iPad Wars: Amazon?s 1Q Report To Show Kindles Gained Market Share

Shares of Amazon.com (Nasdaq: AMZN), the No. e-retailer, rose slightly Thursday ahead of the company's report of first-quarter results that might beat analyst estimates.

In afternoon trading, shares were at $194.53, up 11 cents, while shares of Apple (Nasdaq: AAPL), the world's most valuable technology company, fell $3.12 to $606.92.

Analysts expect Seattle-based Amazon to report first-quarter net income to plunge 84 percent to 7 cents a share, from 44 cents a year earlier, as revenue jumps 31 percent to $12.9 billion.

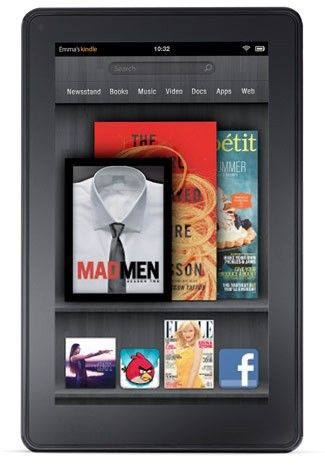

Besides books, clothes, appliances, electronic products and a department store of products, Amazon is battling Apple's iPad with the Kindle Fire, introduced in the fourth quarter, as well as older models of the Kindle.

CEO Jeffrey Bezos has said he'll do what it takes to knock Apple's market share from near dominance in 2010 to lower levels now by selling the lower-priced Kindle Fire well below the iPad's $499 list price and offering more and more titles for his Amazon Prime entertainment services.

Market analysts say the strategy is working and already forced Apple to institute two-tiered pricing, keeping the latest iPad at $499 but the older iPad 2 at $399, still $200 more than the Kindle Fire and $300 more than the Kindle.

During the fourth quarter, Forrester Research said Apple's tablet market share was trimmed to 54.7 percent from 61 percent a year earlier. Amazon, which sold 5.5 million Kindle Fires in its first quarter, boosted its share to 17 percent from zero in 2010.

To be sure, Amazon probably won't announce how many Kindle Fires or Kindles were sold in the first quarter, if it holds to precedent. By contrast, Apple reported selling 11.8 million iPads, bringing the cumulative total to nearly 67 million in two years. Others, such as Samsung Electronics (Pink: SSNLF) and Lenovo Group (Pink: LNVGY) have also entered the tablet sector.

To date, major retailers have generally reported earnings growth. Amazon's e-retailing rival, eBay (Nasdaq: EBAY) reported stronger-than-expected first quarter results.

Here some other key points:

Forecast for higher earnings: What will Amazon forecast for second-quarter earnings, either in its financial announcement or in its investor call with CFO Thomas Szkutak?

Analysts surveyed by ThomsonReuters expect second-quarter earnings to rise to 19.5 cents a share, still down from the year-earlier's 41 cents. Revenue is expected to keep surging, reaching $12.82 billion from $9.9 billion in 2011.

New services, especially telecommunications. Apple's third version of the iPad provides connections to wireless carriers' long-term evolution (LTE) networks. The Kindle Fire lacks that capability.

To compete, though, CEO Bezos, a Princeton-trained electrical engineer, has personally filed patents for certain innovations. Amazon's principal Taiwanese manufacturer, Quanta Computer (TPE: 2382) could execute the design whenever needed.

Adding LTE would increase the cost of the Kindle Fire, though, and might not be desirable. Stay tuned.

Cash and investments. If Amazon sacrifices near-term profit for long-term share, the company will need plenty of cash to tide it over. In December, the company reported cash and investments of $5.3 billion.

By contrast, Apple reported cash and investments of nearly $110 billion as of March 31.

© Copyright IBTimes 2025. All rights reserved.