Staked Ether (stETH) And The Curious Case Of Depegging

After Terra (LUNA) wiped out in excess of $44 billion crypto wealth, its death spiral triggered a tsunami of financial contagion. Near its center is staked Ethereum (stETH), a yield-generating asset for a variety of lending platforms, including the embattled Celsius Network.

What exactly is stETH in relation to ETH, and what is its role in crypto contagion that has been plaguing the crypto sector throughout May, June and July? To answer that, let’s first revisit the concept of toxic assets.

2008 Global Financial Crisis: Toxic Assets Enter Public Spotlight

Recessions come and go, but rarely does one get dubbed a Great Recession. It not only lowered economic output and employment but it spawned an entire social movement. Although the Occupy Wall Street movement was short-lived, it was born as a reaction to massive banking bailouts to the tune of $500 billion.

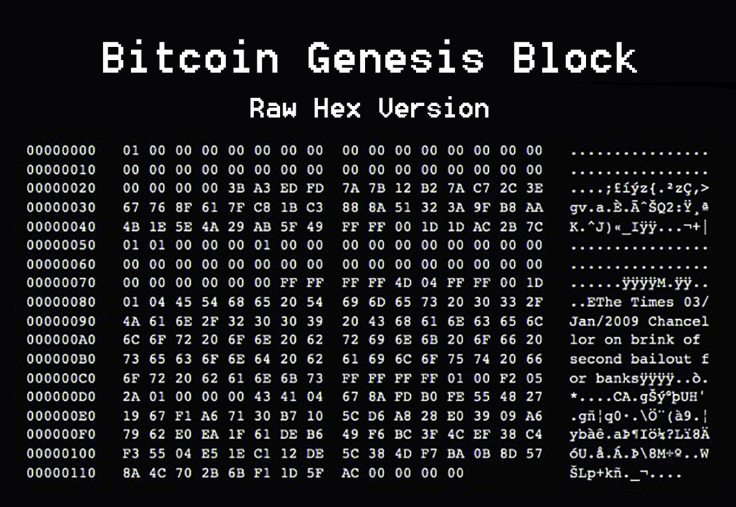

In fact, just a year later, Bitcoin itself launched as a direct response to these bailouts, demonstrated by its genesis block.

What caused this financial contagion for bailouts to be needed? In essence, it was caused by investing in toxic assets. Specifically, subprime mortgages were offered to people who couldn’t repay them.

A wide range of banks, hedge funds and insurance corporations were exposed to this toxic asset via mortgage-backed securities (MBS). These are financial contracts, or constructs, that derive value from an underlying asset. One bank, in particular, Lehman Brothers, had enormous exposure in these MBS derivatives, alongside Bear Stearns.

More precisely, Lehman Brothers had $680 billion in assets covered by only $22.5 billion of liquid capital. In short, the firm was so exceedingly over-leveraged. So much so that only a 3%–5% real estate market decline would have collapsed the leveraged house of cards. And that’s exactly what happened.

Terra (LUNA): The Crypto Version of Lehman Brothers

Terra (LUNA) network had a different toxic asset than Lehman Brothers’ MBS, but the collapse mechanism was identical. Terra Labs introduced an algorithmic stablecoin TerraUSD (UST), pegged to the dollar in a 1:1 ratio. It was supposed to be a key tool to make Terra the blockchain equivalent to Visa.

The problem was the “algorithmic” part. Although it sounds advanced in promoting the spirit of decentralization, such a stablecoin is not backed by any cash reserve like USDC or USDT. Instead, UST relied on the price of Terra’s native LUNA tokens to maintain the peg to the dollar.

But, it only took an external nudge to collapse the price of LUNA, which in turn collapsed UST stablecoin. That nudge came from the Federal Reserve as it ramped up interest rate hikes, raising the cost of capital which caused investors to exit many market positions.

That is bad in and of itself, but multiple crypto-oriented companies had exposure to one of Terra’s lending platforms — Anchor Protocol. The DApp promised APY returns up to 19.5% by locking UST stablecoins. Naturally, this sparked huge growth given that the average savings account in banks has only 0.08% APY.

In the aftermath of UST’s collapse, hundreds of millions of dollars were wiped, bringing down Three Arrows Capital (3AC) hedge fund and Voyager Digital crypto broker/lender, to name a few. Yet, the Terra ripple effect was not contained there.

