Euro Jumps, Stocks Wobble After Hefty ECB Hike

Stocks see-sawed and the euro rose after the European Central Bank raised interest rates by a bigger than expected 50 basis points, its first increase in more than a decade, to quell runaway inflation as it plays catch up with other central banks.

After guiding markets to expect a 25 basis point hike, the Frankfurt-based central bank raised its benchmark deposit rate from 0% to 0.5%, saying further rate hikes will be appropriate at upcoming meetings.

The euro EUR=EBS rose 0.6%, moving further away from last week's parity against the dollar.

The ECB also said it had approved a plan, to be published later in the day, to cap bond yields, key to helping heavily indebted countries like Italy, whose coalition government fell after the resignation of Prime Minister Mario Draghi.

The STOXX index .STOXX of 600 European companies initially fell on the ECB's news but quickly pared losses to trade little changed on the day.

The MSCI All-Country stock index .MIWD00000PUS was also little changed.

ING bank said hiking rates by 50 basis points and softening forward guidance showed that the ECB thinks the window for a series of rate rises was closing quickly.

Michael Brown, head of market intelligence at Caxton, said the ECB was marginally more hawkish than expected.

"The euro rally in reaction to the larger-than-expected hike is also likely to be short-lived, given said mounting recession risks," Brown said.

Nasdaq 100 futures NQc1 were up 0.25%, with S&P 500 futures EScv1 little changed. Earnings from Blackstone, Dow Chemical, Philip Morris International, Twitter and American Airlines were due on Thursday.

European markets were generally steadier on Thursday as the flow of Russian gas resumed to Germany after a 10-day outage, but not enough was being supplied to end the threat of rationing to cope with potential winter shortages. (Full Story)

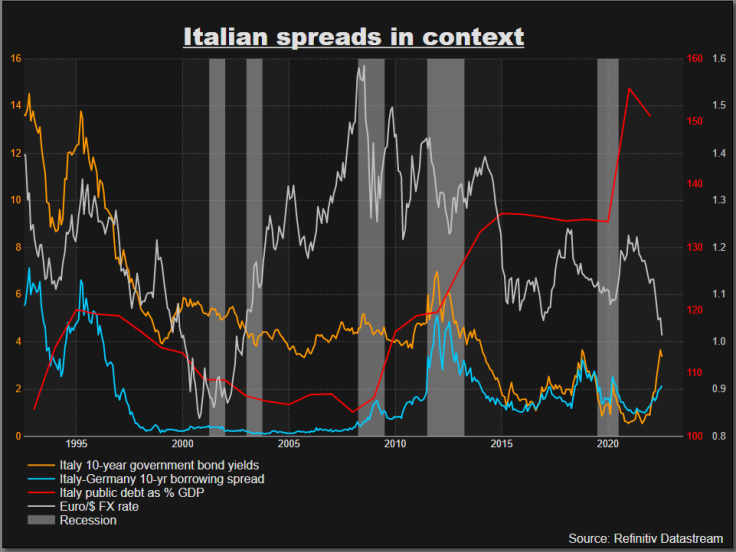

(GRAPHIC: Italian spreads and debt/GDP -

)

Italian bonds IT10YT=RR sold off sharply following the collapse of the Italian government in the euro area's third biggest economy. (Full Story)

The Italian banks index .FTITLMS3010, a sector sensitive to domestic political crises, fell 2%.

After the ECB, the market's focus now turns to expected rate rises from the U.S. Federal Reserve next week, and from the Bank of England in August before investors take stock of their impact on the economy.

Nadege Dufosse, head of cross-asset strategy at Candriam, said investors will be trying to gauge whether the economy is headed for a soft or hard landing as higher borrowing costs are absorbed, she said.

"It's the expectations for the fourth quarter or next year that can really determine the trend in the market. For now we do not have the answer and we just have to be very pragmatic," Dufosse said.

Bucking the trend, the Bank of Japan left its super-loose monetary policy unchanged on Thursday, as expected, and raised its inflation forecasts slightly.

CRUDE SLUMPS, GOLD WEAK

Oil prices fell for a second straight session, as demand concerns outweighed tight global supply after U.S. government data showed tepid gasoline consumption during the peak summer driving season.

Brent crude LCOc1 was down 3.5% at $103.18 a barrel, while U.S. West Texas Intermediate CLc1 dropped 3.8% to $96.11 a barrel. O/R

Gold recovered after touching its lowest levels since March 2021 as the prospect of aggressive rate hikes by major central banks weighed on the non-interest bearing metal's appeal.

Spot gold XAU= was up 0.16% at $1,699 per ounce.

The benchmark 10-year Treasury yield US10YT=RR eased slightly after the ECB hike to 3.0284%. US/

MSCI's broadest index of Asia-Pacific shares outside Japan .MIAPJ0000PUS fell 0.1% and Japan's Nikkei .N225 gained 0.4%.

A cloud over Chinese growth due to its strict COVID-19 controls and more trouble in its ailing property market is also casting gloom over the prospects for global demand.

"Past due mortgages doubled over the week, and ... potential home buyers are waiting for a general drop in home prices for the housing market, including completed projects," ING analysts said in a note to clients on Thursday.

"This is negative even for cash-rich developers."

(Additional reportig by Tom Westbrook, Editing by Sam Holmes, Kim Coghill and Nick Macfie)

© Copyright Thomson Reuters {{Year}}. All rights reserved.