New York Real Estate: Billionaire Brothers Buy $170 Million Midtown Retail Condo Amid Coronavirus

KEY POINTS

- The property was purchased from SL Green, which will retain the office space leased to WeWork

- The 13-story building is at 609 Fifth Ave.

- BlackRock CEO Larry Fink predicted the commercial real estate market will be adversely affected by the pandemic

The coronavirus pandemic and the need to shutter stores, factories and offices and send employees home to work likely will prompt companies to rethink their commercial real estate needs, but that isn’t stopping a pair of brothers who are buying up space in Manhattan.

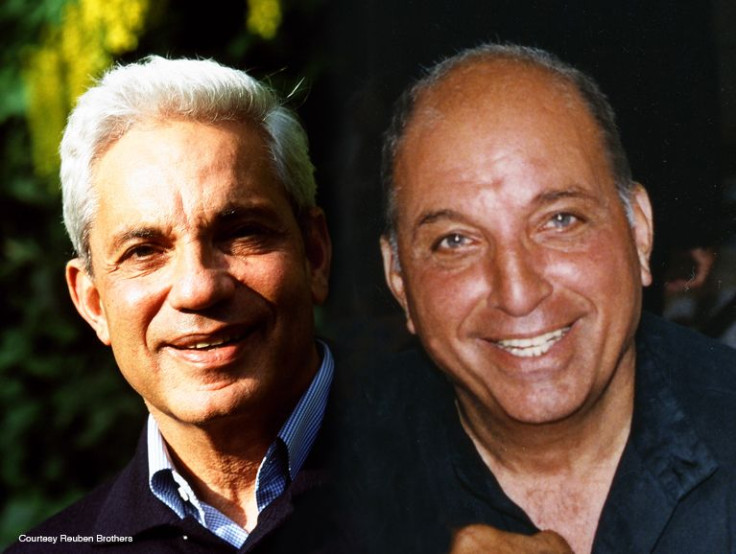

Billionaire brothers David and Simon Reuben reportedly bought a retail condo in Midtown for about $170 million, Bloomberg reported, quoting sources. The deal comes amid questions over the real value of commercial real estate.

Blake Kentrick of Stream Realty wrote in an D Magazine it will be months before we can understand how the pandemic will affect vacancy rates and lease terms. He noted rent relief requests began in early March with as much as 22% of industrial tenants and 15% of office looking for rent relief.

The brothers, known for their investments in London properties, are part of a consortium involving Saudi Arabia’s PIF and British businesswoman Amanda Stavely that is trying to buy the Newcastle United Premier League soccer club.

The retail condo was purchased in a deal with SL Green. Space in the 13-story building is leased to Puma and WeWork. Bloomberg said SL Green will retain control of the office space.

BlackRock CEO Larry Fink said he thinks the demand for commercial real estate will be adversely affected by the pandemic, with many companies choosing to keep at least a portion of the workforce working remotely.

“I don’t think any company’s going to go back to 100% of the workforce in the office,” Fink told a virtual event last week hosted by Saudi Arabia’s Future Investment Initiative Institute. “That means less congestion in cities. It means, more importantly, less need for commercial real estate. So, to me that’s one of the great outcomes of this.”

Billionaire investor Carl Icahn said he’s shorting commercial real estate now, predicting the market will suffer as badly as it did in the 2008 financial crisis.

© Copyright IBTimes 2025. All rights reserved.