Forex: Month End Review May 2011, USD, EUR, GBP, JPY, CHF, CAD, AUD, NZD

Forex: Month End Review - May 2011, USD, EUR, GBP, JPY, CHF, CAD, AUD, NZD

May started off with a bang as CME raised margin requirements on Silver multiple times.

Silver was down over 25% before recovering to close the month down 20%.

This seemed to be the catalyst to spur on sell in May and go away phenomenon. Market traders have long believed that the summer months are a great time to stay away from stocks and take profits off the table.

Even though this seemed the case early on, S&P 500 was only down 1.3%, 17pts. That's not considered to be a sell off by any means. The S&P low for the month was 1,311 and closed at 1,345.

Greek woes came back to life after almost a year on hiatus. Will they restructure wont they restructure?

Here are some key observations from the month of May:

- CME raises margin requirements for both Silver and Oil

- Greek restructuring woes?

- FOMC Minutes - much ado about nothing? FOMC minutes reveal constructed plan to exit current loose monetary policy

- Goldman Sachs: The U.S. DOLLAR TO WEAKEN Versus EURO

- As Japan heads into their 3rd Recession, YEN looks poised to lose more ground

- NORWAY FREEZES $42M IN PAYMENTS TO GREECE

- EUR/USD -Implications from Fitch cutting Greek rating, Norway freezing $42M in payments to Greece, German Bundesbank comments

- EUR/USD - May 2010 déjà vu: Iceland volcano eruption, Greece sovereign debt crisis...

- UK credit rating downgraded by Chinese rating agency

- Goldman Sachs: Back to Bullish call on Commodities

- Durable Goods Orders: Plunges more than expected

- Goldman Sachs: Cuts Q2 GDP to 3.0%

- United Nations: Says US Dollar could Collapse

- CHINA: Wealth Fund to invest NZ$6 billion on New Zealand assets and government bonds

- Forex: Bill Gross, US Dollar at Risk

- Fitch: Cuts Outlook on Japan Sovereign Debt to Negative

- Moody's Warns of Japan Downgrade

- Bank of Canada keeps Interest Rate unchanged, for now at least

- Citi: A Debt Ceiling Breach would have Disastrous US Dollar Implications

- Australia: Treasurer Wayne Swan says First-Quarter GDP Suffered Dramatically from Floods

