Bitcoin Around The World: How Virtual Currencies Are Treated In 40 Different Countries

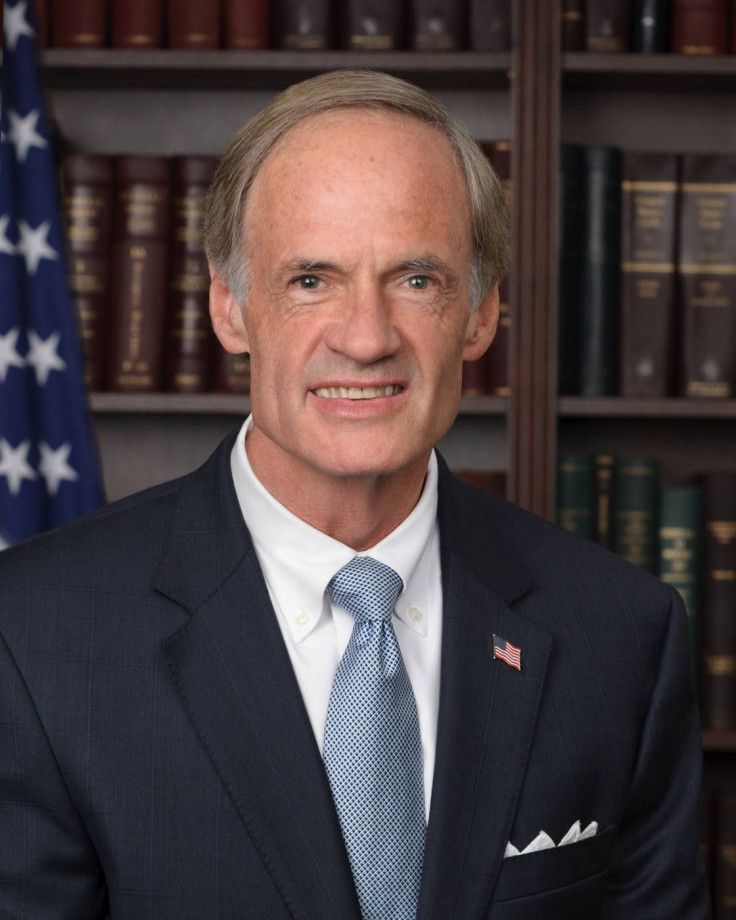

Senator Tom Carper (D-Del.) has clearly boned up on bitcoin. In a December interview with Bloomberg TV, the chairman of the Homeland Security and Governmental Affairs Committee said what he knew about the contested currency "would fit into a very small thimble,” but now he' ha released a 25-page report prepared by the Library of Congress on how countries around the world are addressing, taxing and viewing cryptocurrencies like bitcoin.

“This report has some good news – namely that the United States may not be as far behind the curve on virtual currencies as some have argued,” said Chairman Carper. “In fact, the United States might be leading the way for a number of nations when it comes to addressing this growing technology.”

The chairman’s praise of the United States may be a bit hasty considering many governments outlined in the report are listed as reviewing cryptocurrencies, a somewhat obfuscating non-action. Although, the report clearly identifies two countries as laying actual framework for bitcoin. China and Brazil have taken actual stances on the subject.

In December, China’s national bank denounced the validity of bitcoins by issuing “the Notice on Precautions Against the Risks of Bitcoins,” stating that financial institutions could not use the currency because “by nature the bitcoin is not a currency and should not be circulated and used in the market as a currency,” according to the report. The move halted a massive arbitrage play that bitcoin traders were using and caused the then rapidly rising digital currency to drop more than 50 percent in value.

Alternatively, Brazil has embraced the concept of electronic currencies. “On October 9, 2013, Brazil enacted Law No. 12,865, which created the possibility for the normalization of mobile payment systems and the creation of electronic currencies, including the bitcoin,” states the report. The law allows Brazil to regulate bitcoin, other cryptocurrencies and any future electronic currency.

But the majority of countries chose not to define bitcoin or reaffirmed the definition of legal tender, which bitcoin mostly doesn’t fit. “While there is no consistent or clear definition or treatment of digital currencies throughout the world,” Carper said, “this report underscores that bitcoin and other virtual currencies are present and growing in major economies, supporting the call for increased global cooperation.”

The report also states that Russia and Estonia show the most public interest in bitcoins. “According to Google’s search statistics, Estonia is the country with the second-largest number of Internet searches for the term “bitcoin”; Russia has the most such searches,” the report says. However, Russia has not yet ruled on digital currencies despite public interest. The report states that a Russian law firm cited article 140 of the Russian Civil Code as a way to consider bitcoin as “illegal currency operation subject to prosecution under the Russian law on administrative responsibility.” The report indicates that the Bank of Estonia currently monitors bitcoin transactions, but Estonia does not regulate them.

“Significantly, this report shows that other countries have addressed how virtual currencies are taxed,” Sen. Carper said, “and I urge the Internal Revenue to glean the findings from this survey to help determine its own treatment of virtual currencies.” Several countries, including Canada, Finland, Germany and Singapore, are taxing bitcoin and virtual currencies through Goods and Services taxation. “Our Committee will also continue to work closely with the Internal Revenue Service to get greater clarity as to their timelines and thought processes on dealing with the potential tax vulnerabilities of digital currencies.”

One notable dissident in the report is France. While other countries are treating virtual currencies like a barter or trade, France’s central bank issued a report that states “that the bitcoin cannot be considered a real currency or means of payment under current French laws, and criticizes it as a vehicle for speculation as well as an instrument for money laundering and other illegal activities.” The report proposes that bitcoin-to-fiat transactions should be limited to French authorized payment service providers, therefore reducing the risk of money laundering and fraud.

Money laundering is a concern around the world. Many of the countries listed in the report considered virtual currencies to be a danger and recommended avoidance of bitcoin. Recently in the United States, the New York Department of Financial Services (NYDFS) held a hearing on virtual currencies, with much discussion on anti-money laundering (AML) regulation. The NYDFS has yet to issue any regulation, AML or not, but proposed a timeline of sometime in 2014 for statewide regulation to exist.

Chairman Carper summed up the need for clarity on bitcoin and other virtual currencies well. “At the end of the day, I think this report is an important reminder to those of us in Congress as well as federal agencies that this technology continues to play an increasing role in our economy here in the United States as well as around the world, and we need to ensure that our policy making in this area is thoughtful, effective and timely.”

Find a full copy of the report here.

© Copyright IBTimes 2025. All rights reserved.