Rupert Murdoch's Ownership Bid For Time Warner Inc (TWX) Failed, But Merger Still Possible

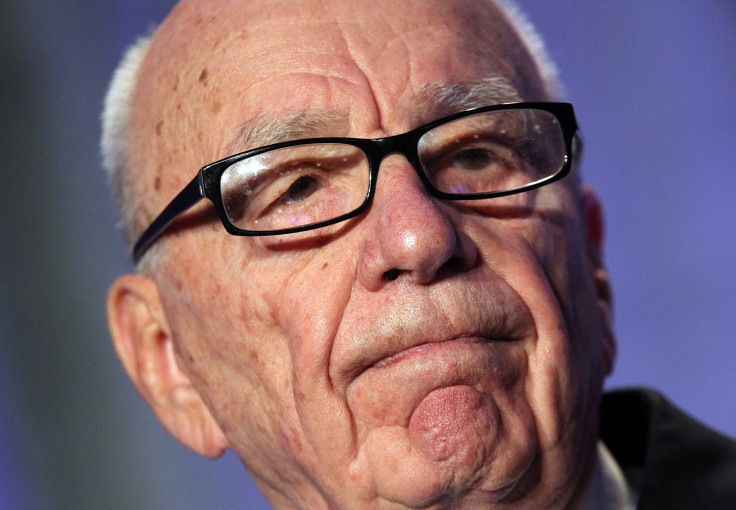

Rupert Murdoch has been uncharacteristically quiet on Twitter for the last several weeks, and it looks like we now know why.

The chairman and chief executive of Twenty-First Century Fox Inc. (NASDAQ:FOXA) was apparently busy making an $80 billion bid to take over Time Warner Inc. (NYSE:TWX) in a deal that -- had Murdoch not been rejected -- would have merged two of the most powerful entertainment and media companies in the world.

The New York Times reported the “friendly” talks on Wednesday, and Fox confirmed that it had made a “formal proposal” last month but was rebuffed by Time Warner’s board of directors. Time Warner later issued a statement saying its own strategic plan makes more sense for the company than any bid Murdoch could throw on the table. “[We] determined that it was not in the best interests of Time Warner or its stockholders to accept the proposal or to pursue any discussions with Twenty-First Century Fox,” the company said.

At a time of megamergers like Comcast-TWC and AT&T-DirecTV, why would Time Warner reject an offer that would have turned it into an even larger and more competitive colossus?

Edward Atorino, a media analyst at the Benchmark Company, said consensus on Wall Street is that a merger makes sense for Time Warner, but it’s possible that there wasn’t a love connection between the company and the notoriously difficult Rupert Murdoch. “He’s a pretty tough taskmaster,” Atorino told International Business Times. “He cuts costs and does other things like that. Maybe they just don’t want to merge with Murdoch.”

Atorino admits, though, that a Time Warner merger is likely when the right person -- and the right price -- comes along. And that person could still be Murdoch if he comes back with a sweeter offer. “There’s always a price at which they have to say yes,” Atorino said.

Murdoch, who built his empire on acquisitions over several decades, has a way of upping the stakes until he gets what he wants. Martin Blanc, an analyst for Bidness Etc., pointed out in a blog post on Wednesday that "several companies have over the years balked at Murdoch’s initial offer, but many have eventually subverted control,” he wrote. (Among those companies is Dow Jones, whose owners, the Bancroft family, initially balked at Murdoch's offer.)

Still, Murdoch’s track record is peppered with its share of failed bids, including a high-profile attempt in 2010 to take control of British Sky Broadcasting (BSkyB). The bid, withdrawn in 2011, failed in part because of outrage surrounding the phone-hacking scandal at the now-defunct British tabloid News of the World, which folded the same year.

A lot has changed since 2011. Murdoch has spun the money-losing News Corp. (NASDAQ:NWSA) into a separate company, allowing him to focus on Twenty-First Century Fox and its media and cable properties, including its highly profitable cable networks such as Fox News and FX. Time Warner recently made a similar move, spinning off its struggling print magazine business -- Time Inc. -- as a means of becoming a leaner media entity.

It may not stay lean for long. Even if Murdoch is ultimately unsuccessful, there is no shortage of possibilities. Fourteen years after Time Warner’s disastrous merger with AOL Inc. (NYSE:AOL), analysts expect a new age of consolidation mania to unfold in the wake of Comcast Corporation’s (NASDAQ:CMCSA) proposed acquisition of Time Warner Cable (NYSE:TWC) -- which, ironically, was spun out of Time Warner Inc. in 2009.

CBS Corporation (NYSE:CBS) has long been seen as one of the likeliest merger matches. Time Warner’s most profitable assets are its cable-TV properties, most notably Turner Broadcasting (including CNN) and HBO, but it owns none of the major broadcast networks.

Others have speculated that Time Warner could get snatched up by a technology company like Google Inc. (NASDAQ:GOOG) or Amazon.com Inc. (NASDAQ:AMZN), which are expanding their efforts as content creators and could benefit from a ready-made portfolio of known Hollywood properties.

Upon news of the Murdoch bid, Time Warner shares were up 20 percent in pre-market trading Wednesday and continued to soar throughout the afternoon. (It hovered around $83.50 at midafternoon, up 17.6 percent.)

Wall Street may love to speculate, but Atorino said it shouldn’t hold its breath. “It’s an ongoing saga with Time Warner, and it looks like nothing’s going to happen unless there’s a better price,” he said.

Then he added with a chuckle: “They should just get it over with and merge with somebody already.”

Got a news tip? Email me. Follow me on Twitter @christopherzara.

© Copyright IBTimes 2025. All rights reserved.