RIM Reboot: New CEO Reports Loss; Ousts Co-Founder Balsillie

Research In Motion Ltd. (Nasdaq: RIMM), the BlackBerry developer, reported a net loss of $125 million, or 24 cents a share, for the fourth quarter, as revenue plunged 25 percent to only $4.19 billion.

It was the BlackBerry maker's first earnings report since Thorsten Heins, 54, was installed as CEO on Jan. 22. Heins was a former executive with Germany's Siemens (NYSE: SI).

Heins is apparently starting to reboot the company. He announced that company co-founder James Balsillie, 51, who had been co-CEO with co-founder Mike Lazaridis, also 51, had resigned from the board. He also announced the Waterloo, Ontario, company will no longer issue estimates of future earnings.

Moreover, Heins also said the chief technology officer, David Yach, will retire, and its chief operating officer, Jim Rowan, had left the company.

The new boss also took a $621 million pre-tax charge to write down assets and transform RIM. The charges were to write down unsold inventory and account for goodwill from prior acquisitions.

As a result, RIM's fourth-quarter results were far worse than the expected net income of 83 cents a share on revenue of about $4.6 billion for the quarter ended March 3. Still, earnings on continuing operations were 80 cents compared to the expectation of 81 cents.

RIM also said it shipped only 11.1 million BlackBerrys in the quarter, fewer than expected. Shipments of its PlayBook tablet were only 500,000.

A year ago, RIM had a fourth-quarter profit of $934 million, or $1.78 a share. Revenue shot up 36 percent to $5.6 billion -- in stark contrast to the direction previously expected for the current quarter.

'Gone In A Year'

For the year, RIM reported net income of $1.1 billion, or $2.22 a share, compared with 2011's $3.4 billion, or $6.36 a share. Revenue eased to only $18.4 billion from $19.9 billion.

On the plus side, RIM said it has cash and investments of $2.1 billion, up $610 million from the third quarter.

Despite anything the new boss does, RIM won't be around in its present form a year form now, said Jon Rettinger, head of TechnoBuffalo, a high-tech consultancy in California. RIM is doomed to fail.

Times have changed. Blame Apple Inc.'s (Nasdaq: AAPL) phenomenal success with the iPhone family for blasting away at the BlackBerry's slice of the smartphone market. Ditto for the iPad: Former longtime co-chief executives Balsillie and Mike Laziridis introduced RIM's PlayBook tablet, only to see it flop. The two, who had run the company since its founding by Laziridis in 1984, remain major shareholders. Laziridis also serves as vice chairman.

BlackBerry sales declines have also been propelled by the rising popularity of mobile devices using Google Inc.'s (Nasdaq: GOOG) Android operating system.

Only one of 50 analysts surveyed by MarketWatch had a buy rating on RIM's shares; 14 rate the stock a sell while the remaining 35 have neutral calls. The shares have lost 75 percent of their value over the past 52 weeks, although only 3.7 percent so far in calendar 2012.

On Thursday, the stock closed up 6 cents at $13.73 a share.They fell about 8 percent to $12.66 after the earnings announcement.

RIM's market capitalization is $7.19 billion, compared with $20 billion a year ago.

New CEO Had Shed Little Light on Plans

Last August, activist investor Victor Alboini, CEO of Toronto-based Jaguar Financial Corp., started buying RIM shares, followed later by Leon Cooperman, founder of New York's Omega Advisers. Neither man has filed with U.S. regulators to indicate a stake above 5 percent.

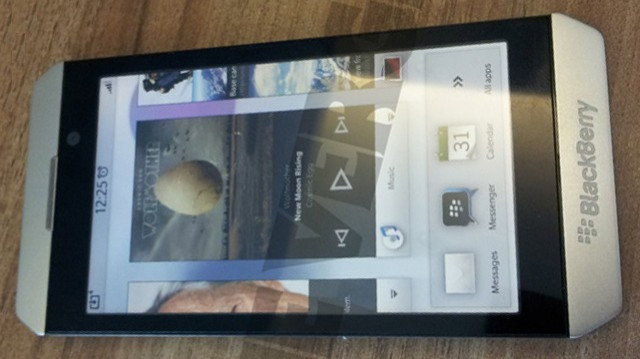

RIM's signature BlackBerry network was hit in October by an embarrassing three-day outage of email and other services. The problem was attributed to software and led to further delays in the launch of an operating system for QNX handsets and the BlackBerry 10. RIM has said its next-generation BlackBerry will be rolled out in late 2012, with hopes of reversing months of declining market share and waning interest from developers of smartphone apps.

Heins, RIM's operating chief, who had come from Siemens in 2007, was elected CEO

Jaguar's Alboini said he was dubious but willing to give Heins a year to prove his mettle.

Heins advised caution and said he would use RIM's technology, customer base and cash to marshal a turnaround. He didn't give many hints about how he would do so, except to mention respect for his predecessors' process discipline and willingness to monetize some of the company's patents.

Some analysts, such as Peter Misek of Jefferies & Co., see little hope on the BlackBerry horizon. For the full fiscal year, he estimates handset sales will have plunged another 20 percent, to only 42 million of a total 1.8 billion sold worldwide.

Last week, technology market researcher International Data Corp. reported that RIM was outsold by Apple even in Canada in 2011. The California-based company sold 2.85 million iPhones, compared with only 2.08 million BlackBerrys on RIM's home ice.

Citigroup Inc. analyst Jim Suva wrote that RIM's financial performance is going to get worse than expected. He expects earnings of only 83 cents on sales of 11.4 million BlackBerrys and 241,000 Playbook tablets.

The tech sector is studded with fallen angels that mounted successful turnarounds, including International Business Machines Corp. (NYSE: IBM), Dell Inc. (Nasdaq: DELL) and Texas Instruments Inc. (NYSE: TXN) as well as Apple.

Now, with charges taken, old managers out and a customer base exceeding 76 milion, Heins' next step will be to regain momentum for the company that invented the enterprise e-mail market long before the iPhone came along.

© Copyright IBTimes 2025. All rights reserved.