Tech Sector Is Seeing A Bubble And It’s Ready To Burst: Carlos Dominguez

A bubble is brewing in the technology sector and the cold reception that the Wall Street is giving to IPOs from some celebrated privately-held companies indicates that the sector is in for a negative surprise, Carlos Dominguez, president and chief investment officer at Element Pointe Advisors said.

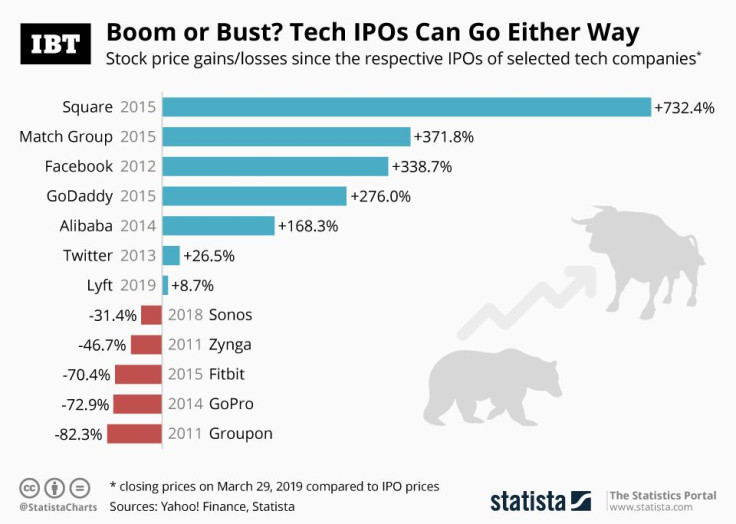

“I think it's a bubble and it will burst,” Dominguez told International Business Times. He said the catalyst for the bubble to burst would be more of the much-awaited big-brand name IPOs trading poorly. “The more they come public and the more they end up trading as poorly as Uber, Lyft, Luckin, and if they just fail to justify their private-market valuations, that's what starts to pop the bubble.”

The stratospheric valuations of some of these companies is a result of inflated rate of growth, he said, adding that the influx of funding from SoftBank and some new entrants in the private tech market has pushed up the valuations. These companies, with no clear path to profitability, have been unable to sustain the hype once they went public, adding to the disenchantment.

Uber (NYSE:UBER), for instance, went public on May 10 with a valuation of $82.4 billion, or $45 a share. But it traded at $42 a share on the first day and closed even lower at $41.57 a share -- down 7.6 percent from its IPO price.

“When your revenues are $15 billion or so roughly, and still showing nowhere near profitability, in fact your revenues have grown, your losses have grown, and you're a 10-year old company -- it's a very different setup,” Dominguez said.

Comparing Uber to Amazon’s (NASDAQ:AMZN) IPO in 1997, he said: “That is very different from Uber that has been private for 10 years. The thing about Amazon is that for a long time it didn't show profitability but it showed positive cash flow -- it's a little bit different. When they have positive cash flow, they don't need to come to the capital markets to continue to reinvest in their business.”

Amazon's stock had soared 30 percent above its opening price when the company went public in 1997. The target price by underwriters a night before the debut was marked at $18 a share, and the stock touched a day's high of $30 before settling close to $23-1/2 a share.

Softbank, a Japanese holding conglomerate, put together a $100 billion Vision Fund in 2016 to invest in the world’s leading technology companies. The fund has taken stakes in tech bellwethers including Uber and WeWork Cos. Softbank is now planning to raise another $100 billion for its second Vision Fund.

“Masayoshi Son [the CEO of Softbank] has basically put a $100 billion to work in two years, which is unheard of,” Dominguez said. “All of a sudden now, they are seeing an investor who's coming in and is pushing valuations up.”

“The mindset is like ‘winner-takes-it-all’ markets,” he said. “And you're seeing there are a lot of these private companies, their revenues are going up very quickly, but they have no profits to show and it's really unclear what the profitability, if any, of the long-term model is.”

Many of these startups, which work with big data and artificial intelligence, are now entering the late stage of the fund-raising cycle and eyeing markets to raise fresh capital, contributing to a surge in IPOs.

Citing the decline in value of Lyft and Uber post going public, Dominguez cautioned that the effects could not just be across the companies but across the entire tech value chain.

“There's obviously a multiplier effect throughout the tech value chain. The problem is that now we're far enough along into this, and you're at that point where you need to see returns so that they can recycle cash back in,” Dominguez said.

MANY OF THE 97 UNICORNS WILL BE MAJOR DUDS

Referring to the latest list of 97 unicorns in the U.S. valued at over a billion dollars each, Dominguez said: “Undoubtedly some of these private companies will grow into their valuations and will be long-term winners. But a lot of these ‘97 unicorns’ will be major duds. They will never materialize into their potential and a lot of these sort of returns that you see on paper throughout the venture capital industry or that Softbank is advertising, are going to end-up being much, much lower.”

Dominguez said Softbank actually had “only one realization (Indian e-commerce firm Flipkart, which was recently bought by Walmart); the rest of these are unrealized returns.” He expects funds and owners to mark down their holdings in the future.

Dominguez said the world is awash in liquidity which started with central banks and low interest rates, creating “a bubble, feeding on itself.”

“If you look back to the late 1990’s and 2000's -- you had this flood of really outsized tech IPOs -- and that usually marks the top,” Dominguez said comparing the current IPO rush to the dotcom bubble of the early 2000s.

“I don’t know if history will repeat itself,” he said, because there are not enough data points to make statistically significant observations. "But there's some good reason why you see it happen that way,” he said.

© Copyright IBTimes 2025. All rights reserved.