Obama To Announce Student Loan Debt Relief, Expansion Of ‘Pay As You Earn’

UPDATE, 3:30 p.m. EDT -- By executive order, President Obama extended on Monday afternoon eligibility for an income-based monthly federal-student-loan repayment program to all holders of student debt. The move expands the number of student-loan debtors qualified for the monthly pay cap by about five million.

Original story begins here:

Weighed down by more than a trillion dollars of student loan debt, millions of young Americans are struggling to find jobs their costly college educations were supposed to provide, which is why President Barack Obama is expected to announce Monday an expansion of current programs aimed at reducing the burdens of federal student loan borrowing.

The plan would broaden the number of young student loan debtors who would qualify for monthly payments capped at 10 percent of discretionary income under the “Pay As You Earn” (PAYE) program. Remaining debt for many of these borrowers also would be forgiven after 20 years for private sector workers and 10 years for government workers and employees of some nonprofit organizations.

The details are similar to those outlined in the White House’s 2015 budget proposal (pdf) at a cost of $7.3 billion between 2015 and 2019. The president will be answering questions on Tuesday about student-loan relief submitted though the Tumblr microblogging site.

Under the current five-year-old Income-Based Repayment Plan, federal student loans can be adjusted annually based on changes to income and family size and are capped at 15 percent of income after basic costs of living are paid, known as discretionary income.

Starting next month borrowers with financial hardship will be eligible for the 10-percent monthly repayment cap. Obama’s proposal would remove the financial hardship requirement.

Federal student loan debtors who began making debt payments after October 2007 are eligible for some debt forgiveness under the Public Service Loan Forgiveness program. Civil service agencies can also repay federal student loan debt as a recruitment and retention incentive.

The Education Department estimates that the number of debtors that joined the Income Based Repayment Plan increased 24 percent to more than 1.6 million in the first quarter.

“The recession brought a sudden reversal in this relationship. As house prices fell, homeownership rates declined for all types of borrowers, and declined most for those thirty-year-olds with histories of student loan debt,” according to an article on the New York Fed’s blog “Liberty Street Economics.”

In the article, the Fed’s senior economist Meta Brown points out that in the years after the 2007-2009 Great Recession, young Americans without student loan debt were more likely to have a home mortgage by the age of 30 than those with student loan debt. Before that, young Americans with student loan debt were more likely to take out a mortgage by the age of 30 because they tended to out-earn Americans without student-loan debt.

But now more college graduates are working in jobs that don’t require college diplomas and are earning less, according to a Fed study from earlier this year (pdf).

“In recent years, the economy has grown annually at 2 percent or so,” an editorial in Saturday's New York Times said, which points out that young Americans who have entered the workforce since the end of the last recession are facing increased economic hardship. “That’s too slow to make up the current shortfall of nearly seven million jobs, let alone to absorb new graduates or push up wages in jobs that do exist.”

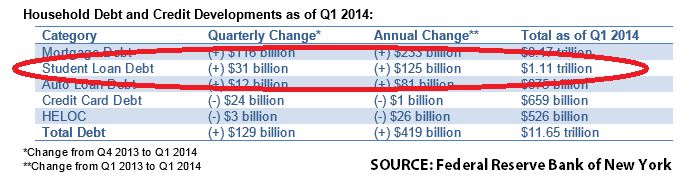

In the first quarter, total U.S. student loan debt increased by $31 billion, breaking through $1 trillion for the first time, according to the Fed’s Household Debt and Credit Report in May (pdf).

© Copyright IBTimes 2024. All rights reserved.