- Oil down 10%, Silver down 20%, and Gold only down -1.76%

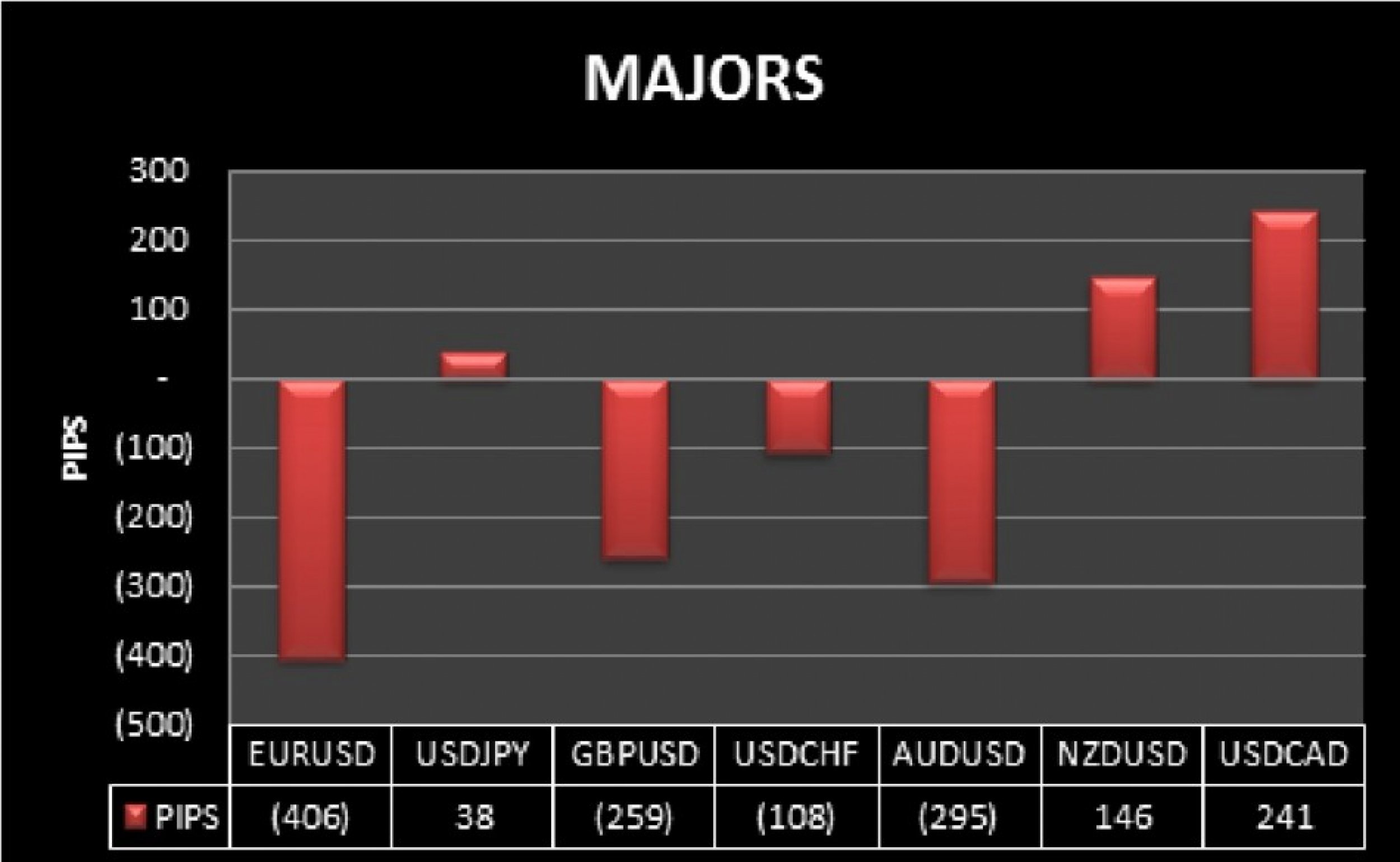

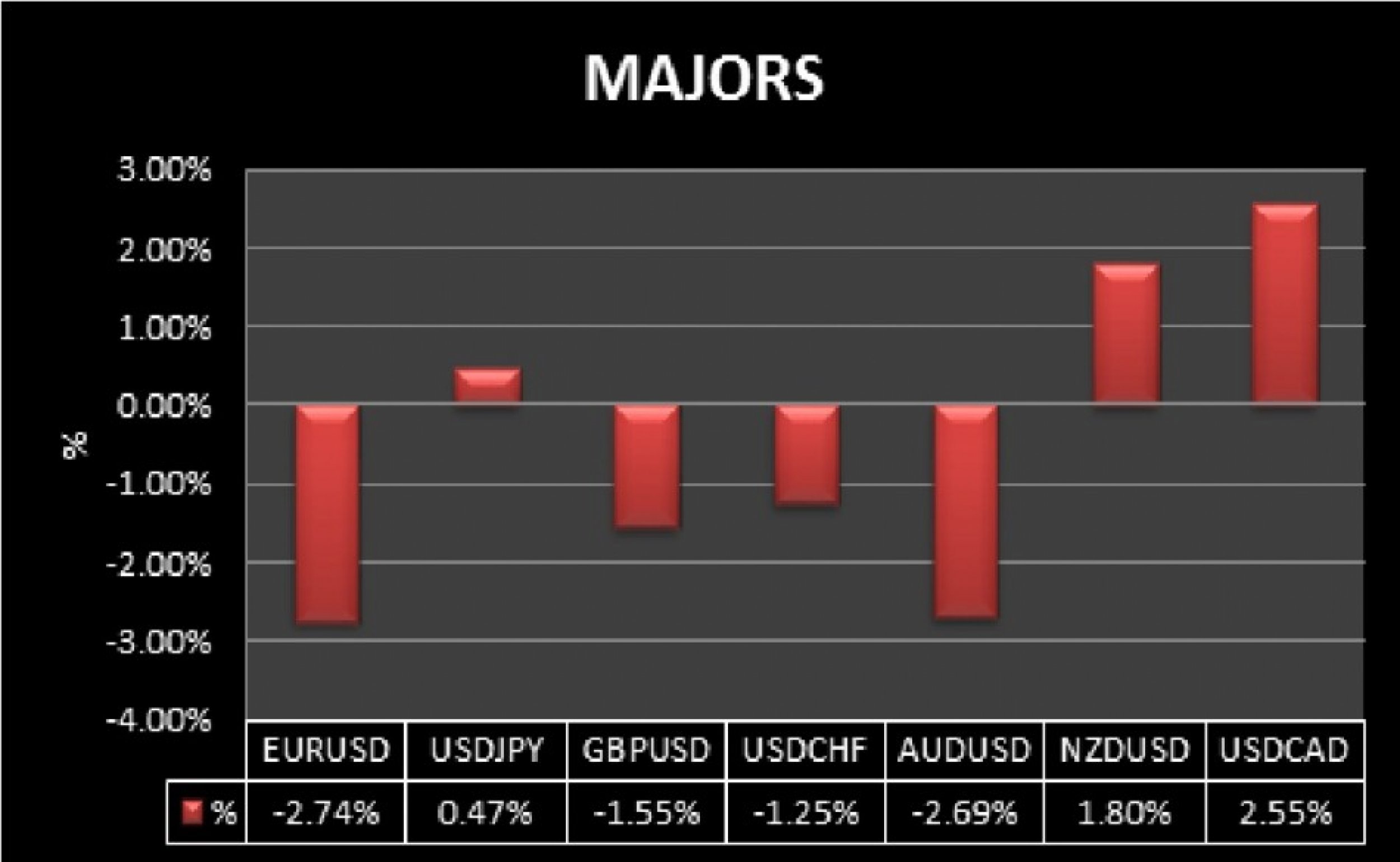

US dollar up against most majors except CHF and NZD...

Biggest Monthly Decliner's amongst Majors:

EUR/USD - down 406 pips, -2.7%

AUD/USD - down 295 pips, -2.7%

GBP/USD - down 259 pips, -1.5%

Biggest Monthly Gainer's amongst Majors:

