Sub-Saharan Africa Is Mobile Money Hotspot, Global Findex Report Shows

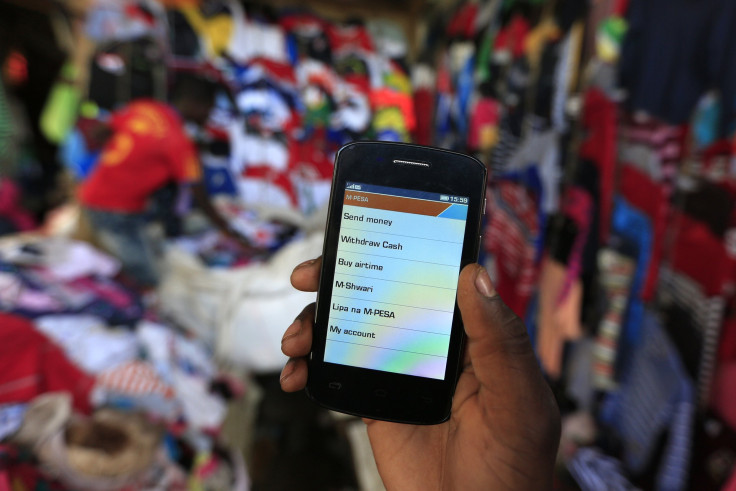

When it comes to mobile money, the world’s biggest hotspot isn’t where you might expect. The concept of using cell phones to move cash around is just catching on in Europe and North America with apps like Venmo and Evenly, but there’s one region of the world that was adopting the idea before it was cool.

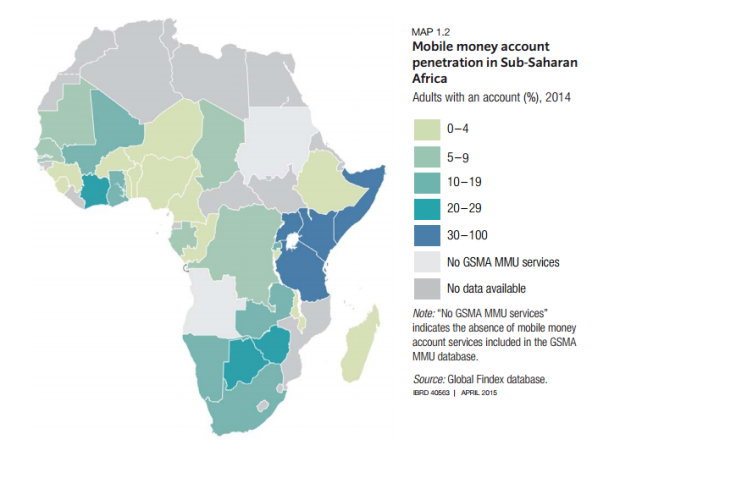

“In 13 countries around the world, penetration of mobile money accounts is 10 percent or more. Not surprisingly, all 13 of these countries are in sub-Saharan Africa,” reads the latest Global Findex report, an international survey by the World Bank and Gallup.

South Africa was the first to launch a mobile money service in 2004, but Kenya began to lead the way in 2007, sparking a movement that picked up speed over the next few years. Today, in sub-Saharan Africa, roughly 12 percent of adults have a mobile money account, compared to just 2 percent worldwide, according to the new data.

And the trend isn’t just helping people avoid a trip to the teller, or feeding a market that could be worth more than $14 billion in a few years. It’s also helping to spur economic development.

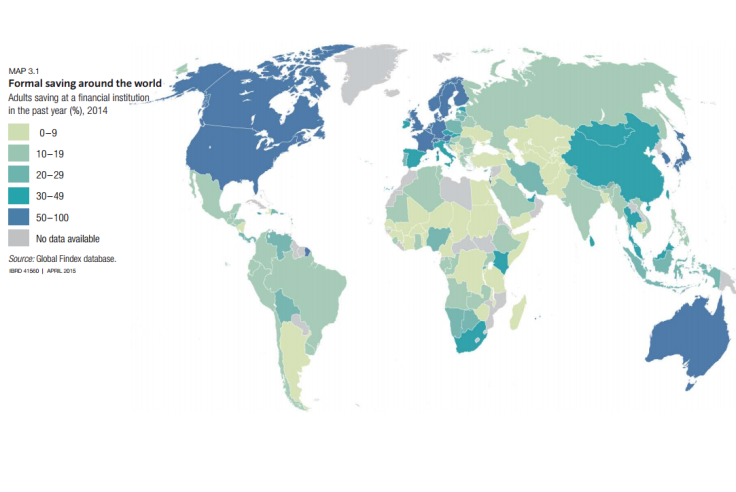

“Along with these gains, the data also show that big opportunities remain to increase financial inclusion, especially among women and poor people,” the report reads.

A lack of access to formal banking systems is a major problem for developing countries, which badly need these services to encourage job creation and economic growth. According to the new data, 700 million adults became bank account holders between 2011 and 2014, with 13 percent of this growth coming from developing markets like countries in Africa. For many adults, mobile money accounts are the only ones they have.

However, it’s important to note the wide variance of use within the continent. In Ivory Coast, Somalia, Tanzania, Uganda and Zimbabwe, adults are more likely to have a mobile account than an account at a financial institution. Kenya, home of the M-Pesa mobile money transfer system, has the highest share of adults with a mobile money account, at 58 percent, but, according to the data, adults in the poorest 40 percent of households are more likely than the richest 60 percent to have a mobile money account.

“Mobile money accounts, by providing more convenient and affordable financial services, offer promise for reaching unbanked adults traditionally excluded from the formal financial system—such as women, poor people, young people, and those living in rural areas,” the report reads.

© Copyright IBTimes 2025. All rights reserved.