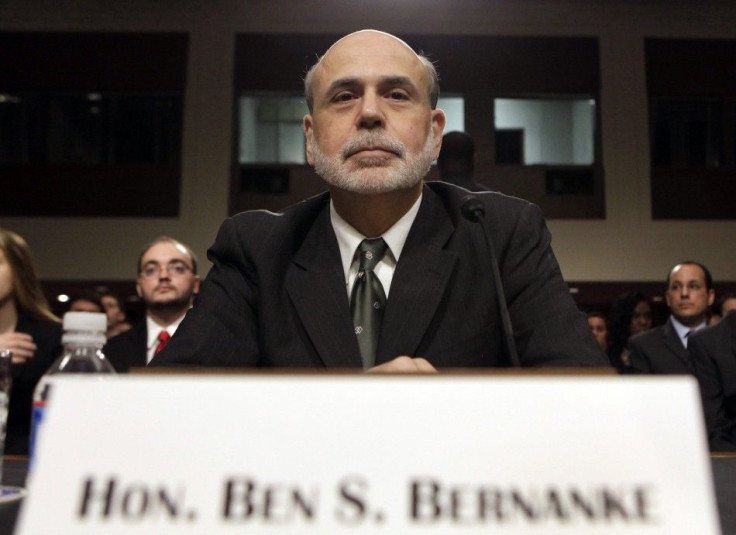

Bernanke Press Conference On QE3 - Live Blog

The Federal Reserve's powerful rate-setting committee announced Thursday, as most market-watchers had expected, that it would engage in a third-round of unsterilized asset purchases to stimulate the U.S. economy.

Following up on suggestions at a speech in Jackson Hole, Wyo., that it would go through with the monetary policy course -- colloquially known as QE3 -- the Fed announced it would expand the size of its long-term asset balance sheet by some $85 billion per month through the end of 2012, buying about $40 billion in mortgage-backed bonds. It will also continue its program of buying long-term Treasuries while selling short-term ones, its so-called Operation Twist.

The actions by the Fed were arguably more than policy-watchers had predicted, and the financial markets rallied in response.

The Chairman is scheduled to speak at 2:15, and the International Business Times will live-blog this event right here.

***

3:28: CNBC has had enough of Bernanke and is back to talking about the iPhone v. Galaxy battle for world domination. Guess that's out cue to wrap this up. Thanks for tuning in.

3:26: Barclays: We interpret today's action as a bold shift in Fed policy. On the one hand, the committee significantly strengthened its commitment to a low rate environment and embarked on an open-ended purchase program. These moves indicate the accommodation switch has been turned on and the data have to tell the committee when to stop.

3:21: Further adventures in my inbox: BNP Paribas economists interpreted Bernanke as saying QE won't be over till it's over. They also highlight how much it's clear the man personally sets the agenda and other FOMC members (except Lacker) follow it.

3:15: Reaching into my inbox, the House Republican Conference Chairman and Financial Services Committee Vice Chairman Jeb Hensarling (R-Texas) put out what I guess will be the GOP line of attack on today's Fed action: There are limits to what monetary policy can achieve, and it's clear the Fed has reached them. Much of what Bernanke said at the press conference disagrees with that. Maybe Hensarling can invite Bernanke to Texas to settle their differences. Oh, wait.

3:09: First thoughts from this humble reporter: Today's Fed action is a total game-changer. The Fed basically gave up on waiting for the politicians and committed itself to helping the economy with cheap credit even after the economy starts getting better. A few wiggles on a chart showing marginal growth and angry words from the Ron Paul crowd is not going to scare them anymore. Beyond QE3, Bernanke just demonstrated he's the most powerful public official in the country to give a fig about the unemployed.

3:05: Press conference is over. Bernanke used nominal GDP targeting in the last few minutes, which made the wonks in the high-end econ Twittersphere throw a fit.

2:56: Reporter for the LA Times must have missed the first 20 minutes of class, too. Asks how much Bernanke expects rates to go down as part of QE3. Bernanke reiterates it doesn't matter, what matters is the markets looking better.

