The U.S. Federal Reserve's assessment of current conditions, as well as data on inflation and trade, will highlight the economic calendar this week.

French fashion designer offended many Chinese nationals after saying Chinese tourists would not be welcome at his new exclusive, upscale hotel in Paris.

The U.S. unemployment rate fell to 7.8 percent in September, the lowest since Barack Obama became president in January 2009.

Spanish police arrested a suspect who they say was planning a Columbine-style attack on a university near Majorca, Spain.

Friday's jobs report probably won't be dramatic enough to alter the direction of the U.S. presidential race.

Iranians, reeling from high unemployment, western economic sanctions and the near collapse of their currency, have reacjed the end of their tether.

Renowned for their automobile culture, the economic crisis has led Italians to buy more bicycles than their beloved cars.

Private employers added more workers than expected in September, a report by a payrolls processor showed on Wednesday.

The Asian Development Bank cut its 2012 and 2013 growth estimates for several developing countries in Asia Wednesday, citing weakness in global demand.

A branch of John Deere advertised 150 jobs available, with an application deadline of Monday. 15,000 people applied.

Could a jump in consumer confidence and holiday hiring indicate a promising holiday sales season?

Michigan lotto winner Amanda Clayton, who was charged with welfare fraud this year, was found dead.

Friday's jobs report will carry the most weight, since this is the penultimate report before the elections.

Despite mild uptick in September's U.S. PMI, the deepening euro zone crisis will continue to weigh on the global economy.

India would finalize the guidelines on its controversial anti-avoidance law within 20 days after considering the recommendations made by a government panel, ending months-long stalemate on the issue, Finance Minister P Chidambaram said Monday.

India's trade deficit widened marginally to $15.6 billion from July's $15.5 billion as export fell at a sharper rate than the imports for the month of August, according to the data released by the Ministry of Commerce Monday.

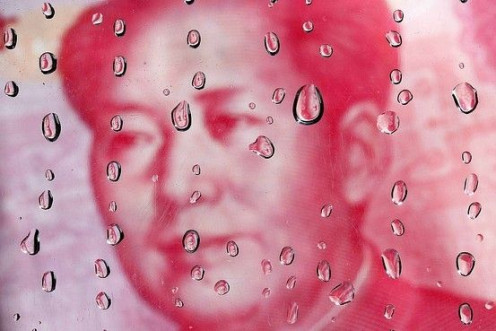

The factory slump in the world’s second-largest economy continues as China's Manufacturing Purchasing Managers Index, or PMI, rose to 49.8 in September from 49.2 in August.

With China’s economy slowing down as a result of weakness of investment and export demand, market participants are calling for urgent policy easing measures to bolster economic growth.

Russian President Vladimir Putin shared his love of animals by giving a terrier puppy to Venezuelan President Hugo Chavez as a diplomatic present.

French President Francois Hollande wants to impose a 75 percent income tax rate on France's wealthiest, making even Sweden look like a bargain.

U.S. consumer sentiment rose to its highest level in four months in September as Americans saw better prospects for the job market and economy, a survey released on Friday showed.

Conservatives call Spain's new budget one for "crisis," while opposition Socialists deride it as one for a "depression."

China's three decades of miraculous GDP growth is over because the recent slowdown is largely structural in nature.

Earlier in the week, it was widely reported that 2013 would bring a “bacon shortage,” as rising pork prices would eventually drive up demand for bacon to the point where it would be almost impossible to find. However, even after falling for the story themselves, NBC News is reporting that the bacon shortage is hogwash.

The winning ticket for the $202 million Powerball jackpot Wednesday was sold in Iowa.

Fewer Americans than forecast filed applications for new jobless benefits last week. However U.S. 2Q GDP rose less than initially estimated.

Climate change caused by global warming is contributing to nearly 400,000 deaths a year and reducing global GDP by 1.6% annually.

China's has banned Twitter for 3 years, but the country’s net users have beat it by using Virtual Private Networks and other tricks.

U.S. single-family home prices rose for a sixth month in a row in July, though the improvement was not as strong as expected, a closely watched survey showed on Tuesday.

According to a new study, suicide has risen by 15 percent in the last decade due to the economy.