. However, management expects revenue growth to meaningfully lag user growth.

• 7 of 8 People Are Clueless About This Trillion-Dollar Market

When Twitter reports its second-quarter results, investors should look to see if management provides more specific insight into management's outlook for revenue.

Daniel Sparks owns shares of Facebook. The Motley Fool owns shares of and recommends Facebook and Twitter. The Motley Fool has a disclosure policy.