What Is Liquidity Mining?

(Update: An earlier version of this article referred to Citadel Securities in the eighth and ninth paragraphs. The references have been removed as they were not relevant to this article.)

Although Bitcoin is a smart contract network by its very nature, it was only after Ethereum streamlined smart contracts that Decentralized Finance (DeFi) came to be. Ethereum tied blockchain's smart contracts to web interfaces, delivering decentralized applications (DApps).

Their modest moniker hides their revolutionary nature. DApps can decentralize and automate any human activity that can be framed in legal terms, including financial ones. Functions that were once exclusive to banks, such as borrowing or lending, can now be conducted freely without gateways and meddlers.

One of the clearest examples of this is liquidity mining. However, before we can properly understand it, we need to see how the traditional markets work.

The role of market makers

How can a stock market function without having large financial institutions that cover traders' bids and asks? After all, in any trading arrangement, there needs to be a match to one's asks or bids. Otherwise, the trading would ground to a halt.

This unimpeded flow of assets is what we mean by market liquidity. High market liquidity ensures that both buyers and sellers execute their trades swiftly. And market makers ensure that happens. Citadel Securities, the New York Stock Exchange (NYSE), and American Stock Exchange (AMEX) are just some of the hundred market makers that keep the markets liquid.

In conjunction with clearinghouses, market makers (MMs) facilitate trades from the point of a buyer setting a bid, to the point of a seller setting an ask. MMs cover the space between those two sets, called spreads, earning a small cut in the process on every trade. In fact, such is the MM's incentive to cover people's trades that they have sparked a whole new sector — zero commission trading — first pioneered by Robinhood and then adopted by all other brokerages.

The problem is, such trading is not free at all. Robinhood was able to offer this service because of its relationship with Citadel Securities, one of the largest MMs in the United States, accounting for about 35 percent of all U.S.-listed retail trading volume. Even Gary Gensler, the Securities and Exchange Commission Chair, noted Citadel's market share in his prepared note, in the footnotes section.

Following the fallout from GameStop (GME) and AMC Entertainment (AMC) short squeeze, it came to light that much of Robinhood's revenue came from such market makers. In other words, the price of zero-commision trading in relaying market makers order flows from retail traders. This practice is known as pay for order flows (PFOF), currently legal in the U.S. but banned in many countries, such as Canada and the U.K.

This potential conflict of interest resulted in many congressional hearings and class-action lawsuits against Robinhood.

As you can see, the cost of centralization is pretty significant. Although market liquidity is necessary, having large financial institutions intercepting trades introduces many moral hazards. That’s up until smart contracts showed up.

Liquidity mining explained

Now that you understand how important market makers and liquidity are to the blood flow of the economy, it is easier to understand how the traditional way of doing things can be decentralized and automated.

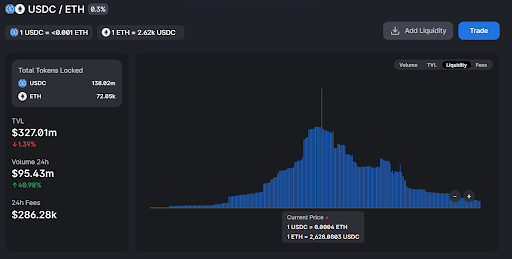

Whenever you enter a market position, such as exchanging one token for another, there has to be a token holder on the opposite end of that trade. These positions between sellers and buyers make up token pairs. To illustrate, one of the most popular token pairs is USDC/ETH. Why? Because USDC is a stablecoin pegged to USD, so it doesn't have crypto volatility, while ETH is the second-largest cryptocurrency used for paying gas fees across thousands of DApps.

In other words, USDC/ETH is not only a token pair but a liquidity pool. A decentralized exchange (DEX) like Uniswap offers dozens of such liquidity pools for various token pairs. This is how the problem of a centralized market maker is solved.

Thanks to smart contracts, Uniswap uses Automated Market Maker (AMM) protocol to cover people's spreads. Because it is on a public blockchain, it is completely transparent. Anyone can link up their MetaMask wallet to a Uniswap DApp, select a liquidity pool and click on “Add Liquidity.”

This is when a user either locks in their USDC or ETH funds into the liquidity pool. Then, just like Citadel Securities makes a cut from its spreads, users get a cut whenever people tap into those pools to swap tokens. In other words, they become liquidity providers (LPs) engaged in liquidity mining.

The cut liquidity providers receive is measured as either APY (annual percentage yield) or APR (annual percentage rate). Both count interest rates on your staked funds in liquidity pools, but APR leaves out the compound interest rate.

Case in point, if you had deposited 1000 USDC into a liquidity pool, you would've gained APY of up to 8 percent. However, because the interest compounds daily, you would receive 83.2 USDC in a year's span. With that said, there are some dangers to consider in liquidity mining as well.

Impermanent loss lurks to kill APY gains

Impermanent loss (IL) is just what it sounds like. Because cryptocurrencies are known for their volatility, it often happens that your locked tokens are priced differently than when you staked them. This price difference results in an impermanent loss.

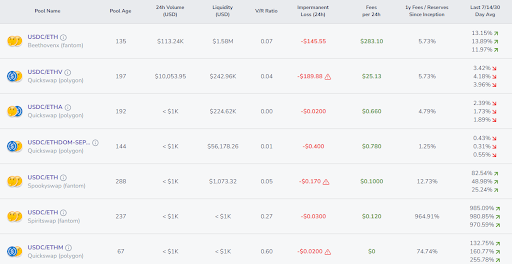

The more drastic the disparity, the greater IL will be, regardless whether the price goes up or down. In turn, this means you are losing money instead of just holding tokens in your wallet. To ensure what you are getting into, APY.Vision is a great tool to get an overview of different liquidity pools across networks.

As you can see, IL can vary wildly depending on token pairs. However, IL can be countered by trading fees. For instance, a 0.3 percent fee on every trade that Uniswap charges goes to LPs. Therefore, with a big enough trading volume, some liquidity pools can overcome IL.

As a golden rule, it is wise to avoid staking your funds in liquidity pools that hold volatile token pairs. Likewise, it is better to first start with a small investment to explore APY gains vs. IL.

Rahul owns no cryptocurrencies.

International Business Times holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

© Copyright IBTimes 2025. All rights reserved.