General Motors' China Sales Fall Again As SUVs Slip

General Motors (NYSE:GM) said that its sales in China fell 17.5% in the third quarter from a year ago, as good growth at the Cadillac luxury brand wasn't nearly enough to offset sales declines in GM's mass-market brands.

Year to date through September, GM's sales in China are down 15.8%. They have now fallen for five consecutive quarters, and GM's profit from China was down sharply in the first half of 2019. Will that profit be down in the third quarter as well?

The raw numbers

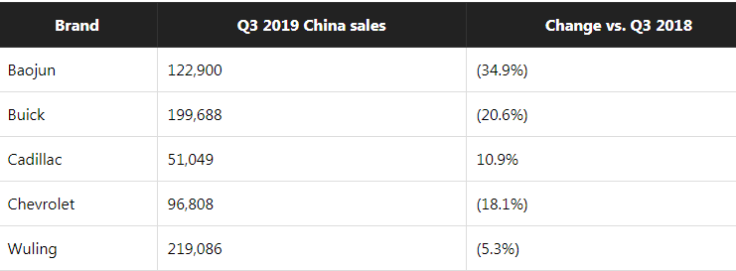

Here's a brand-level look at how General Motors fared at retail in China in the third quarter of 2019.

We don't yet know how GM fared versus the overall light-vehicle market in China. The China Association of Automobile Manufacturers won't release industrywide sales data for September until next week.

What happened with GM in China in the third quarter

As in the second quarter, GM's China sales continue to be affected by the sluggish China economy, particularly in mass-market segments, as well as the ongoing trade-war talk between the Trump administration and the Chinese government. Increased competition was also a factor in GM's third-quarter sales decline, particularly in a key affordable crossover SUV segment.

- Cadillac is the brightest spot in GM's China portfolio at the moment, and it's doing well with both crossover SUVs and its traditional sedan models. GM said that sales of the flagship CT6 sedan were up sharply, and its strong-selling XT4 and XT5 crossovers were joined by the new three-row XT6 in July.

- Buick has long been GM's passenger-vehicle volume brand in China. Sales of its top-selling Excelle GT sedan were up 20% from a year ago, but SUV sales were soft as GM transitioned to an all-new version of the small Encore. GM said that the three-row Enclave crossover will join Buick's China lineup in the fourth quarter.

- Chevrolet saw very strong demand for the new China-only Monza, a new sporty sedan that is mechanically related to the now-discontinued Buick Verano. The Monza, introduced earlier in 2019, racked up about 43,000 sales in the third quarter. Sales of the Malibu XL, a close relative of the U.S. Chevrolet Malibu, rose 32% to over 17,000. But sales of Chevrolet's crossover SUVs suffered from increased competition and model changeovers.

- Baojun, GM's value-priced China-only brand, did well with its new small electric E100 and E200 commuter cars. But sales of its longtime mainstay, the 560 SUV, sagged as domestic competition grew.

- Wuling is a maker of low-cost small commercial vans. It remains the market leader in the segment, which has suffered over the last few quarters as China's building boom has tailed off. GM has responded to the decline by introducing passenger versions of Wuling's small vans under the Hong Guang sub-brand; sales have been good so far.

How GM's China sales will affect its third-quarter earnings

GM's sales in China fell 15% in the first half of 2019, but its equity income from its Chinese joint ventures fell much more -- by 48.6%, to just $611 million. (As seasoned auto investors know, automakers' high fixed costs mean that a relatively small sales decline can lead to a much more dramatic decline in profit.) Unless GM has been able to sharply reduce costs over the last few months, it's easy to conclude that we'll see a similar decline in the third quarter from the $485 million it earned in the year-ago period.

It's possible that we'll see an even greater decline, as GM and its joint-venture partners may have increased spending to support their new-product launches. We'll find out when GM reports third-quarter earnings on Oct. 29.

This article originally appeared in the Motley Fool.

John Rosevear owns shares of General Motors. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.