Alibaba Group Holding Ltd (BABA) Authorizes $4B Stock Buyback, Shares Drop Amid Slowing Revenue Growth

Shares of Alibaba Group Holding Ltd. (NYSE:BABA) dropped 5 percent Wednesday to $73.16 after the Chinese e-commerce giant posted quarterly sales that missed Wall Street forecasts. Though the company's revenue rose 28 percent, it marked Alibaba's slowest growth in more than three years. The company also announced a $4 billion stock buyback program that will take place over two years to offset dilutions from its stock-based compensation programs.

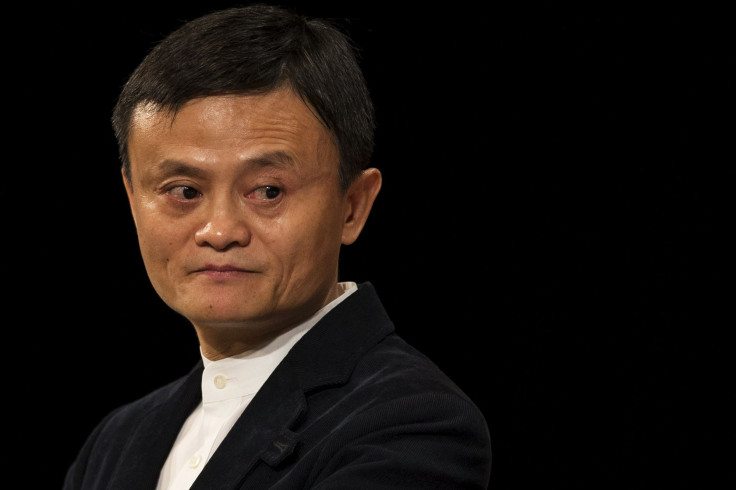

The results marked the fourth public earnings report from Alibaba after Jack Ma, the company's founder and executive chairman, led the e-commerce giant to a record-breaking $25 billion initial public offering in September.

Alibaba's slowdown is little surprise. More than 80 percent of its revenue comes from its home market, and as China and other Asian economies slow, the company's growth is decelerating. This week, China unexpectedly depreciated the yuan by roughly 4 percent in an attempt to jumpstart its flagging economy, which, in the first quarter, grew at its slowest pace since the global financial crisis.

Alibaba’s disappointing sales figures for the quarter underscore how hard it is for a company of its size to continually grow at outpacing rates, James Gellert, CEO of Rapid Ratings, said in a note. "Time will tell if their results are indicative of Chinese economic slowdown or Alibaba-specific challenges. Nevertheless, Alibaba is executing on its diversification strategy, as the acquisition of Suning Commerce demonstrates."

The significant cash raised at IPO needs to be invested in growing and diversifying the business, or else it is just an inefficient asset on the company’s balance sheet, Gellert explained.

Following the company’s initial public offering price of $68 in September, shares opened for trading at $92.70. Since then, the stock has lost 18 percent of its value since its IPO, declining about 26 percent so far this year.

For the April-June period, Alibaba reported that fiscal first-quarter net income soared 148 percent to $4.97 billion, or $1.92 cents per share, on revenue of $3.27 billion, compared with a profit of $494 million, or 20 cents per share, on sales of $2.5 billion during the same period a year ago. The company's profit surged due to a gain from the deconsolidation of Alibaba Pictures.

Wall Street had expected the company to report net income of $823 million, or 33 cents per share, on revenue of $3.39 billion, according to analysts polled by Thomson Reuters.

Meanwhile, mobile transactions accounted for 55 percent of Alibaba's overall transactions, up from 33 percent a year ago.

Last week, Alibaba appointed former Goldman Sachs executive J. Michael Evans as president. The move marked the latest managerial change at the Chinese e-commerce giant since Daniel Zhang, former chief operating officer, replaced Jonathan Lu as CEO in May.

© Copyright IBTimes 2025. All rights reserved.