Celsius and stETH As the Crypto Yield Derivative

Terra held enough assets for there to be a major suppression of the crypto market. By trying to defend the UST peg to the dollar, Luna Foundation Guard resorted to selling 33,206 bitcoins. Such selling pressure in a Fed-induced bear market is extra bad news. And when Bitcoin went down, other altcoins followed, including Ethereum.

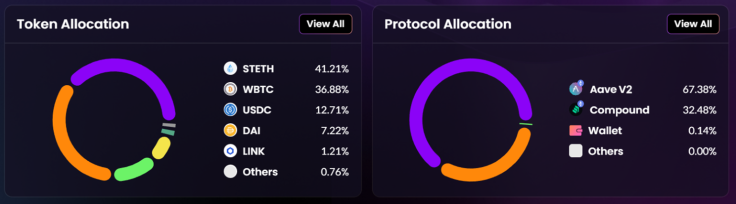

As the largest smart contract blockchain at $40 billion TVL, Ethereum hosts the highest number of lending DApps. Just like Terra’s Anchor Protocol, they offer yields for depositing funds. In turn, centralized finance platforms (CeFi) take advantage of this. One of CeFi’s biggest players with over 1.7 million customers, Celsius Network, had huge stakes in a wide range of staking operations, in which stETH is the main asset.

Following multiple insolvencies, after Terra crashed, Celsius suspended account withdrawals and transfers on June 13th. While the lending platform offered loans based on over-collateralized digital assets, Celsius itself has been engaging in overly risky trading strategies.

The company needed to over-leverage and over-expose its customers’ assets so it could offer double-digit APY returns to attract more customers.

The problem is that such a business model is a little different from a classic Ponzi pyramid, in which the bottom — customer base — has to constantly expand with new collateral flooding in. In turn, Celsius took customers’ collateral to make very risky bets. Former money manager for Celsius, Jason Stone, delved into these practices after filing a lawsuit against the company.

But in late Feb 2021, we discovered Celsius had lied to us. They had not been hedging our activities, nor had they been hedging the fluctuations in cryptoasset prices. The entire company’s portfolio had naked exposure to the market.

— 0xb1 (@0x_b1) July 7, 2022

Is stETH Another Toxic Asset?

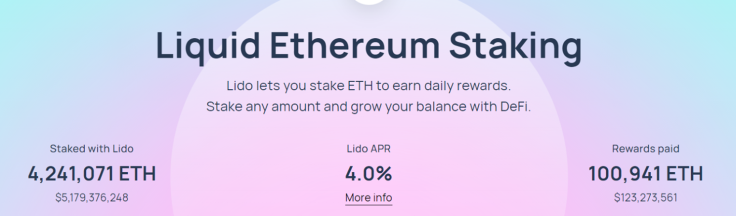

Ethereum investors who are betting on the project’s future had one option to do so — lock 32 ETH as the minimum to secure the future proof-of-stake (PoS) blockchain until The Merge completes. However, the blockchain space is nothing but innovative. Lido Finance came in with a new way to earn yields, offering a custom amount of Ethereum to be staked. This derivative asset is called stETH.

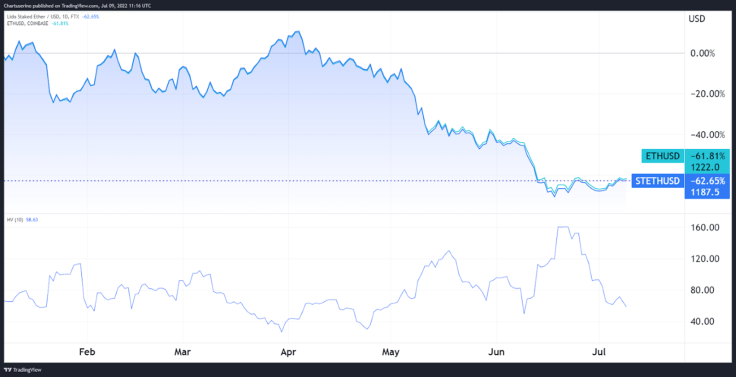

Just like toxic mortgage loans served as an underlying asset for mortgage-backed securities (MBS), Ethereum is an underlying asset for stETH. Needless to say, when Ethereum plunged by nearly 70% YTD, so did stETH returns.

