Monday's Stock Market Close: US Equities Rise, S&P And Nasdaq Set New Highs, Despite Coronavirus Fears

KEY POINTS

- S&P 500 and Nasdaq set new closing highs

- Sinn Fein got most votes in Ireland election

- WHO warned coronavirus infections now only tip of iceberg

U.S. stocks closed higher on Monday, with the S&P 500 and Nasdaq setting new closing highs, as traders continued to assess the ongoing economic impact of the coronavirus

The Dow Jones Industrial Average gained 174.31 points to 29,276.82 while the S&P 500 rose 24.38 points to 3,352.09 and the Nasdaq Composite Index advanced 107.88 points to 9,628.39.

Volume on the New York Stock Exchange totaled 3.49 billion shares with 1,721 issues advancing, 248 setting new highs, and 1,210 declining, with 86 setting new lows.

Active movers were Ford Motor (F), NIO Inc. (NIO) and Nokia Corp. (NOK).

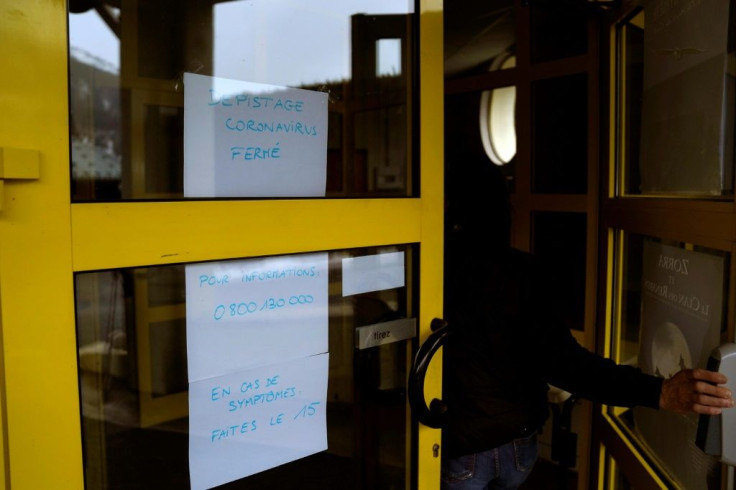

Chinese officials said that as of Sunday night, the number of people infected with coronavirus surpassed 40,000 and 908 had died.

On Sunday, Tedros Adhanom Ghebreyesus, director-general of the World Health Organization, warned that nations outside of China have to prepare for the spread of coronavirus.

‘The detection of a small number of cases may indicate more widespread transmission in other countries; in short we may only be seeing the tip of the iceberg,” he said. “[The spread] appears to be slow now, but could accelerate. Containment remains our objective, but all countries must use the window of opportunity created by the containment strategy to prepare for the virus’s possible arrival.”

Tedros’ comments added to growing fears about the virus.

“This coronavirus seems to be going on for longer, is infecting more people and the hit to growth will be longer,” said Diana Mousina, an economist at AMP Capital Investors Ltd. “You won’t be able to recoup all of the negative impacts in the first quarter.”

But other analysts are more circumspect.

“Stock market investors are torn between fear that the coronavirus might continue to spread, weighing on global economic growth, and optimism given that the latest batch of global economic indicators is showing rebounding global growth,” said Ed Yardeni, president and chief investment strategist at Yardeni Research.

Chinese President Xi Jinping said China will accelerate development of drugs aimed at viruses. Xi also said China will win the battle against the coronavirus.

“The duration of this virus will determine how long businesses will be sidelined and what the effect will be on China and the global economy” said Bruce Bittles, chief investment strategist at Baird.

In a shock, Sinn Fein, long linked to the Irish Republican Party, received the most votes in tight Ireland elections. Sinn Fein now has to form a coalition with other major parties.

Overnight in Asia, markets finished lower. China’s Shanghai Composite dropped 0.51%, while Hong Kong’s Hang Seng slipped 0.59%, and Japan’s Nikkei-225 fell 0.6%.

In Europe markets finished lower, as Britain’s FTSE-100 fell 0.27%, France’s CAC-40 slipped 0.23% and Germany’s DAX slumped 0.15%.

Crude oil futures dropped 1.41% at $49.61 per barrel and Brent crude edge up 0.17% at $53.36. Gold futures climbed 0.22%.

The euro dipped 0.32% at $1.0913 while the pound sterling gained 0.17% at $1.2911.

The yield on the 10-year Treasury plunged 1.96% to 1.547% while yield on the 30-year Treasury fell 1.08% to 2.02%.

© Copyright IBTimes 2025. All rights reserved.