Growth in Japan’s services sector was at its weakest in nine months amid stagnation in new business and employment, a new survey shows.

China's service sector shows resilience even as the economy struggles to maintain growth momentum, HSBC's latest reading of PMI shows.

The latest HSBC China purchasing managers’ indexes indicate a divergence between the two economic sectors.

Earnings season is winding down, but a number of market-moving companies are set to report their financial results.

The latest levels of Japan’s PMI composite and its PMI for the service sector indicate a slowdown in the economy.

When trouble arrives, banks often depart, and access to cash becomes difficult. This is the story of how people bank in conflict zones.

Global regulators may be realizing that current risk calculations are too complex and subjective.

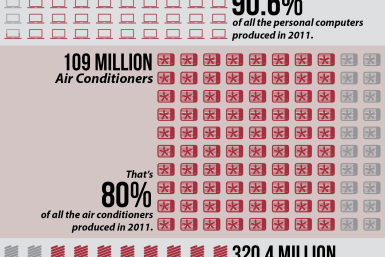

More than 90 percent of all personal computers manufactured in the world in 2011 were made in China.

The ruling has deepened differences within the government comprised of Berlusconi’s center-right party and PM Letta’s center-left party.

Friday’s jobs data may help determine if the economy is creating jobs fast enough for the Fed to consider winding down its stimulus program.

The organic grocer’s shares climbed more than 111 percent to close at $38.05 apiece on Thursday, the best debut performance since LinkedIn's IPO.

New York's attorney general is probing allegations that top U.S. banks unfairly use credit reports to deny banking access to Americans.

AIG, nearly wiped out by derivative bets five years ago, authorized the repurchase of $1 billion in stock after profit jumped 17 percent.

Fabrice Tourre, the former Goldman Sachs trader, was found guilty of six out of seven counts of securities fraud.

With all eyes on Friday’s jobs report for July, analysts question how the unemployment rate is masking larger structural issues.

Citigroup shareholders had claimed in November 2007 that the bank misled shareholders about mortgage-backed assets.

The bellwether stock index reaches a record high on Thursday morning after an encouraging jobs report from the Labor Department.

As the Keystone XL pipeline is delayed TransCanada looks east in moving its crude oil from Alberta.

The oil company's Q2 profits dropped 60 percent because of higher exploration costs, production disruptions, and a write-down of shale assets.

The Purchasing Managers Index rose 4.5 percent to 55.4 as stable demand and improving business conditions boosted employment.

European Central Bank President Mario Draghi said interest rates would remain significantly low for the near future.

Pre-market movers include E Commerce China Dangdang, Yelp, J.C. Penney, LivePerson, Lloyds Banking, ArcelorMittal, NII Holdings.

The big Canadian company booked impairment charges of $8.7 billion.

Indian stocks suffer a downgrade by Goldman Sachs while a separate survey shows factory activity dropped in July.

The relationship between U.S. interest rates and gold prices is becoming murkier than ever, according to the World Gold Council.

A continuation of the Fed's stimulus and a rise in factory activity in the EU and China to keep sentiment upbeat, pending U.S. economic data.

Official and private estimates of the state of China's factory sector differ, making it harder to judge the true health of the country's economy.

The HSBC PMI fell to 47.7 in July, suggesting that the slowdown in China's growth continues to hurt its factories.

Also, the Fed said Wednesday that its outlook on the nation's economy was slightly less optimistic than a few months ago.

The gold industry leader is expected to report earnings losses following major delays and high costs in a Chilean mine.