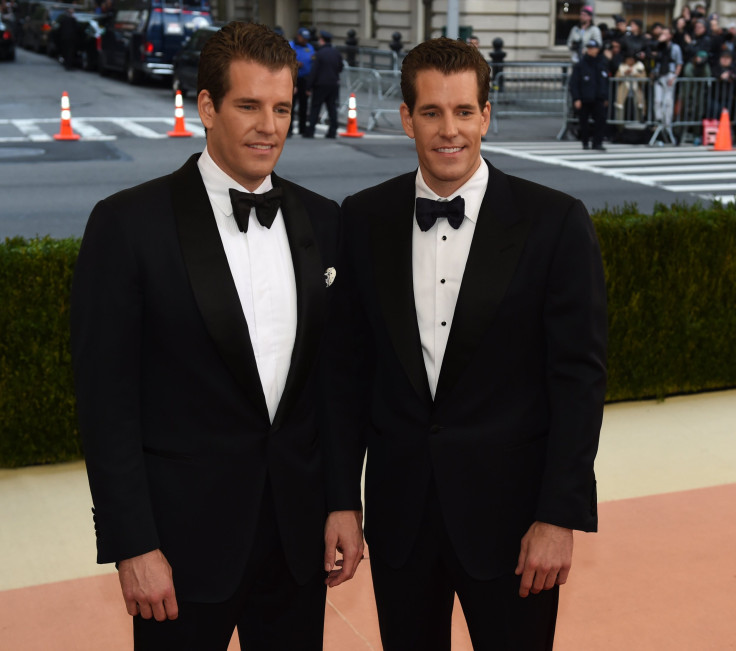

Winklevoss Believes Next Bitcoin Bull Run Will Be 'Dramatically Different', Here's Why

KEY POINTS

- Legal clarity allows Bitcoin companies to have good relationships with financial institutions

- That banks start warming up to cryptocurrency is a sign that Bitcoin is maturing to become a mainstream asset class

- With better infrastructure, users can be onboarded easier to cryptocurrency

Billionaire Cameron Winklevoss predicts that the next time Bitcoin increases its price in a bull run will be "dramatically different" from the time it went as high as $20,000 in 2017. The Winklevoss twin cited new startups and better market infrastructure that could potentially onboard users easier than before.

Regulations surrounding cryptocurrency have drastically improved and become well-defined. The new directive from the Office of the Comptroller of the Currency (OCC), which allowed banks to take custody of crypto, is a clear indication that financial institutions do not need to shy away from dealing with crypto firms. OCC Acting Chief Brian Brooks, a former Coinbase executive, added that banks can choose what kind of involvement they would like to do with cryptocurrency. A common use case is the safekeeping of private keys.

In the past, new users and traditional institutional investors are discouraged to get into Bitcoin because of the effort it takes to keep them. Users must have their own Bitcoin wallet and must secure their own private keys. These wallets are often not insured. If the user lost their private keys or if the crypto wallet company got hacked, there’s no way they could get back their Bitcoins or even recoup a portion of their funds in U.S. dollar. Banks are familiar to users and investors and their perceived security could entice them to keep Bitcoin in the financial institution’s custody.

Bloomberg’s June Crypto Market Report said banks and institutional investors coming to embrace Bitcoin is a sign of the cryptocurrency maturing into a mainstream asset class.

Banks are also embracing crypto companies as clients, something they don’t do in the past because of the perceived risk involved. Coinbase and Gemini, which is owned by Tyler and Cameron Winklevoss, are now clients of JPMorgan.

Because of the increasingly good relationships between cryptocurrency firms and financial institutions, many crypto startups are thriving without fear. The crypto startup Zap has joined Visa’s Fast Track program to help it launch efficiently. Strike’s crypto app Zap allows users to send and receive Bitcoin as dollars. Mastercard followed Visa’s footsteps and now expanded its cryptocurrency program so that startups can launch their own cryptocurrency debit cards powered by Mastercard.

© Copyright IBTimes 2025. All rights reserved.