Worldwide Tablet Shipment Down 20% In Q3 As Big-Screen Smartphones Cannibalize Sales

The worldwide PC market suffered its fourth consecutive quarter of negative growth in the three-month period ending in October, with tablets being the worst-performing category in the third quarter of 2015, according to data released Friday by market research firm Canalys.

According to a report by Canalys, global shipments of tablets fell 20 percent in the third quarter of this year as smartphones with bigger screens are cannibalizing sales. The tablet market is also struggling with sluggish sales because consumers update their tablets less frequently compared to their smartphones.

The Canalys report also said that shipment of Apple’s iPad dropped 20 percent during the period to below 10 million units for the first time since the second quarter of 2011. Samsung also suffered shipment decline with 7.9 million units shipped during the quarter.

However, in third place, Lenovo’s tablet shipments increased by around 2 percent to 3.1 million units amid growth in the U.S., Europe, the Middle East and Africa.

“New iPads were not announced until the end of Q3, meaning that the vast majority of Apple’s shipments comprised of products that have not been refreshed for over a year,” Tim Coulling, a senior analyst at Canalys, said in a statement. “Holiday purchases, as well as the launch of the iPad Pro and iPad mini 4, will boost shipments in Q4. However, we do not expect a significant increase in sales until Apple launch a successor to the iPad Air 2, a product that some expected in Q4 but is currently unannounced.”

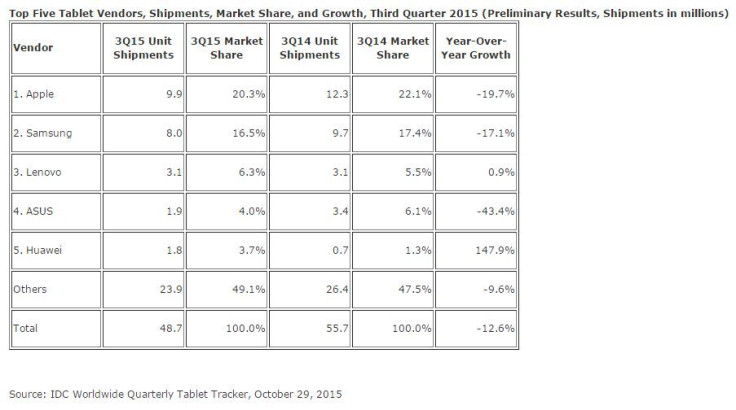

International Data Corporation (IDC) also said in its latest report that the worldwide tablet market recorded lower shipments for the fourth straight quarter. According to IDC, 48.7 million tablets were shipped in the third quarter of 2015, down 12.6 percent from the same period last year.

“We continue to get feedback that tablet users are holding onto devices upwards of four years,” Ryan Reith, a program director at IDC, said in a statement. “As the smartphone installed base continues to grow and the devices get bigger and more capable, the need for smaller form factor slate tablets becomes less clear. With shipment volumes slowing over four consecutive quarters, the market appears to be in transition.”

Here’s a list of top 5 tablet vendors in the third quarter of 2015, compiled by IDC:

© Copyright IBTimes 2025. All rights reserved.