AT&T-DirecTV Merger Hearings: Heated Disagreements Over Antitrust Implications And Past Promises

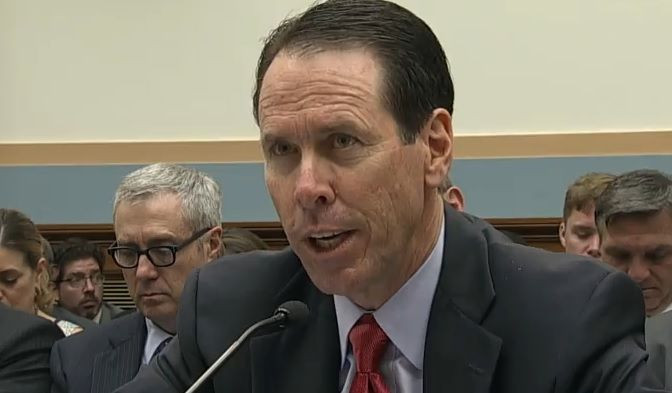

In a day of exhausting rhetoric, the head of AT&T Inc. (NYSE:T) on Tuesday fervidly defended his company against accusations that it doesn’t keep its promises and therefore should not be allowed to move forward with its proposed acquisition of DirecTV Group (NASDAQ:DTV).

Randall L. Stephenson, the telecom giant’s chairman and chief executive, boasted to a panel of antitrust policymakers on Capitol Hill that the merger would allow AT&T to bring high-speed broadband Internet to 15 million new customers, including some within the company’s current wireline footprint.

But John Bergmayer, a senior staff attorney at the nonprofit group Public Knowledge, wanted to know why AT&T wasn’t already offering broadband to those customers, especially since it promised to do so in 2006 when it merged with BellSouth. That AT&T is now making a similar promise some eight years later speaks to its “spotty record with regard to past merger commitments,” Bergmayer said. “Why are these people still unserved?” he asked. “And is it good policy to allow AT&T to make the same promise this time?”

Stephenson countered that Bergmayer was relying on false data, and that the reason 100 percent of its customers aren’t offered broadband today is that its customer base has grown since 2006. “We fully complied with every single condition proposed in that merger,” Stephenson insisted.

Bergmayer was unconvinced. He said AT&T is continuing its history of making unspecific promises and cited the announcement last year of its $14 billion through Project Velocity IP -- known as the VIP project -- through which it is expanding its wireless and wireline broadband networks. Bergmayer said the plan is “ambitious” but “hard to quantify.”

Stephenson’s response? All the commitments made in VIP are publicly available. “Those are all documented, they are in the public record, they in our financial filings, and we are fulfilling those,” he said, to which Bergmayer countered that some of the information in the filings has been redacted.

The spirited back-and-forth took place with the aid of moderators at the first of two congressional hearings meant to examine the merger’s impact on consumers and marketplace competition. Stephenson made his case before both the House and Senate and was joined by DirecTV’s chairman and chief executive, Michael D. White. The two executives argued that the proposed merger does not violate antitrust regulations because it combines companies with, in Stephenson’s words, “complementary products and capabilities” -- AT&T’s broadband service and DirecTV’s pay-TV service. The merged company, Stephenson said, would not only satisfy customers’ growing demand for bundled services, but it would also help AT&T and DirecTV compete with major cable providers like Comcast Corp. (NASDAQ:CMCSA), which already offer such services.

When AT&T first announced the $48.5 billion merger last month, the deal was seen in part as a response to Comcast’s proposed merger with Time Warner Cable Inc. (NYSE:TWC), and the potential combination of those two cable colossi cast an ominous shadow over Tuesday’s hearings. Ross J. Lieberman, the American Cable Association’s vice president of government affairs, said policymakers should seriously consider the marketplace forces driving consolidation before green-lighting yet another massive merger.

Testifying at both hearings Tuesday, Lieberman expressed deep concerns about the Comcast-TWC merger and the AT&T-DirecTV merger. He said the combining of large companies is having devastating effects on smaller cable operators, which lack the resources to acquire companies as a way of staving off competition. “Unable to spend their way out of trouble, these video providers will struggle to remain viable,” Lieberman said.

Got a news tip? Email me. Follow me on Twitter @christopherzara.

© Copyright IBTimes 2024. All rights reserved.