(Reuters) - Asia's manufacturers stepped up the pace in March to fill an influx of new orders as Europe's debt crisis subsided and U.S. growth picked up, dispelling some of the gloom that had shrouded the global economy.

China's big factories were surprisingly busy in March as a stream of new orders lifted activity to an 11-month high, but credit-constrained smaller manufacturers struggled, suggesting that the economy is still losing steam.

Stocks and other risky assets rallied Friday, rounding out the quarter with even more price gains on a day that encapsulated the main developments of the year so far: encouraging news out of Europe, better-than-expected consumer sentiment in the United States, and the perceived and steady pull of inflation.

Americans spent their hard-earned money a bit more freely in February, the most in seven months, even as income rose only modestly, according to government data released Friday.

Household income grew at a faster pace in the fourth quarter than previously thought as the jobs market strengthened, a development that could underpin consumer spending.

Containing inflation will be critical when the time finally comes for the U.S. Federal Reserve to reverse its ultra loose monetary policy, two top Fed officials said on Thursday.

Some industry experts warned that the gold price has been artificially suppressed due to its strong impact on interest rates and government bond values, leaving many gold equities significantly undervalued.

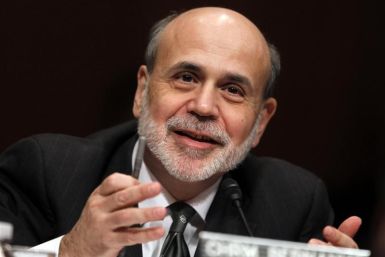

Claims for jobless benefits fell to 359,000, but Federal Reserve Chairman Ben Bernanke warned this week that recently improved employment data seem out of sync with the pace of U.S. economic growth.

Argentina’s economy expanded at a lower rate in the fourth quarter than in the previous quarter due to a slackening in the manufacturing sector and weaker consumer sentiment.

Window dressing, the practice of stock fund managers buying up top performers as the quarter ends to boost the appearance of success, failed Tuesday to lift the major indexes into positive territory.

Americans were more worried about inflation in March than at any time in the last 10 months and consumer confidence waned in the wake of higher gasoline prices.

Consumers are still confident about the state and medium-term trajectory of the U.S. economy, a highly-influential survey of consumer confidence indicated Tuesday, but an increasingly polarized view of the situation in the labor market -- as well as less-optimistic predictions about the future -- means they are expressing that optimism less emphatically than a month ago.

Americans this month ratcheted up their expectations on inflation to the highest level in 10 months and consumer confidence waned, though the economic recovery was still seen on track.

Consumer confidence dipped in March, while Americans ratcheted up their inflation expectations to the highest level in 10 months, according to a private sector report released on Tuesday.

Vietnam’s GDP for the first quarter declined to 4 percent from the last quarter growth of 6.1 percent, according to data released by the government.

Asian stocks rebounded Tuesday and the dollar eased after Federal Reserve Chairman Ben Bernanke said ultra-loose monetary policy was still needed to reduce unemployment even though the U.S. economy has shown signs of improvement.

The economy needs to grow more quickly to bring the unemployment rate down further, Federal Reserve Chairman Ben Bernanke said on Monday, defending the central bank's policy of very low interest rates.

Stock indexes gained 1 percent on Monday after Federal Reserve Chairman Ben Bernanke signaled a supportive monetary policy will stay even as the unemployment rate improves.

Stocks rose on Monday, rebounding from last week's decline, after Federal Reserve Chairman Ben Bernanke suggested the central bank would continue supportive monetary policies, even as the unemployment rate improves.

Gold prices rose 1 percent on Monday after comments from U.S. Federal Reserve Chairman Ben Bernanke that faster growth will be needed to boost employment supported expectations that further quantitative easing measures may be necessary.

After calling the recent recovery a puzzle, markets reacted enthusiastically to Fed Chairman Ben Bernanke's pronouncements

The Fed chairman said U.S. job market conditions remain weak despite three months of strong hiring and that the improved employment data seem to be out of sync with the overall pace of economic growth.