Marketmind: This Is The Yuan

A look at the day ahead in Asian markets from Jamie McGeever

If investors are warming to Wall Street, however fleeting that rapprochement may turn out to be, they could not be giving Chinese markets a colder shoulder.

Wariness over exposure to China has been building for a while, as reflected by the steady decline in the onshore and offshore exchange rates, tech stocks and the equity complex more broadly, to cite some examples.

The two trading sessions since President Xi Jinping tightened his grip on the country by securing a historic third term as leader last weekend suggest that wariness has deepened.

China's main equity indexes on Tuesday failed to claw back Monday's heavy losses, while Hong Kong's Hang Seng Index hit a new 13-year low. And that was despite recording its worst day since the global financial crisis the day before.

Hong Kong tech stocks might have bounced 3%, but they've still lost 45% in just four months.

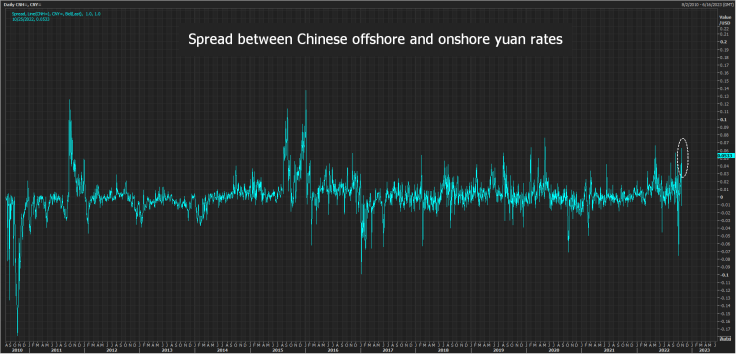

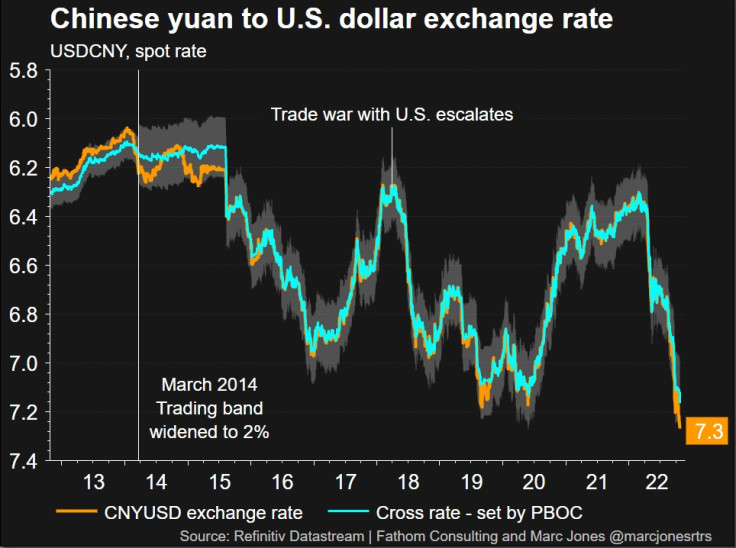

Then there's the yuan. It is depreciating fast as capital outflows accelerate - the onshore yuan is at its weakest since 2009 and the offshore yuan is the lowest ever since its 2010 launch.

Is the central bank losing its ability to control the exchange rate? Some observers say the People's Bank of China is no longer directing the market, rather it is following it. (Graphic: Chinese yuan - onshore, offshore spread

(Graphic: Chinese yuan - spot vs PBOC rate

)

All that said, perhaps the bouyant sentiment across U.S. markets will filter through to China and Asia on Wednesday. It was 'Turnaround Tuesday' for Treasuries - especially the long end - while Wall Street posted another solid rally.

Q3 earnings are doing much of the heavy lifting - nearly three quarters of the 129 S&P 500 companies who have reported so far have posted profit beats, according to Refinitiv data. Microsoft and Alphabet are the big hitters up after Tuesday's bell.

Key developments that could provide more direction to markets on Wednesday:

Australia inflation (Q3)

Japan services PPI (September)

Japan leading indicator (August, revised)

Canada interest rate decision (75 bps hike forecast)

U.S. earnings

© Copyright Thomson Reuters {{Year}}. All rights reserved.