USD/CAD - up 241 pips, +2.5%

NZD/USD - up 146 pips, +1.8%

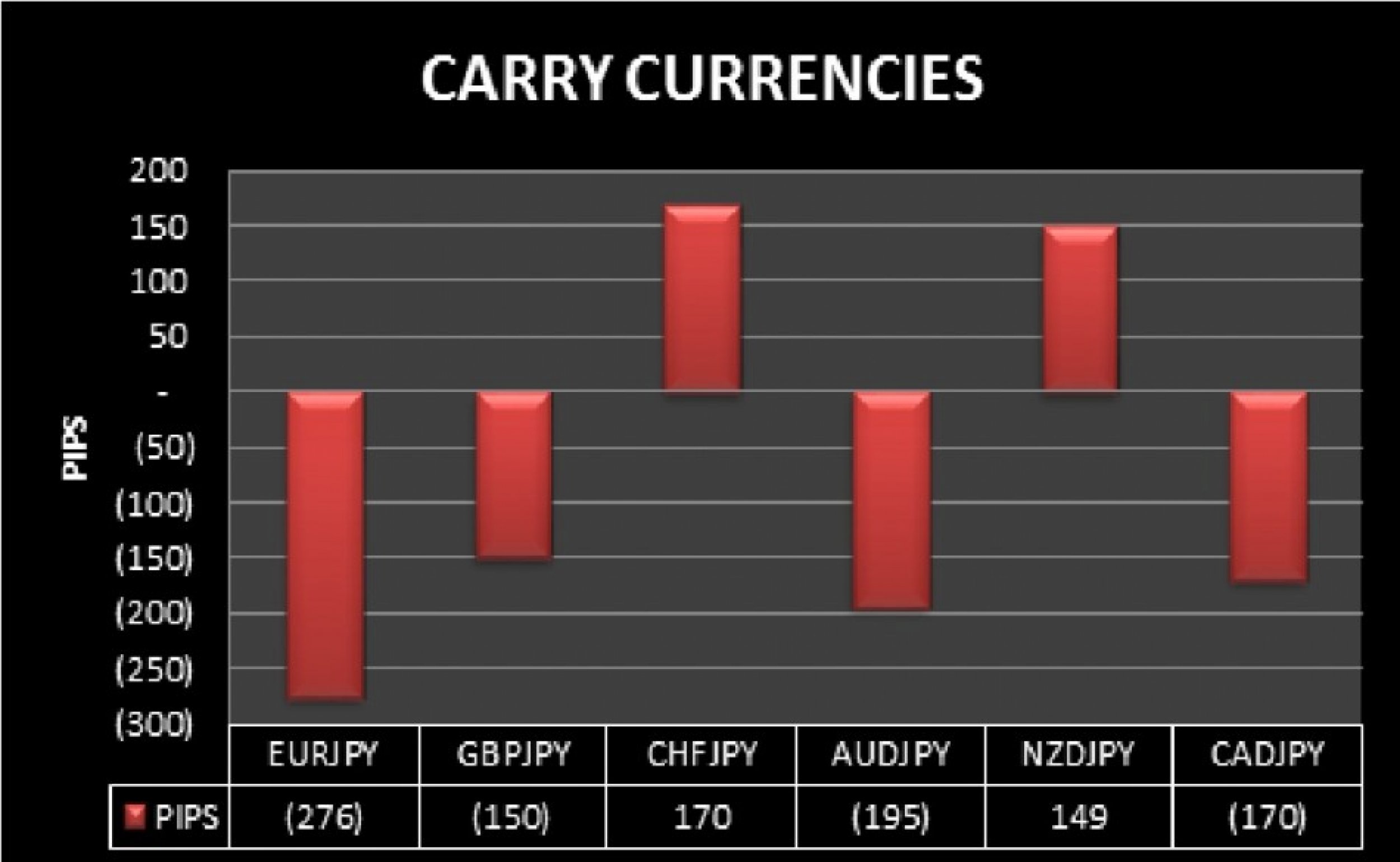

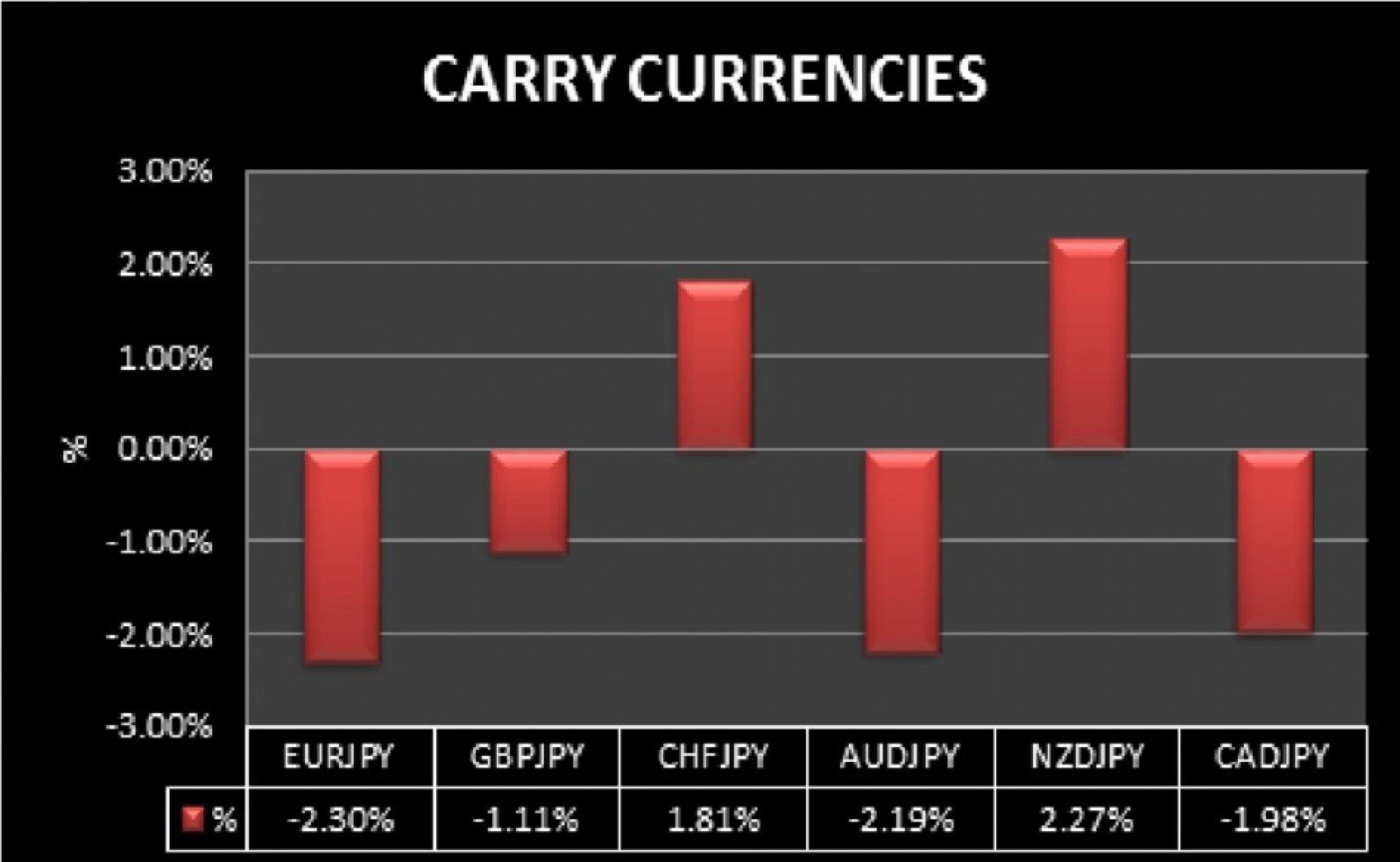

Carry trade analysis, majors against YEN: It was a risk aversion month where all YEN cross were down, higher YEN, except for CHF and NZD...

