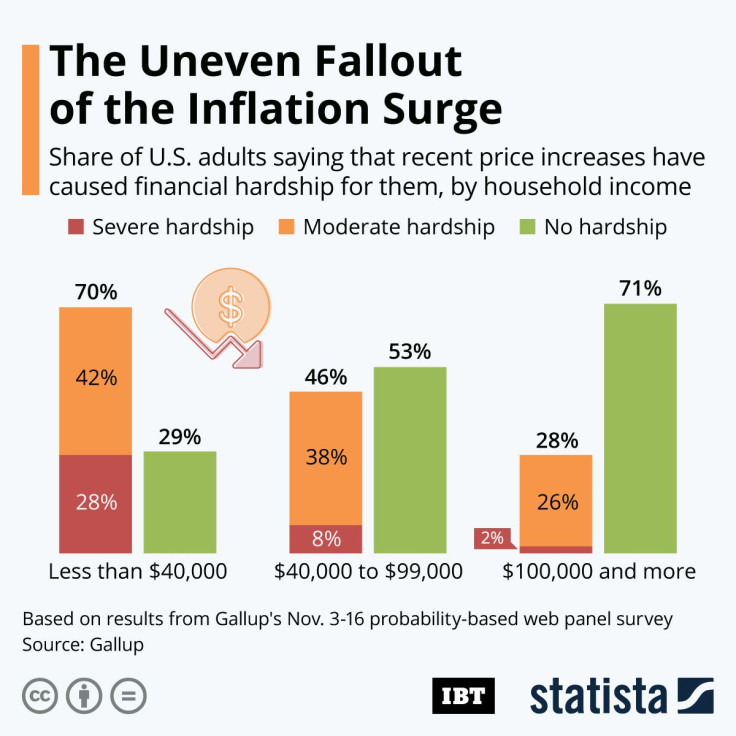

Infographic: The Uneven Fallout Of The Inflation Surge

With Christmas just three weeks away and the holiday shopping season in full force, now is the worst time of the year to be confronted with financial worries. And yet, millions of Americans are facing financial hardship due to the recent surge in consumer prices.

According to a survey conducted by Gallup in November, 10 percent of U.S. adults have been caused severe financial hardship by the latest surge in inflation, severe meaning that it might affect their ability to maintain their current standard of living. Another 42 percent face moderate hardship, meaning that price increases affect them but don’t threaten their standard of living.

Making inflation woes worse is the fact that they affect lower income groups disproportionately. While it’s relatively easy to shrug off price increases when it only reduces the amount of money left at the end of the month, it is much harder for people who struggled to make ends meet even before prices started surging.

As the following chart shows, the perceived effect of recent price increases varies significantly by income group. While 71 percent of those living in households with an annual income of less than $40,000 experience some kind of financial hardship these day, just 29 percent of those earning $100,000 or more claim to do so.