Wall Street Stocks Pull Back As US Economy Shows Signs Of Stalling

European stocks gave up most of their early gains Thursday and Wall Street equities fell after US initial jobless claims pointed to renewed lockdowns taking a heavy toll on the stuttering economy.

The US Department of Labor reported that 1.4 million people applied for jobless benefits last week, the first week-over-week increase in claims since the early days of the COVID-19 crisis this spring.

"The recovery appears to be stalling as jobless claims rose for the first time since March and as continuing claims remain elevated," said Edward Moya at OANDA, calling the data from the United States "downbeat."

But on the upside, a less-than-solid US economy made further government stimulus more likely, just as another relief package was being negotiated between the White House and the Senate, Moya said.

The dollar fell following the data release.

Key European stock markets closed broadly unchanged, while Wall Street ended firmly lower.

Thursday's downward move in the US was led by technology giants such as Apple, Amazon and google parent Alphabet, all of which fell by more than three percent.

Republicans have been struggling to come up with a bill to counter a $3.5 trillion Democrat proposal, fanning concerns they will not pass a measure ahead of their August break.

However, media reports said Republican Senate majority leader Mitch McConnell would soon unveil a $1 trillion plan after overcoming some differences with the White House.

"Even as the Republicans and Democrats remain far apart on how much to spend in this next round of stimulus, the markets are optimistic that an agreement will be reached sooner rather than later," said City Index analyst Fiona Cincotta.

"The prospect of both monetary and fiscal support taps running at the same time is keeping the mood in the market upbeat."

Such hopes gave Asian and then European markets a lift earlier Thursday, outweighing coronavirus concerns and simmering China tensions.

Optimism over the development of a COVID-19 vaccine also sparked some buying.

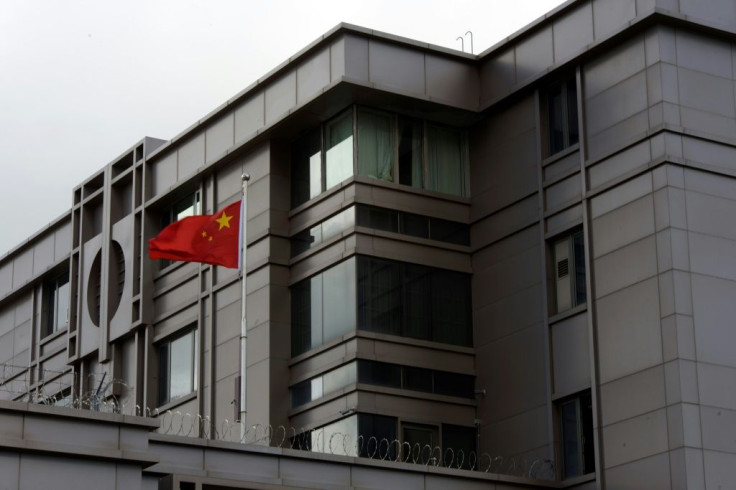

Washington's order to close the Chinese consulate in Houston a day after two Chinese nationals were indicted for allegedly hacking hundreds of companies worldwide seeking to steal vaccine research added to tensions between the two top economies.

China slammed the US move, and threatened retaliation, while Trump said "it's always possible" more consulates could be closed.

"The escalation in US-China tensions is a reminder of the headline risk faced by investors during the upcoming US election campaign," said AxiCorp's Stephen Innes.

New York - Dow: DOWN 1.3 percent at 26,652.33 (close)

New York - S&P 500: DOWN 1.2 percent at 3,235.66 (close)

New York - Nasdaq: DOWN 2.3 percent at 10,461.42 (close)

London - FTSE 100: UP 0.1 percent at 6,211.44 (close)

Frankfurt - DAX 30: FLAT at 13,103.39 (close)

Paris - CAC 40: DOWN 0.1 percent at 5,033.76 (close)

EURO STOXX 50: FLAT at 3,371.74 (close)

Hong Kong - Hang Seng: UP 0.8 percent at 25,263.00 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,325.11 (close)

Tokyo - Nikkei 225: Closed for a holiday

West Texas Intermediate: DOWN 2.0 percent at $41.07 per barrel

Brent North Sea crude: DOWN 2.2 percent at $43.31 per barrel

Euro/dollar: UP at $1.1594 from $1.1570 at 2100 GMT

Dollar/yen: DOWN at 106.86 yen from 107.15

Pound/dollar: UP at $1.2736 from $1.2734

© Copyright AFP {{Year}}. All rights reserved.