Consequently, as Ethereum kept dropping, stETH volatility kept increasing, putting more distance from its underlying asset, as seen on the stETH vs. ETH volatility chart below.

With so much stake in stETH, there is a growing fear that Celsius will put additional pressure on this volatility as it tries to fulfill its debt obligations and consolidate. Since July 1, Celsius managed to completely pay off its debt to MakerDAO, a decentralized lending platform.

Consequently, the company took control over its 21,962 WBTC collateral, having transferred it to the FTX exchange in the meantime. While this puts that liquidation risk to zero, it is still uncertain if Celsius can consolidate and reopen accounts.

JUST IN: Celsius Network has transferred 24,462 $WBTC ($510,853,000) to an FTX wallet.

— Watcher.Guru (@WatcherGuru) July 7, 2022

What is ultimately at risk is stETH’s redeemability. It will take between six and 12 months after Ethereum’s Merge to PoS for stETH holders to redeem their derivative tokens. Outside of that, they can convert stETH on other DeFi lending protocols, such as Curve. However, another problem pops up.

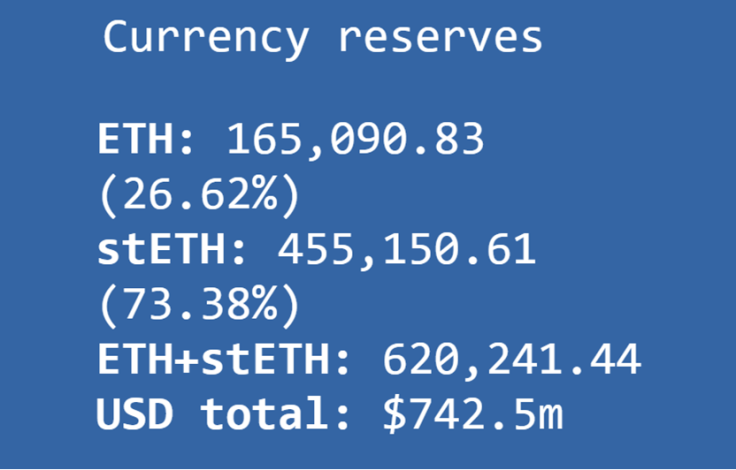

Because Curve relies on users to provide liquidity, and traders are fleeing from stETH, Curve’s liquidity pool is significantly off-balance. Presently, at 73.38% in favor of stETH vs. 26.62% in ETH.

Meaning, there will not be enough underlying asset — Ethereum (ETH) — to make stETH conversion for all stETH holders. Nonetheless, stETH is not a UST-like stablecoin. Lido Finance assured investors that each stETH is backed by ETH, with the secondary market causing price fluctuation.

Staked ETH issued by Lido is backed 1:1 with ETH staking deposits.

— Lido (@LidoFinance) June 10, 2022

The exchange rate between stETH:ETH does not reflect the underlying backing of your staked ETH, but rather a fluctuating secondary market price.

In the end, while there are similarities between LUNA’s depreciation that collapsed UST, or when the housing market decline dropped MBS, it seems unlikely that this scenario will unfold in the case of stETH.

It is then a matter of whether Ethereum itself will suffer further decline as an underlying asset for stETH.

Crypto Contagion Lessons Learned

It seems that many crypto market participants got ahead of themselves in a bull cycle. They forgot that it is just that, a cycle inevitably heading into a bear cycle. In a rush to establish market dominance, CeFi companies took unreasonable levels of risk, as if the bull run would last indefinitely.

We are now in a leverage winding down period. Unfortunately, outside of already collapsed companies, such as 3AC or Voyager Digital, millions of crypto holders are still at risk of losing their savings. To add to the tragedy, much of the market mayhem could have been avoided if CeFi lending platforms, including Terra’s Anchor, had settled for reasonable 3–5% yields.

According to JTBC, Anchor's designers said that the original interest rate was designed to be 3.6%, but the proposal was not accepted by Do Kwon, and Anchor's interest rate was raised to 20% a week before the release. https://t.co/THhM51shhM

— Wu Blockchain (@WuBlockchain) June 8, 2022

But, while that APY range would still be dramatically higher than in TradFi, it wouldn’t be a strong enough marketing magnet. As a result, both clients and greedy CeFi companies fed off each other.

Rahul owns less than 1 BTC and 40 LRC.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.