Moody's Investors Service downgraded 15 global financial institutions Thursday, including five of the largest U.S. banks, nine major European banks and the Royal Bank of Canada (NYSE: RY), a move that could tighten borrowing and require the companies to post billions of additional collateral.

Markets are losing the power to ride high after positive political developments, a worrying trend that might rain chaos on the best laid plans of central bankers and politicians looking to buy time to solve the financial crisis in Europe with grandiose statements.

Spain's banks would need between 51 billion and 62 billion euros ($64-78 billion) in extra capital to weather a serious downturn of the economy and new losses on their books, two independent audits of the sector showed on Thursday.

Where else to go when markets in North America and Europe are stagnating?

To that end, Hollande wants to slap a 75 percent tax rate on those Frenchmen earning in excess of ?1 million per year.

Chinese market regulators announced Thursday they could be easing the rules that currently allow only a small group of foreign banks to invest in the national equity and bond markets, a move that is seen as part of a wider campaign to open the country's financial system to global competition. Whether by design or by coincidence, however, the move also takes a tremendous amount of pressure off the country's central bankers, who are between a rock and a hard place in deciding whether or n......

Manufacturing has been one of the few bright spots of the otherwise frail U.S. economic recovery, but Markit said weaker overseas demand could be starting to slow hiring in the sector. U.S. manufacturing grew in June at the slowest pace in almost a year and hiring in the sector also slowed.

U.S. sales of existing homes fell 1.5 percent to an annual rate of 4.55 million units due to low inventory, the National Association of Realtors said Thursday, missing expectations and raising doubts about a housing recovery.

U.S. 30-year fixed-rate mortgages fell to a new record low of 3.66 percent following weak economic indicators, mortgage financier Freddie Mac said Thursday.

First-time claims for jobless benefits in the U.S. fell by 2,000 to a seasonally adjusted 387,000 in the week ended June 16, Labor Department said Thursday, but the overall level still shows a weak labor market.

Onyx Pharmaceuticals, QuinStreet, Molycorp, EZchip Semiconductor, Red Hat, Ampio Pharmaceuticals, Mechel OAO, Chimera Investment and Nokia Corp. are among the companies whose shares are moving in pre-market trading Thursday.

African migrants in China have a life that is light years away from the glamour, adulation and affluence enjoyed by Drogba.

Paul Simon once crooned: Every generation sends a hero up the pop charts. But the heroes of the latest generation of young music-hungry consumers are finding it difficult to get them to actually buy their work.

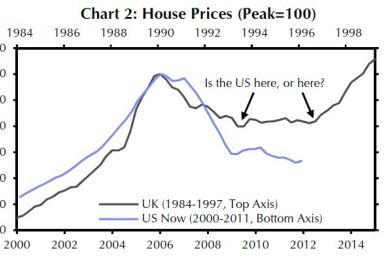

U.S. housing prices won't just hit the bottom this year -- they'll rise by 2 percent, according to a report by Capital Economics released this week. But that doesn't mean the market is in great shape.

Asian stock markets mostly declined Thursday as the Federal Reserve's limited help to bolster the domestic economy disappointed some market participants.

Crude oil futures declined Thursday, weighed down by an unexpected jump in the U.S. crude supplies and the Federal Reserve's limited help to revive the domestic economy.

U.S. stock index futures point to a lower opening Thursday after the Department of Labor's initial jobless claims report, which showed that more people than expected filed for unemployment benefits, and the National Association of Realtors' report on existing home sales.

European markets fell Thursday as investors were disappointed the U.S. Federal Reserve failed to announce any quantitative easing measures on Wednesday.

The top after-market NYSE gainers Wednesday were: Skilled Healthcare, VOC Energy, Oriental Financial Group, Alon USA Energy and Kindred Healthcare. The top after-market NYSE losers were: Red Hat, Main Street Capital, Vmware, Apartment Investment & Management and hhgregg.

Most Asian markets fell Thursday as investors felt let down by the U.S. Federal Reserve, which did not announce a further round of quantitative easing.

Asian stocks struggled and commodities fell broadly on Thursday after the Federal Reserve ramped up monetary stimulus by expanding Operation Twist, but disappointed some investors who had been hoping for more aggressive measures.

Peter Thiel, a director of Facebook (Nasdaq: FB), the No. 1 social networking site as well as co-founder of PayPal, announced his third venture capital firm, Mithril Capital Management.

LANDesk Software, the venerable desktop management software developer, said it had acquired private Wavelink to extend its reach into mobile platforms like smartphones and tablets.

Air India's contingency plan was disrupted Tuesday after 30 of its 120 executive pilots, deployed by the national carrier to run its international flying operations in the wake of the pilots' strike, reported sick, reports said Wednesday.

There?s a silver lining to the bearish global economic news ? a slide in crude oil prices: U.S. gasoline prices fell from their April peak, which will likely prompt more Americans to hit the road for the Independence Day holiday.

Biosante Pharmaceuticals Inc., Tesla Motors Inc., Barclays PLC, Bank of America Corp., Adobe Systems Inc., Michael Kors Holdings Ltd and Procter & Gamble Co. are among the companies whose shares moved in pre-market trading Wednesday.

Hundreds of thousands of South Korean cab drivers began their first nationwide strike Wednesday, demanding higher fares and cheaper fuel, prompting the authorities to run additional bus and subway services.

U.S. stock index futures point to a mixed opening Wednesday ahead of economists' expectations that the Fed will announce an extension of its 'Operation Twist' monetary policy designed to boost the economy.

European markets fell Wednesday as investors remained watchful ahead of the U.S. Federal Reserve's announcement of the monetary policy decision.

Asian stock markets advanced Wednesday on expectations that the major central banks around the world would announce further stimulus measures to spur economic growth.