Apple Overtakes Starbucks In US Mobile Payments

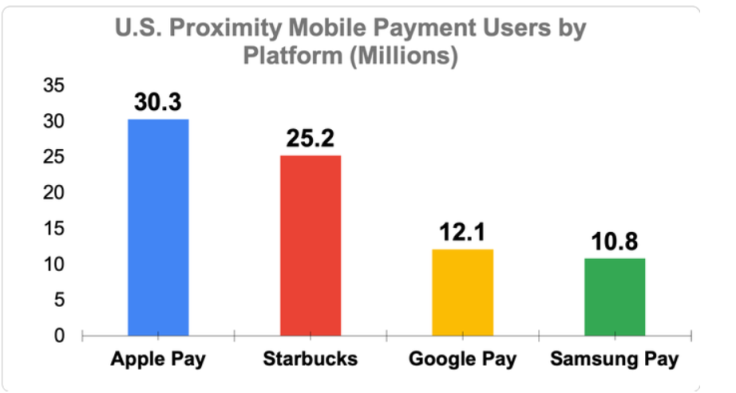

Apple (NASDAQ:AAPL) Pay recently surpassed Starbucks' (NASDAQ:SBUX) mobile app as the top proximity mobile payment platform in the U.S., according to eMarketer. The research firm expects Apple Pay to account for 47.3% of that market this year, while Starbucks slips to second place with a 39.4% share.

eMarketer attributes Apple Pay's growth to the rapid adoption of the near-field communications (NFC) standard across brick-and-mortar retailers. It notes that Google's and Samsung's platforms use the same standard, but that the two companies are splitting the Android market.

The iPhone maker controls 41% of the U.S. smartphone market, according to Counterpoint Research, making it tough to ignore Apple Pay as a payment option. That's why Digital Trends expects 70% of U.S. retailers to support Apple Pay by the end of the year.

This isn't necessarily bad news for Starbucks, which also supports Apple Pay as a payment option. There's also plenty of room for growth, since eMarketer estimates that only 30% of U.S. smartphone users will use mobile payments this year. Nonetheless, companies with an early foothold in this market -- like Apple and Starbucks -- could profit and lock more users into their cashless ecosystems.

This article originally appeared in the Motley Fool.

Leo Sun owns shares of Apple. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Apple, and Starbucks. The Motley Fool has the following options: short January 2020 $155 calls on Apple and long January 2020 $150 calls on Apple and recommends the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.