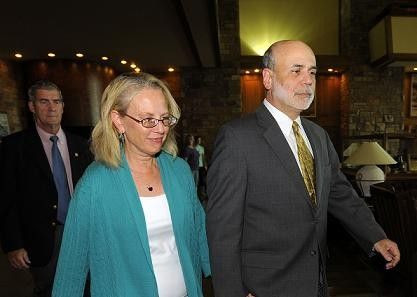

Bernanke Speech: For Now, No QE3, But Stay Tuned

Perhaps the two most compelling themes from U.S. Federal Reserve Chairman Ben Bernanke's speech to central bankers Friday at an annual forum in Jackson Hole, Wyo. concerned his evaluation of the U.S. housing sector -- which he sees as substantially hurting the U.S. economy -- and his observation about the Congress -- which he said had harmed the economy with its protracted debate over the debt ceiling.

Beyond that, another cogent point that is likely to resonate with institutional investors in the months ahead: at least for the time being, they'll be no third phase of quantitative easing, or QE3, but if market players are calculating that the Fed is without question done deploying unconventional tactics to stimulate growth, they are mistaken.

The Federal Reserve has a range of tools that could be used to provide additional monetary stimulus, Bernanke said, in his speech. We discussed the relative merits and costs of such tools at our August meeting...The Committee will continue to assess the economic outlook in light of incoming information and is prepared to employ its tools as appropriate to promote a stronger economic recovery in a context of price stability.

Translation: The Fed believes the U.S. economy is growing too slowly, but it's hopeful that the economy will strengthen in the second half of 2011. If it doesn't, or if it sees overwhelming evidence that an economic stall is imminent -- such as monthly job losses -- it will take additional action -- quantitative easing and/or other measures -- to stimulate growth.

Fed: Many Tools To Stimulate Growth

Other growth-enhancing tools available to the world's most powerful central bank include, among other tactics: extending the duration of holdings of market securities with the goal of pushing down long-term interest rates; or lowering the 0.25 percent interest rate paid on excess reserves to give banks more incentive to make loans.

U.S. stock markets rallied and closed substantially higher Friday after Bernanke's speech -- with the Dow Jones Industrial Average closing Friday up 135 points to 11,285 and the Nasdaq closing up 60 points to 2,480 -- and with good reason: investors know the economic expansion has slowed to a crawl, with GDP up only 1.0 percent in the second quarter -- but they also know now, as a result of Bernanke's words, that it will take additional action, if warranted.

On the housing factor, Bernanke took pains to underscore the role the housing slump is playing in keeping GDP growth low, and he called on Congress and the White House to consider good proactive housing policies that could help speed a turnaround in the sector.

Several economists at Jackson Hole are calling for a debt forgiveness program as one way to at least stabilize the housing sector, if not point it toward consistently increasing sales and home prices. A few economists want President Barack Obama to put debt forgiveness in the stimulus plan he is expected to announce next month.

On the U.S. Congress, Bernanke said, in so many words, that the protracted, and totally-avoidable squabble by fiscal policy makers -- Congressional Democrats and Republicans -- hurt the U.S. economy, and it's best that the nation never experience another fight like it again.

That's about as bold a statement a central bank chairman can make about fiscal policy, given its neutral, non-partisan, civil service status, and it should serve to put lawmakers on notice that their action -- really, inaction for weeks -- was, in a summary, deplorable and destructive to the nation.

Monetary/Economic Analysis: And, the view from here argues that's how history will record the protracted U.S. debt deal impasse -- as a period when a tiny, vocal but ultimately destructive political faction -- the Tea Party -- deployed a 'scorched earth' tactic that hurt the U.S.'s standing with institutional investors abroad and that weakened the U.S. economy.

That counter-productive show of brinkmanship by the Tea Party has made the U.S. Federal Reserve's job harder, but Bernanke's speech has put that faction and others on notice that those investors who think the Fed does not have the tools to rev-up GDP growth despite the more-difficult task, are going to be on the wrong side of history.

© Copyright IBTimes 2025. All rights reserved.