Inflation Rate Takes Center Stage This Week As Economists And Markets Eye Hint Of Next Fed Rate Move

The debate continues inside the U.S. Federal Reserve between inflation hawks, those board members who think the recent easy money policies at the central bank will cause inflation to spike down the road, and inflation doves, who argue low rates and cheap money need to be maintained to spur corporate investment and create jobs. The next round plays out Tuesday when the government releases the latest Consumer Price Index, called CPI.

The hawks are concerned employment puts upward pressure on wages, sparking broader inflation for goods and services. The only problem with that argument today is an improving employment market is not being accompanied by a rise in wages. To the hawks, this indicates we just have not yet seen the inflation that will, in their opinion, necessarily follow gains in employment.

The doves point to the severity of the Great Recession that rocked the global economy in the last several years and argue the job destruction it wrought means it will take much longer for wages to catch up with job growth than in past recoveries. Therefore, they conclude, low rates and a focus on job creation trump inflation worries.

The doves have the upper hand to date, but the hawks are making more noise. Three of the Fed's most prominent inflation hawks are Richard Fisher of Dallas, Charles Plosser of Philadelphia and Esther George, head of the central bank's Kansas City branch.

In a speech in July Fisher said, "I believe the time to dilute the punch is close upon us. As I have said repeatedly, a bourbon addict doesn't go from Wild Turkey to cold turkey overnight. The punch is still 108 proof. It remains intoxicating stuff."

His point, from his perspective, is the Fed already has injected so much money into the economy that even if the Fed were to tighten more than it already has, the surplus cash buildup will devalue those dollars, requiring more of them to buy goods and services. He also points to the continuing improvement in the labor market to back up the hawks’ position.

Newly minted Fed Chairwoman Janet Yellen disagrees, despite a clearly improving U.S. economy and falling unemployment, a rate hike is needed sooner rather than later. Yellen, firmly in the majority dove camp, takes the position the labor market issues trump the danger of inflation, and, therefore, rates should remain low.

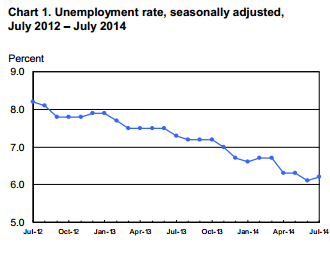

During a press conference following the Fed's last rate decision July 18, she said: “In the labor market, conditions have improved further. The unemployment rate, at 6.3 percent, is 0.4 (of a point) lower than at the time of our March meeting, and the broader U-6 measure -- which includes marginally attached workers and those working part time but preferring full-time work -- has fallen by a similar amount. Even given these declines, however, unemployment remains elevated, and a broader assessment of indicators suggests that underutilization in the labor market remains significant.”

However, in a nod to those on the other side she acknowledged if the labor market "continues to improve more quickly than anticipated by the committee, resulting in faster convergence toward our dual objectives, then increases in the federal funds rate target likely would occur sooner and be more rapid than currently envisioned."

That makes Tuesday's CPI report this week's most important economic news.

Bill McBride, author of the influential economics blog "Calculated Risk" commented Sunday evening in the current environment, "my sense is most FOMC members believe the risks are not symmetrical and that the risks from tightening too soon far outweigh the risk from being 'behind the curve,' and the title of the Jackson Hole economic symposium this year is 'Re-Evaluating Labor Market Dynamics' and I think on Friday Fed Chair Yellen will argue -- using several employment metrics -- that there is still significant slack in the labor markets."

According to analysts polled by Bloomberg News, July’s CPI is expected to post a 0.1 percent gain, compared to a rise of 0.3 percent in June. The CPI excluding food and energy is expected to post a 0.2 percent decline.

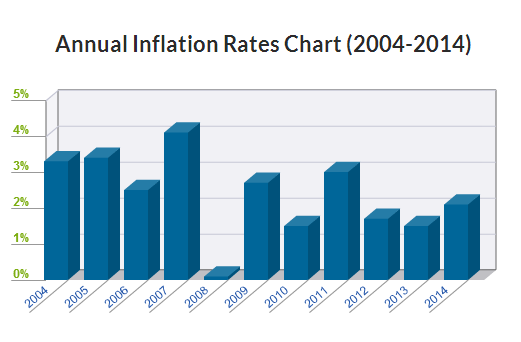

The latest annualized rate in the U.S. currently stands at 2.1 percent for the year ended June 14.

© Copyright IBTimes 2025. All rights reserved.