Cyclone Yasi to disrupt global commodity markets

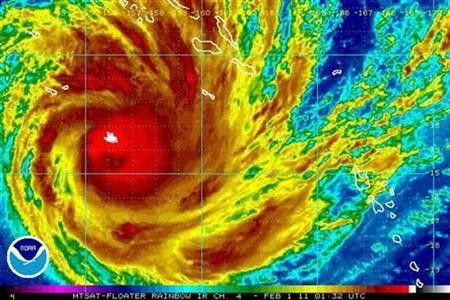

The category-five storm, Cyclone Yasi, that has struck Queensland in northeastern Australia (already reeling from deadly floods last month) is likely to hammer global commodity markets, according to media reports.

Commodity prices has already been rising from deepening political unrest in Egypt.

Queensland is a principal supplier of coal (a key ingredient in steel-manufacturing), sugar, nickel and wheat. Reuters is reporting that the cyclone has already forced a number of copper refinery and coal mines to shut down; and paralyzed sugar and coal exports through the closure of ports.

Mines and railway lines have also been closed ahead of the cyclone, which is believed to be the most dangerous cyclone the province has ever witnessed.

We've shut everything down and that situation is likely to carry on for several days until a clearer picture emerges, Josh Euler, a spokesman for the refinery owner, Xstrat, told Reuters.

Already, raw sugar futures have climbed to their highest level in three decades and white sugar prices reached a record peak (Australia is the third-largest sugar exporter in the world).

The price of copper reached an all-time high of $9810/tonne on the London Metal Exchange, while aluminum and nickel prices have climbed to two-year highs.

Also, mining companies BHP Billiton and Peabody Energy have also closed down several coal mines in Queensland.

BHP's Peak Downs, South Walker Creek and Broadmeadow coal mines (which have a combined capacity of over 15 million tonnes of coal per year of coking coal) were all closed. Peabody closed its Burton mine, which makes 2.7 million tonnes of coal annually.

The beleaguered coal-mining sector looks set to avoid a direct hit, while the event on its own should not cause critical problems for any individual market, wrote Colin Hamilton, commodities analyst at Macquarie in a research note to clients. However, any form of volume constraint will further tighten commodity markets already under intense strain from amplified levels of demand.

Hamilton added that several base metals facilities would also be damaged by high winds and heavy rains, with important key ports shut down for the duration of the storm.

Xstrata’s Mount Isa and Ernest Henry copper mines in western Queensland and BHP Billiton's Cannington silver mine (the world's largest lead and silver operation) will likely both be closed.

Yet again, this highlights that 2011 will be another year when mine supply is under huge pressure, and any unforeseen disruptions will add fuel to the commodity price fire, Hamilton said.

Ben Westmore, a minerals and energy economist at National Australia Bank, estimates the copper market will record a shortfall of between 500,000 and 1 million tonnes by the end of 2011.

There are some people betting the expected shortfall will increase, he said.

© Copyright IBTimes 2025. All rights reserved.