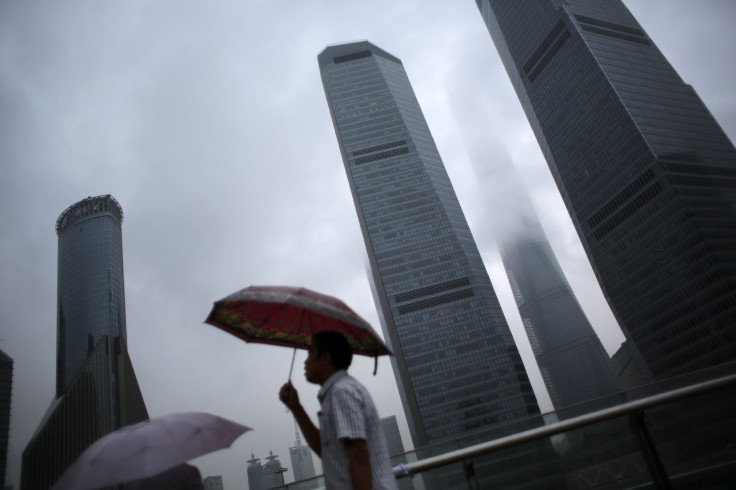

World Bank Cuts Growth Forecast For East Asian Economies, China

The World Bank, in a report released Monday, cut its growth forecast for the next two years for China and some East Asian economies. The bank called for the enactment of crucial reforms in these economies while also noting that the East Asia and Pacific will remain the fastest-growing developing region in the world.

The bank changed its growth estimate for developing East Asian countries to 6.9 percent in 2014 and 2015, down from its April estimate of 7.1 percent. The World Bank also said that growth in China was likely to slow to 7.4 percent in 2014 and 7.2 percent in 2015, down from 7.7 percent in 2013. It had previously forecast China's growth at 7.6 percent for 2014 and 7.5 percent for 2015.

“Measures to contain local government debt; curb shadow banking; and tackle excess capacity, high energy demand, and high pollution will reduce investment and manufacturing output,” the World Bank said, adding that “the efficiency of China’s economy would be improved by relaxing the entry of private firms into sectors previously reserved for state enterprises, improving the governance of state enterprises, and tightening their performance standards, including for financial performance.”

The slowdown in China’s GDP growth reflected the government’s “intensified policy efforts to address financial vulnerabilities and structural constraints, and place the economy on a more sustainable growth path,” the report said.

The bank said that, in the region excluding China, growth is expected to “bottom out” at 4.8 percent in 2014, reflecting a slowdown in Indonesia and Thailand, before recovering to 5.3 percent in 2015 and 2016.

In Thailand, investment “continues to suffer from political unrest and uncertainty,” although that has been partially offset by “generally robust” private consumption, the bank said. In Indonesia, however, export performance is expected to remain fragile, as its commodity prices continue to stagnate and “infrastructural bottlenecks hamper efforts at diversification."

The bank said that there was “still a window of opportunity” to enact “critical -- and in some cases overdue -- reforms…to address the vulnerabilities and inefficiencies that have been created by an extended period of loose financial conditions and fiscal stimulus.”

© Copyright IBTimes 2024. All rights reserved.