Cisco Systems: Does One Quarter Of Solid Gains Prove Growth Formula Works?

Now that Cisco Systems Inc. (NASDAQ:CSCO), the No. 1 provider of Internet products, has posted its first quarter of solid income gains deploying its new formula of boosting software and services, the jury’s still weighing whether the move is paying off.

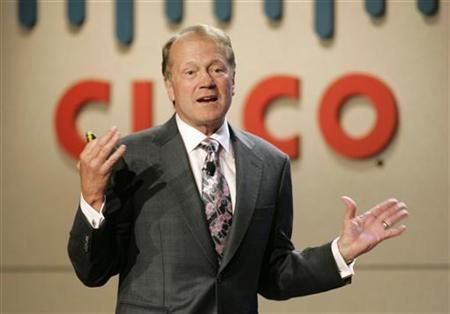

Shares of Cisco, which had gained more than 11 percent since respected CEO John T. Chambers laid out the new strategy in early December, fell 14 cents to $21 on Thursday, lowering the value of the San Jose, Calif., company to $111.5 billion.

Over the past year, the shares with dividends, have gained about 7 percent.

But part of the early decline could be that Chambers and CFO Frank Calderoni issued a cautious forecast for the current fiscal quarter, projecting revenue to gain between 4 percent to 6 percent, with operating profit between 48 cents and 50 cents a share, right in the range of analyst estimates.

At a time when most technology companies have eliminated earnings projections, management may have paid for its candor.

“The guidance may be slightly disappointing,” said Shaw Wu, analyst with Sterne Agee, who noted Cisco may be facing temporary problems selling in China, where Beijing is retaliating against U.S. concerns about Chinese rivals Huawei Technologies, which is linked to the military, and ZTE Corp. (SHE:000063).

Still, Wu said he’s bullish the new focus on reducing dependence on hardware such as switches and routers, which were 49 percent of second-quarter revenue, will start giving way to higher-margin sales of video, wireless, data center and security services.

Cisco reported net income for the period ended Jan. 26 rose 44 percent to $3.14 billion, or 59 cents a share, from $2.18 billion, or 40 cents, a year earlier. Revenue gained 5 percent to $12.1 billion. Operating profit of 51 cents a share beat the analyst estimates of only 48 cents a share.

Besides competing against Chinese rivals with inherently lower expenses, Cisco also is battling units of Hewlett-Packard Co. (NYSE:HPQ), the No. 1 computer company, Dell Inc. (NASDAQ:DELL), the No. 3 PC maker, as well as dedicated Internet products makers including smaller Juniper Networks Inc. (NASDAQ: JNPR) and Aruba Networks Inc. (NASDAQ:ARUN).

Still, Jefferies analyst George Notter said focusing on the competition for hardware products with competitors that also includes Franco-American rival Alcatel-Lucent Inc. (NYSE:ALU) “can often be misleading,” because of quarterly sales or losses and transitions.

Notter said he’s bought into the Chambers strategy and raised his overall forecast for Cisco’s fiscal year that will end in July. He projects earnings of $1.95 a share, a nickel above prior estimates, on revenue of $48.35 billion, about $1.1 billion ahead of his prior estimate.

In fiscal 2012, Cisco reported earnings of $1.60 a share on revenue of $46.06 billion.

Meanwhile, Cisco also reported its cash and investments rose to $46.37 billion, sufficient to handle the pending acquisition of Israel’s Intucell Ltd., for $475 million, which will bring in new techniques for managing wireless networks. During the quarter the company used $1.2 billion to buy Meraki, a San Francisco-based cloud technology company.

In his December analyst meeting where he outlined Cisco’s new strategy, Chambers said the company will make complementary acquisitions. Then it announced the sale of its Linksys home-router business to Belkin International, for an undisclosed price. Cisco bought Linksys for $500 million in 2003.

Chambers also said management will continue to pay dividends and may ask for their views on how to deal with its cash, such as through share buybacks or higher dividends.

Apple Inc. (NASDAQ:AAPL), the most valuable technology company, is facing opposition from Greenlight Capital’s David Einhorn about its record $137.1 billion in cash and investments. Apple said it will consdier Einhorn's and other options but hasn't reached a decision.

© Copyright IBTimes 2025. All rights reserved.