2:54: Some reporter for MNI is blathering. Name-checked Woodford paper. Bernanke adopts attitude of professor answering a really dumb question.

2:51: German reporter from Frankfurter Allgemeine asks really intelligent questions: (1) How is it possible you keep foreseeing low inflation, as detailed in the projections released today, with growth in the next three years? (2) What do you say to people saying QE is not a powerful enough tool? Bernanke: (1) The economy is in no risk of overheating. (2) Our obligation is to do what we can.

2:49: Reporter: What ammunition do you have if politicians keep acting like petulant children and allow the fiscal cliff? Bernanke: We'd have to think about what to do in that contingency.

2:47 Reporter: Don't you wish that some of the Fed members who don't support QE would keep their mou... keep their comments to themselves? Bernanke smiles.

2:45: Press corps is being thoughtful, but they clearly liked what Bernanke did today. He's only gotten beaten up on inflation ONCE. He got absolutely shelled in April when the accommodation was seen as lacking.

2:43: Fox Business reporter: So, was it raining or sunny the day you became a shill for Obama?

2:42: We're not promising a cure to all these ills, but what we can do is provide some support.

2:40: Grep Ip of the Economist asks the Woodford paper question: How come you're now pegging the duration of your policy to conditional goals? Bernanke: Our policies have always had a significant element of conditionality, but the idea here is to make it more transparent.

2:39: Bernanke gets asked a really hard political question. His response: I don't advocate specific Congressional programs, but he praises recent FHA policy.

2:35: Jon Hilsenrath (WSJ) asks the same question that got asked at the beginning: What pace of recovery will be acceptable? Bernanke: What we've seen the past six months, isnt' it.

2:31: Took over 15 minutes for someone (from the Financial Times) to ask the inevitable Are you out of bullets now? question. Bernanke focuses on the fact communication tools are available in his answer. It really does seem the Fed took the Woodford paper at Jackson Hole to heart.

2:29: Stock market is going bananas as reporter questions if transmission mechanism will work at all.

2:27: Bernanke gets asked the same question for the third time. Now gets asked if he will tolerate higher inflation. He dodges the question, saying the FOMC takes a balanced approach.

2:24 - First question, as expected: When will you be satisfied that the economy is OK enough to take accomodation away? Bernanke: We're not going to keep it until full employment but we will keep it even after the recovery quickens. Essentially, until the recovery enters exit velocity.

2:22 - Bernanke: We know people living off the interest off fixed income are receiving very low returns. But the returns are even lower when you don't have a job. Euthanasia of the rentiers.

2:19 - If we do not see substantial improvement, we'll keep doing this, until we do. Also, policy accomodation will continue, even as the economy picks up. Bernanke brought his A game today.

2:18 - Point of QE3: to strenghten the recovery and support the gains we have seen in housing and other sectors. Interesting, he's previously played down how much of a recovery is going in housing and the MBS-focused action suggests they don't believe everything is alright

2:16 - The weak job market should concern every American. It's a huge waste of human talent.

2:15 - Bernanke taking a seat. He looks EXHAUSTED!

2:10 - Quick update on the markets. The S&P Index of U.S. stocks is at levels not seen since late 2007, flirting with 1457. Gold and silver have taken off. Gold, which saw a sell-off at 12:15 as some poor schmuck guessed wrong on QE3, is now over $1768 per ounce (it was closer to $1700 this morning). Also on a rocket: Intrade odds on Obama being elected in November, which went from 63.4 to nearly 65 percent.

2:03 - We're live. Bernanke is on in less than 15. The number one question that's in people's minds following the Fed statement 90 minutes ago is, interestingly, not about the just-announced start of QE3, but its possible end. (Talk about front-running the Fed!) Basically, in its statement, the FOMC said that If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage-backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability. Does that mean this is QE-till-the-cows-come-home? What benchmark would the Fed use to mark a substantial improvement?

© Copyright IBTimes 2025. All rights reserved.