This Trend Should Terrify Big Cable

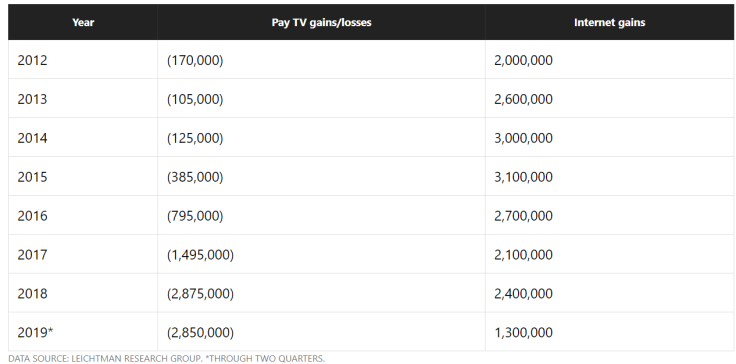

Cord-cutting began in 2013 when the cable and satellite industry lost 105,000 subscribers. Those numbers were small, stayed small in 2014, and were offset by huge gains in broadband customers. At first, cord-cutting looked like more of an industry achieving peak saturation than one that would soon be in perilous decline.

What has become clear since 2016, the year when losses really began to pick up, is that the industry that closed 2016 with over 94 million paying customers has not yet hit -- or maybe even approached -- bottom. Losses have been escalating, roughly doubling year over year in 2015, 2016, 2017, and 2018. That's bad, but the latest numbers are much worse.

How low can you go?

The numbers really got serious in 2017, when cable and satellite providers lost 1.495 million customers in a year for the first time ever. That loss increased to 2.875 million in 2018 and has already reached 2.85 million through two quarters of 2019, according to data from Leichtman Research Group.

The numbers are actually worse than they look for two reasons. First, the cable loss doesn't account for 3.8 million customers who switched to internet-delivery streaming cable plans (which are generally cheaper). Second, the cable loss doesn't reflect that it's likely that 2019 will be the first year in which broadband gains don't exceed cable losses.

Is this the end of cable?

It's hard to know where the bottom is for the cable industry. Older customers may subscribe out of habit or because they don't really understand their options. Younger consumers, however, may grow up having never had a traditional cable bundle. That's very different from the current generation that, perhaps, had cable at their parents' house and opted to cut the cord when faced with paying their own bill.

People who once had cable may opt to return if their household includes multiple members with different viewing needs. Consumers who never had traditional cable probably won't ever consider signing on.

The cable industry needs to address what's happening and make a major course correction. That probably means more a la carte pricing, closing some channels that have limited viewership, and accepting that consumers have a lot more choices when it comes to discretionary spending for television.

Cable was dying a slow death. It's now dying at a faster pace, and when that happens, it can create a snowball effect where negative momentum builds. This isn't going to get better, and cable's biggest players -- Comcast, Charter, and AT&T -- need to act now or watch their pay-television businesses slowly (or not so slowly) walk away.

Daniel B. Kline has no position in any of the stocks mentioned. The Motley Fool recommends Comcast. The Motley Fool has a disclosure policy.

This article originally appeared in The Motley Fool.