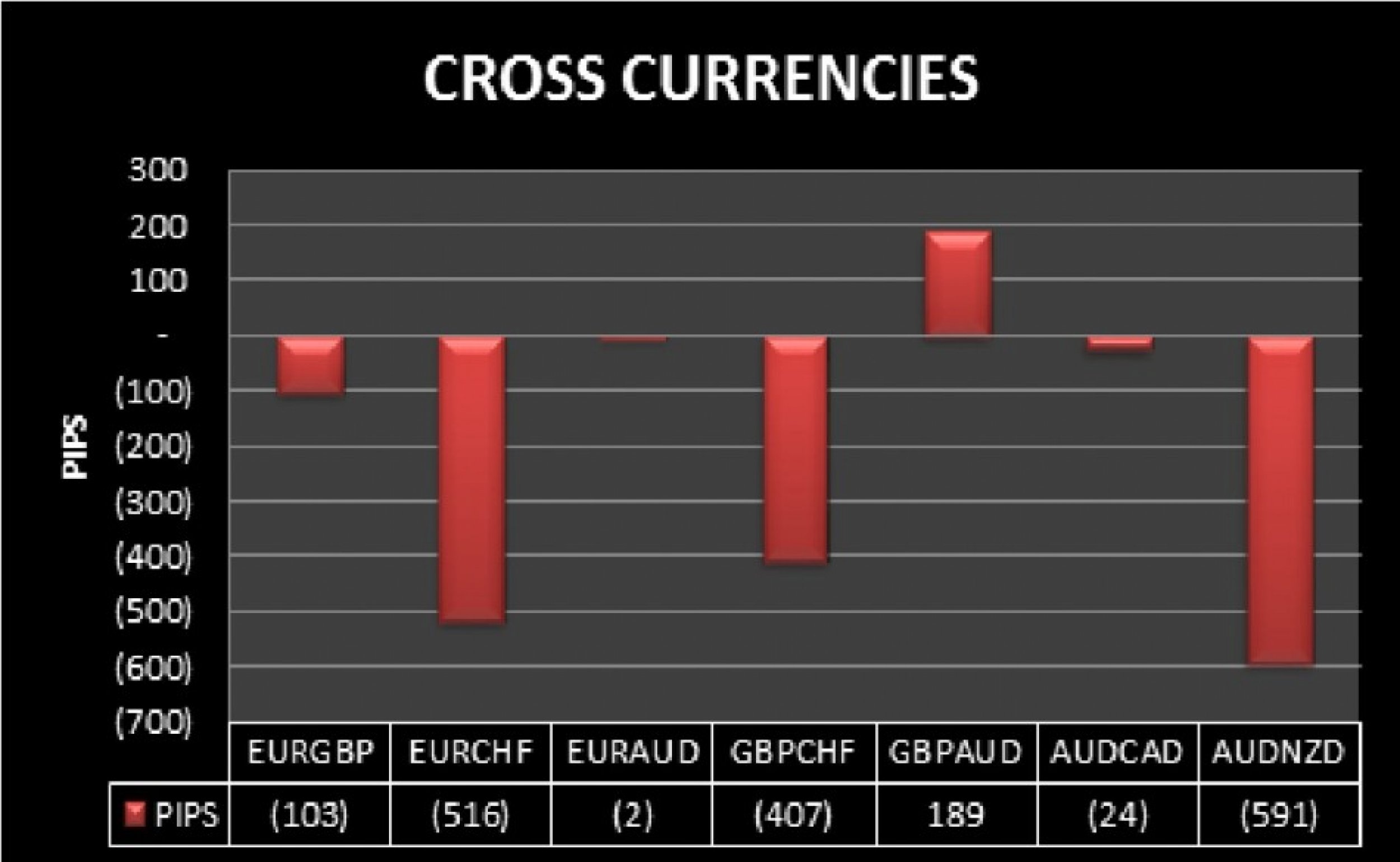

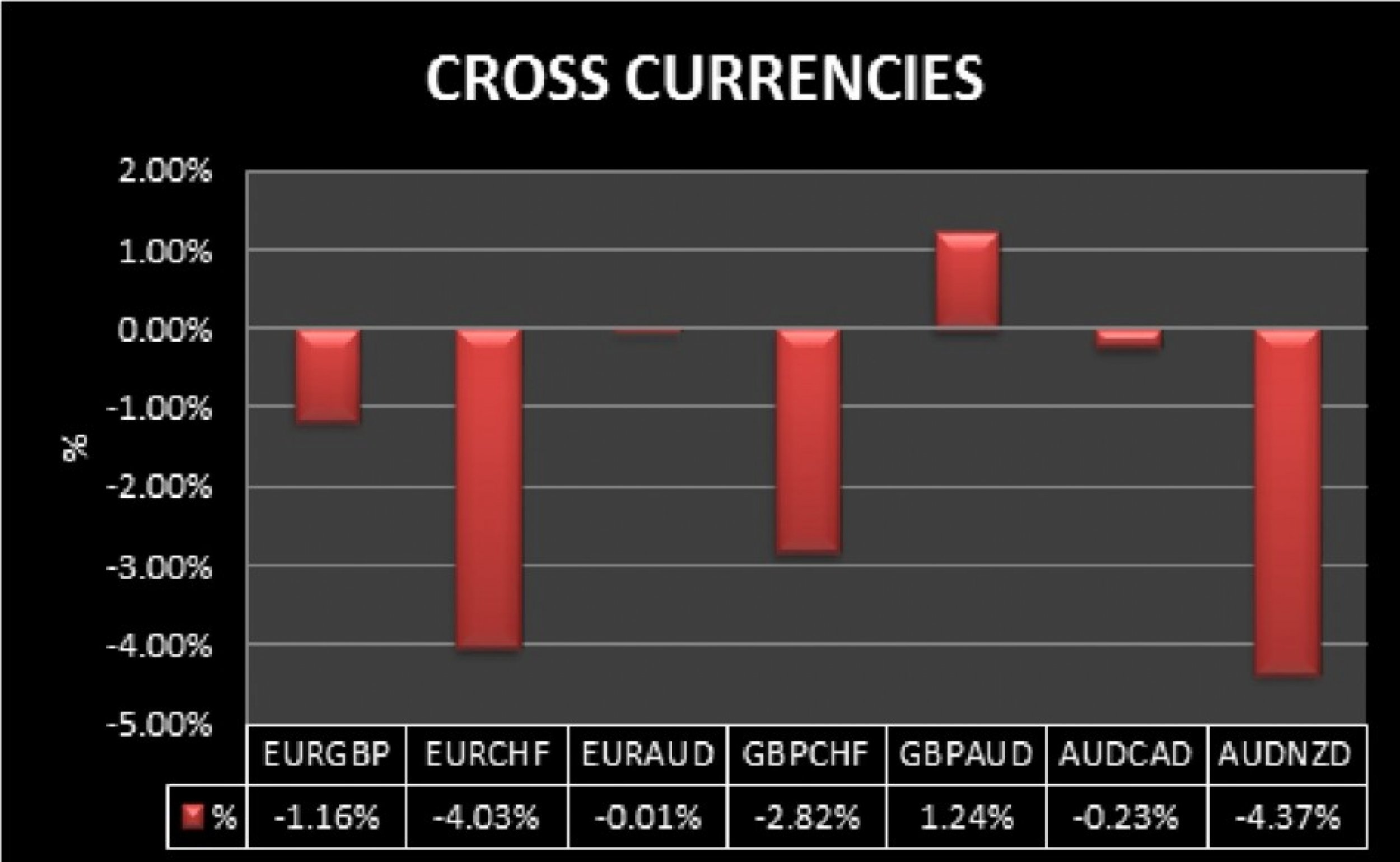

Cross currency analysis: Both EUR/CHF and AUD/NZD saw large losses...

EUR/CHF - down 516 pips, -4%

AUD/NZD - down 591 pips, -4.4%

See below for a breakdown in the graphs:

© Copyright IBTimes 2025. All rights reserved.